The flagship cryptocurrency Bitcoin (BTC) has plunged to a six-month low, sending shockwaves through the market and sparking renewed caution around the “Bitcoin price prediction” outlook. With BTC dipping below US$95,000 and sentiment turning increasingly negative, analysts are warning that this could be the beginning of a sharper correction rather than just a temporary dip. The decline intensifies doubts about near-term upside prospects for the world’s largest crypto asset, even as the long-term case remains intact.

The recent decline is rooted in several key factors. According to market data, Bitcoin dropped to approximately US$95,100 after shedding nearly 7% in a single week, marking its third consecutive weekly retreat. Investing.com+1 Expectations of a December interest-rate cut by the Federal Reserve have evaporated, and ETF outflows plus institutional pullbacks have added to the pressure. An independent analyst noted that once BTC slid below the critical US$100,000 support, the chart “confirmed a descending channel” and raised the risk of deeper losses. New York Post+1

From a technical perspective, the breakdown beneath US$98,000 is viewed as especially alarming. One prominent crypto-analysis firm warns of a possible 30% collapse toward the US$70,000 range if the next support at US$94,000–US$92,000 fails to hold. Finance Magnates+1 Spot volume remains muted, and long-term holders are reportedly offloading prominent positions – over 815,000 BTC were sold in the past 30 days, according to analytics firm CryptoQuant. MarketWatch

Why the “Bitcoin Price Prediction” Outlook Is Turning Bearish

Several market signals illustrate the deteriorating risk-reward profile for Bitcoin in the near term. First, macro uncertainty is elevated. With the US government’s data pipeline disrupted, policy clarity is hampered and traders are de-risking aggressively. Second, derivatives flows show intensifying hedging activity. Large inflows into protective puts signal that many institutional investors are bracing for another leg down. Third, technical structure is weak: a “death cross” is reportedly forming, with the 50-day EMA crossing under the 200-day EMA, which historically precedes larger drawdowns.

Given these factors, “Bitcoin price prediction” models now favour a more cautious stance. Many analysts believe that if Bitcoin fails to reclaim US$100,000 quickly, it could revisit support zones in the mid-US$80,000s or even low US$70,000s, before a sustainable bounce can occur.

What This Means for Investors

For those holding Bitcoin, the message is clear: manage risk. With the downtrend intact, setting defensive stop-losses, trimming leverage, and re-assessing position size may be prudent. Conversely, for traders seeking opportunities, the current dislocation may offer early buying zones—but only if fundamentals remain intact and macroeconomic policy turns favorable.

One interesting consequence is investor rotation: while Bitcoin’s dominance is being tested in the short term, capital is increasingly flowing toward early-stage infrastructure tokens and layer-2 solutions that aim to build on Bitcoin’s base layer, rather than compete directly with it.

Bitcoin Hyper: A High-Conviction Opportunity as Bitcoin Turns Bearish

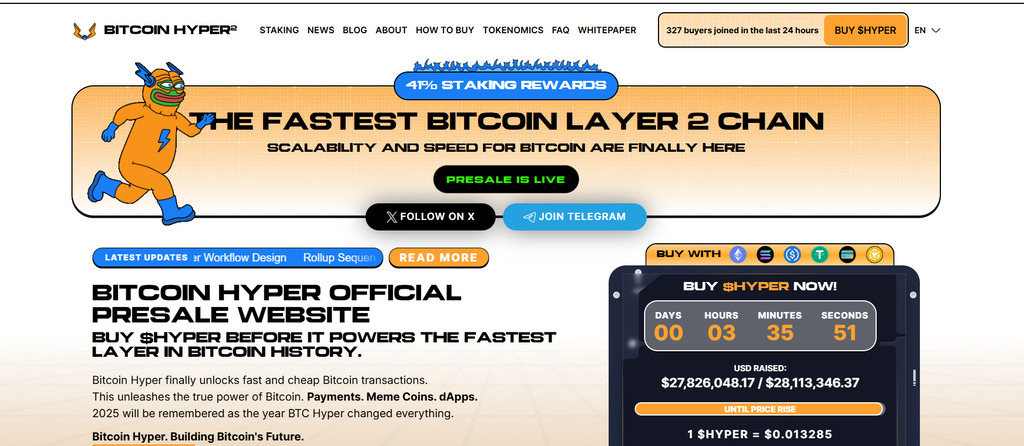

As Bitcoin struggles to hold key support levels, analysts are pointing out that the current downturn may accelerate a shift away from passive BTC holding toward infrastructure projects that expand Bitcoin’s capabilities. This is where Bitcoin Hyper stands out. Far from being “just another altcoin,” Bitcoin Hyper is positioning itself as the first fully functional Layer 2 built for Bitcoin, explicitly designed to address the scalability issues that have hindered Bitcoin’s growth for years.

Clear Use Case: Enhancing Bitcoin Without Replacing It

Unlike many new tokens that rely solely on hype, Bitcoin Hyper has a clear, measurable value proposition: it enhances Bitcoin — an asset known for its security, but not speed — with instant transactions, ultra-low fees, and smart contract support. Instead of replacing Bitcoin, it enhances it. For many investors, this is precisely the kind of project that feels both innovative and safe, as it builds directly on the most trusted asset in crypto.

Recent presale data reveals strong confidence: Bitcoin Hyper has already raised over US$27 million, placing it among the most successful presales of 2025. Analysts covering the downturn in BTC have described Bitcoin Hyper as a potential “high-growth hedge inside the Bitcoin ecosystem,” noting that investors rotating away from Bitcoin’s stagnation are funnelling into Layer-2s with fundamental technical foundations.

Layer-2 Architecture Designed for Real-World Scalability

What makes Bitcoin Hyper especially appealing is its architecture. Built on a Solana Virtual Machine (SVM) framework and supported by a unique Canonical Bridge, the network can process up to 700,000 transactions per second — a staggering contrast to Bitcoin’s limited throughput. This gives Bitcoin Hyper the ability to unlock payments, gaming, on-chain applications, micro-transactions, and full DeFi connectivity, all while remaining anchored to Bitcoin’s security advantages. For many readers, this blend of speed + safety is precisely the combination they want in an altcoin.

The project’s token, $HYPER, powers transaction fees, staking rewards, governance, and ecosystem utilities. Early participants can stake with APYs around 40–45%, which has contributed to the strong presale momentum. Many analysts now list Bitcoin Hyper among the Top Best Altcoins for 2025 — not because of hype, but because it fills one of the most obvious gaps in Bitcoin’s long-term evolution.

For investors who still believe in Bitcoin but want exposure to something with higher upside, Bitcoin Hyper offers a compelling middle ground: a chance to benefit from Bitcoin’s success without relying solely on price.

For more details, please visit the official Bitcoin Hyper page.

Broader Implications for the Crypto Market

If Bitcoin continues to falter, the altcoin market may remain under pressure. Historically, a weak Bitcoin rarely coincides with a strong altcoin bull cycle. That said, infrastructure projects layered on top of Bitcoin could decouple somewhat from BTC’s direct price action. Layer-2 solutions, bridging protocols and application ecosystems may behave differently.

The current environment may produce two broad scenarios:

- A sharp deeper correction in Bitcoin toward US$70,000+, where risk assets including most altcoins also drop.

- A stabilization and normalization period where Bitcoin trades sideways while high-utility altcoins begin to outperform. The latter scenario gives more room for projects like Bitcoin Hyper to thrive independent of Bitcoin’s short-term price swings.

Final Take

The “Bitcoin price prediction” outlook has shifted sharply into bearish territory after Bitcoin dropped to six-month lows and broke key support zones. While the long-term case for Bitcoin remains intact, the near‐term path may include deeper drawdowns and heightened volatility.

For investors, this moment calls for caution, disciplined risk management and strategic thinking. If Bitcoin remains range-bound, then infrastructure plays like Bitcoin Hyper may provide the next wave of growth within the crypto space. For those seeking opportunity beyond Bitcoin, examining projects that build on the base layer may be just as important as predicting where Bitcoin itself will land.

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.