Crypto markets have been volatile, with traders watching key Bitcoin price levels, new Solana-related on-chain activity, and updates from the Remittix (RTX) project. The project has also said it is pursuing additional exchange availability, though timelines and outcomes can change.

Bitcoin Price Prediction: Key Levels Traders Are Watching

Bitcoin is currently hovering near $115,625. Some market watchers cite resistance between roughly $122,000 and $123,700, and note that a move above that area could support scenarios where price tests higher levels, including $130,000. Analysts like Rekt Capital have discussed conditions such as a daily close above $117.2k as part of a potential “reclaim” setup.

This week, Bitcoin initially climbed on optimism around a possible Federal Reserve rate cut. However, BTC later pulled back and has been retesting the $116,000 area. If BTC drops below $116,000, some traders look to levels around $114,000–$114,500, with deeper downside scenarios sometimes referencing $111,000. On the upside, some commentators have floated targets such as $175,000 by year-end, though such projections are speculative and depend on market conditions.

source: @AlemzadehC on X

Solana News Today: Whale Activity and Near-Term Price Levels

Solana-related activity has drawn attention again. 312,233 SOL, valued at over $75 million, was reported as moved to Coinbase Institutional. Large transfers can have multiple explanations and do not, by themselves, confirm an intent to sell.

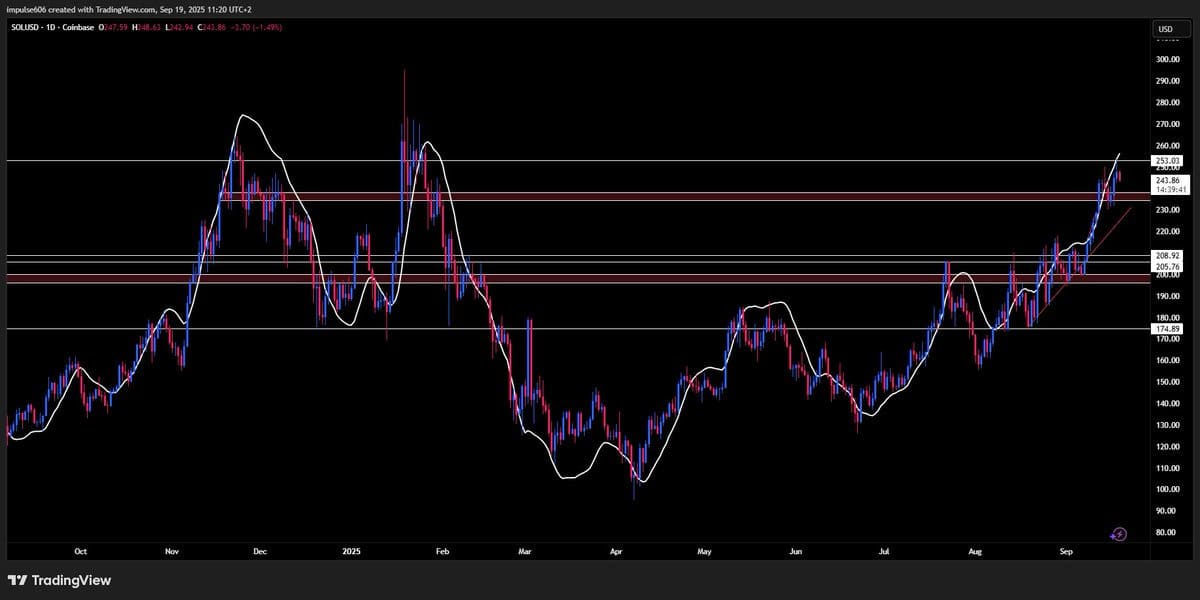

Currently, SOL trades around $239, holding near a frequently cited support zone of $235–$240. The recent rally saw prices test the $250 area, which coincided with about $37 million in liquidations. Some traders watch whether sustained closes above $250 could allow a retest of higher ranges such as $255–$270.

Analysts remain split on what comes next. Some view consolidation near $240 as constructive, while others warn of potential rejections if price revisits the $260–$280 area.

source: @BTC_NFT on X

Remittix: What the Project Has Announced

Alongside broader market moves, Remittix has been mentioned in discussions about newer crypto projects. According to the project’s materials, Remittix has raised over $26.3 million and sold 668 million tokens at $0.1130 each. The team has also announced initial CEX listings on BitMart and LBank.

The project also states that it passed a CertiK security audit and has released a Beta Wallet. Audits and early product releases can reduce certain technical risks, but they do not eliminate market or execution risk.

The project has additionally described marketing incentives, including a referral program. Key points highlighted by the team include:

- A stated focus on the remittance market as a target use case.

- Fundraising figures and token distribution details shared by the project.

- Exchange listing announcements, which may affect access and liquidity but can change over time.

- A reported third-party security audit, which is not a guarantee of safety.

- A Beta Wallet release, which the team presents as part of its product development.

What to Consider When Reviewing Early-Stage Tokens

As attention shifts between Bitcoin, Solana, and newer projects, readers should note that early-stage tokens can involve significant risks, including high volatility, limited liquidity, and execution uncertainty. Any price targets, listing expectations, or adoption forecasts should be treated as uncertain.

Project links (for reference):

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

This article contains information about a cryptocurrency token sale. This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.