Latest Bitcoin [BTC] News

Boston-based mutual fund, Fidelity Investment has a history of meeting customer demands. Perhaps that is the reason why the fund is one of the most popular in the US and the world at large. With close to 13,000 high grade institutional clients and an impressive $2.45 trillion of assets under management, Fidelity Investment is a true definition of a traditional Wall Street behemoth.

Therefore, any hint of their involvement in a space that is deemed “risky”, unregulated and “infested” with criminals with blockchain as a facilitator bins all these and even approves cryptocurrency as an alternative and a new emerging asset class. When the announced their plans of launching a Bitcoin supportive platform back in Q4 2018, many were shocked.

But truth of the matter is that the firm has been experimenting with blockchain, keeping tabs on Bitcoin and at one point even launched a flagship cryptocurrency according to Tom Jessop, the head of Fidelity Digital Assets Services (FDAS). Through the Fidelity Digital Assets Services (FDAS), institutions with interest in cryptocurrency and especially Bitcoin will have access to first class, secure Bitcoin custody.

This Bitcoin custodial service will launch as early as March 2019 according to sources familiar with the matter. However, they have been serving “select set of eligible clients” as they “establish robust set of technical and operational standards” reflective of Fidelity Investment standards.

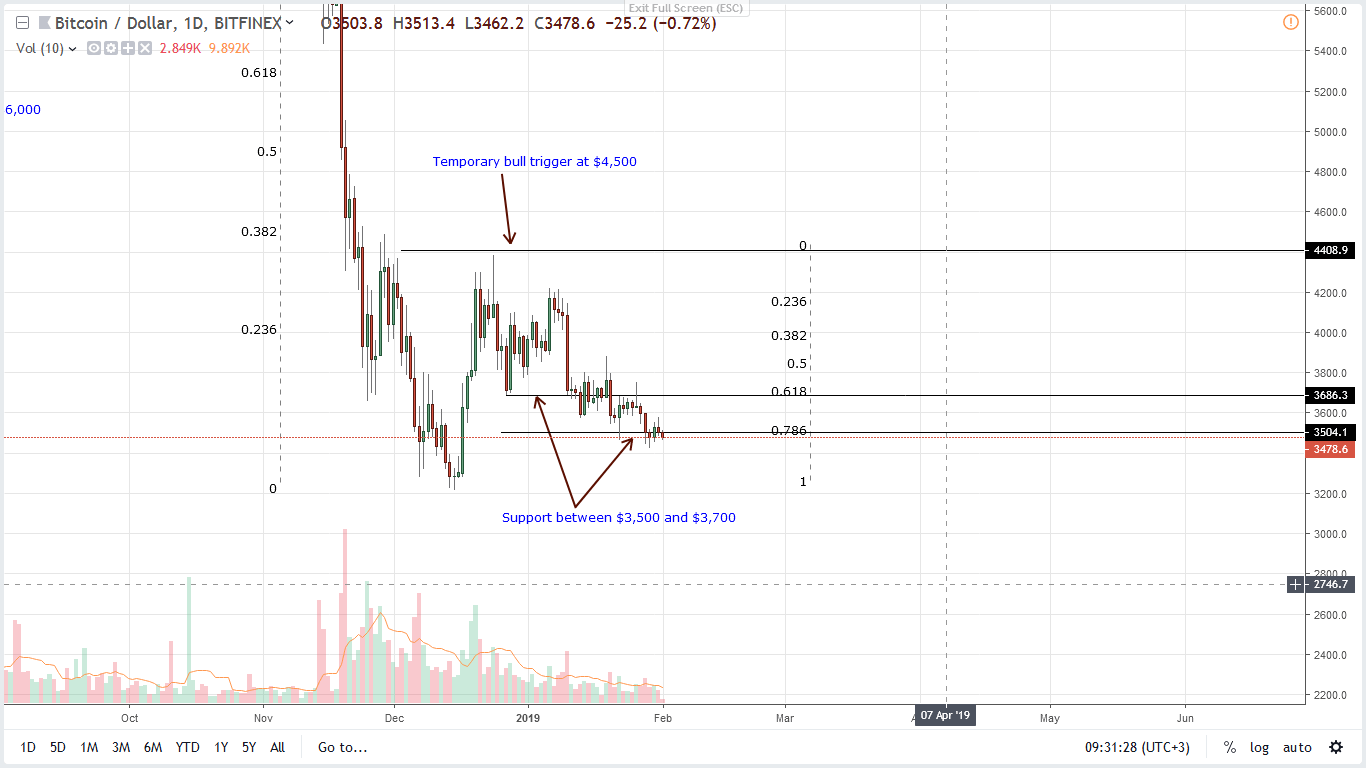

BTC/USD Price Analysis

Back to price action and the initial expectation around Jan 28 price expansion is quickly fading. At spot rates, BTC is down 1.5 percent from yesterday’s and 4.2 percent from last week’s close meaning prices are stable but struggling to shake off sellers.

Even so, we maintain a bullish outlook mostly because of increasing investment in infrastructure and the other fundamental factors supportive of BTC as increasing acceptance by US government agencies. However, at spot rates, we suggest traders to take a neutral stand until after there is a confirmation of Jan 20 bulls.

After that, BTC may find momentum and prices may thereafter rally above our first bull trigger line at $3,800 or Jan 19 highs which also coincides with the 50 percent Fibonacci retracement level of Dec 2018 high low.

That will be the only guarantee, the necessary pad that will form the basis for Jan 10 and 20 loss reversal as BTC prices break off the last three weeks accumulation which favor bears in an effort versus result point of view. Should that be the case, our first target will be modest and as before—at $4,500.

All Charts Courtesy of TradingView—BitFinex

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.