Bitcoin is wavy, steadying below $50k after early this week’s fears. For all there is, buyers appear confident and the path back above $50k is high.

Will there be a Santa Rally?

Ahead of the festive period, traders expect prices to strengthen, even lift above the psychological mark and overcome the immediate resistance—former support at $53k.

While the current BTC/USDT price action beats for sellers, there is hope, especially from the adoption angle.

For instance, amid global economies heating up and forcing inflation levels to historic highs, Bitcoin is slowly entrenching itself as a preferred store-of-value.

Supporters, including billionaire Ray Dalio, are bullish on the digital gold, saying it would protect his vast portfolio.

Over the past few years, Ray shifted his support to Bitcoin, acknowledging the coin’s benefits as an internet native currency.

Inflation concerns, the FED’s Monetary Intervention

The spike in inflation is a net positive for Bitcoin and value-preserving assets, massively benefiting USD—a reserve fiat currency classified by traders as a safe haven.

However, it will be interesting to watch how events pan out in 2022.

While traders expect a mild expansion of crypto-asset prices next year, the U.S. and the FED have set out a clear monetary policy plan.

The central bank has indicated that it will raise interest rates three times and taper their bond purchasing marking the end of a dovish regime which has seen the world’s largest economy propped.

Therefore, how Bitcoin and crypto prices react would most likely dictate these coveted digital assets’ medium to long-term trajectories.

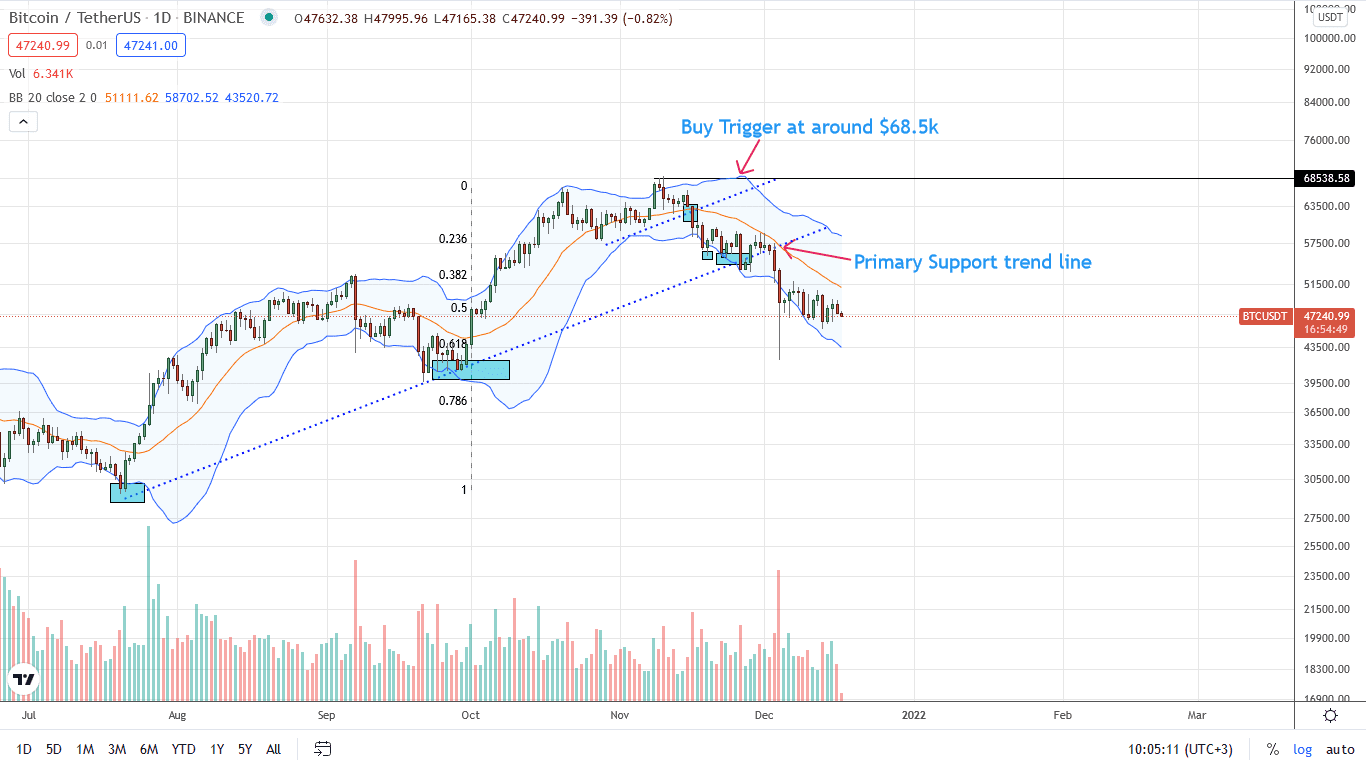

Bitcoin Price Analysis

From the daily chart, the BTC price is steady above $46k and, most importantly, $42k—the depth of December 4, 2021.

Technically, candlestick arrangement favors sellers in the short term despite the soaking of liquidation pressure.

In the days ahead, aggressive Bitcoin sellers may unpack on pullbacks as long as prices are below $53.5k and $52k—these are key resistance levels in the short term.

A surge thrusting BTC prices above December 4 highs would ignite demand, possibly lifting BTCUSDT towards $60k.

Conversely, if sellers take charge, confirming mild losses of December 13, driving BTC past $46k in a bear trend continuation pattern, the coin may slide to $42k—December 4 lows.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news