TL;DR

- Over the past five weeks, U.S.-based Bitcoin ETFs have attracted over $9 billion, while gold-backed funds lost $2.8 billion in the same period.

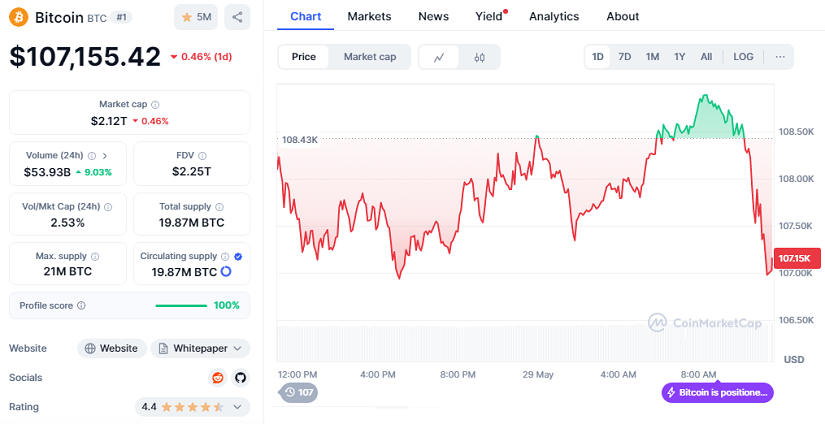

- Bitcoin recently hit an all-time high of $111,980 and is now trading at $107,155.42, with a market cap of $2.12 trillion.

- Analysts see Bitcoin gaining ground as a hedge against global volatility and growing concerns over U.S. fiscal stability.

A quiet but powerful capital shift is unfolding in the U.S. financial markets. Over the past five weeks, exchange-traded funds (ETFs) backed by Bitcoin have taken in over $9 billion, with “BlackRock’s iShares Bitcoin Trust” leading the way. In contrast, gold-backed funds have seen more than $2.8 billion in outflows, according to Bloomberg data.

This movement signals a shift in investor sentiment. Gold, traditionally viewed as the ultimate safe haven during turbulent times, now appears to be losing ground to a digital version that, despite its youth, is gaining credibility due to its decentralized nature and fixed supply. Institutional demand for digital assets is also accelerating, driven by a growing desire to diversify away from government-managed monetary tools.

Currently, Bitcoin is trading at $107,155.42, showing a slight daily decline of 0.46%, but holding a staggering market capitalization of $2.12 trillion. While still below its recent peak of $111,980, the surrounding narrative has been strengthened by favorable regulatory signals and growing momentum behind U.S. legislation focused on stablecoins. Recent approvals of crypto investment products by major regulatory bodies have further solidified Bitcoin’s role in modern portfolios.

Decoupling Strengthens Bitcoin’s Role as an Alternative Asset

One striking factor for analysts has been Bitcoin’s increasing independence from traditional markets. Over the past month, its intraday correlation with the Nasdaq, the dollar, and even gold has been notably low. For some experts, this shift reinforces the perception of Bitcoin as a strategic component in diversified portfolios.

Geoff Kendrick, global head of digital asset research at Standard Chartered, noted that Bitcoin now functions as a shield against both private and public sector risks, from events like the 2023 collapse of Silicon Valley Bank to concerns surrounding U.S. Treasury stability and political pressure on the Federal Reserve’s autonomy.

Investors Seek Refuge in New Alternatives

The recent credit rating downgrade of the U.S. by Moody’s — now aligned with Fitch and S&P — adds pressure on the dollar and other traditional assets. Against this backdrop, Bitcoin is shedding its image as just a speculative tech asset. Instead, it’s increasingly being regarded as protection against the structural weaknesses of the legacy financial system.