TLDR:

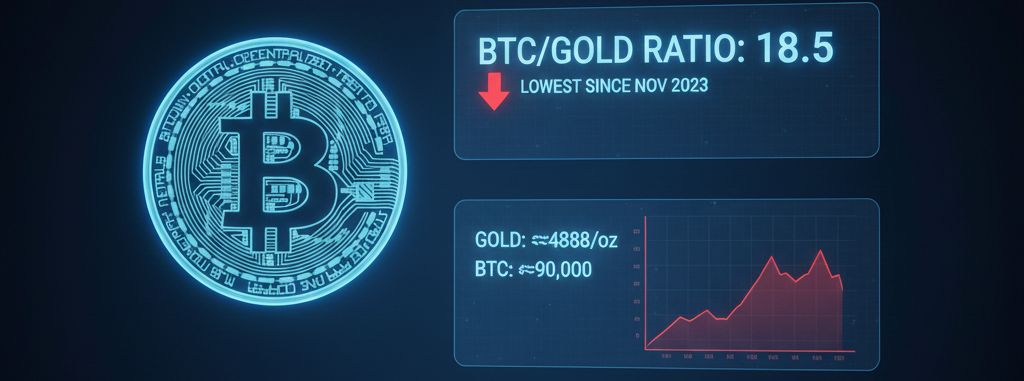

- The BTC/Gold ratio fell to 18.5 ounces per unit, its lowest level since November 2023.

- Gold reached highs near $4,888, while Bitcoin struggles to maintain the $90,000 mark.

- Statistical models categorize this deviation as an extremely rare event in market history.

The financial market is witnessing an uncommon statistical phenomenon. At the close of the week, the Bitcoin-to-Gold ratio hit historical levels of divergence, positioning itself at 18.5 ounces of gold per BTC—the lowest figure recorded in years.

Checking in on Bitcoin's power law in GOLD 💰🪙

— Sminston With 👁 (@sminston_with) January 22, 2026

– – –

This is seriously a historic 'Black Swan' for the BTC/Gold ratio.

Whether we are experiencing a precious metal bubble, soon to pop, or a true transition of the monetary order (a la Ray Dalio), next moves imply huge BTC gains.… pic.twitter.com/vFTJ9OkWmk

The recent gold rally is undoubtedly responsible for the drop in the value relationship, as the precious metal touched levels near $4,888 per ounce. On the other hand, the pioneer cryptocurrency showed weakness while attempting to consolidate above $90,000, putting downward pressure on the indicator.

Industry analysts using “Power Law” models point out that this reading is considered an outlier. In fact, data suggests that Bitcoin is trading well below its historical 1% range against gold, a condition only seen during periods of high financial stress.

Capital Rotation and Contrary Signals in the Market

Experts such as André Dragosch from Bitwise interpret this situation as a contrarian signal. For the analyst, the fact that the Bitcoin-to-Gold ratio hit historical levels of discount suggests that Bitcoin is undervalued compared to the traditional safe-haven asset.

This gap responds to structural changes in the international monetary system, where gold has captured capital ahead of time. However, financial history shows that investment flows typically rotate from gold toward risk assets like Bitcoin once the metal reaches exhaustion levels.

In summary, although gold maintains its dominance due to macroeconomic uncertainty, the current technical structure could signal the end of the downtrend for the ratio. Investors are closely monitoring whether this statistical anomaly will precede a new bullish cycle for the cryptocurrency against the physical asset.