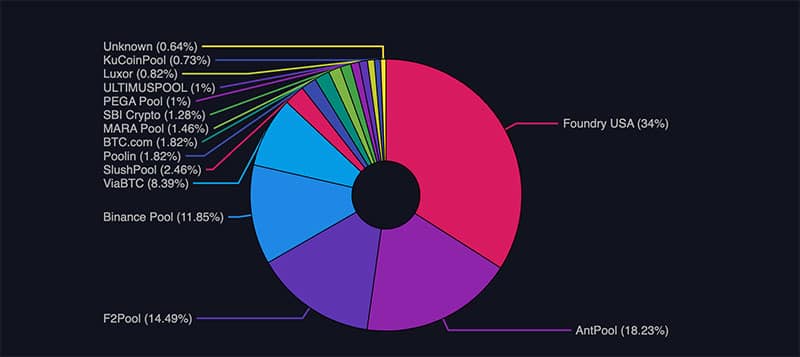

Based on the data about mining pools and hashrates, a great deal of power is being controlled by a few mining pools. According to the latest data available from Mempool, Foundry USA and Antpool hold about 52% of the power.

Where is Decentralization?

For several weeks now, Foundry USA has maintained a hash rate greater than 30% of the Bitcoin network’s total hash rate. A month after the ban on Bitcoin mining in China occurred in the middle of the same year, that mining pool became the first pool of non-Chinese origin to top the list of mining pools in November 2021.

It was estimated that Foundry USA contributed around 17% of the total Bitcoin hash rate back then. According to the latest statistics, the US-based pool is responsible for 34.1% of all the mining power today. As it stands, Antpool is in second place with about 18.0% of the total hashrate.

In this graph, it can be seen that more than 80% of Bitcoin’s mining power is concentrated among just 5 pools and that more than 50% of it is concentrated among the two first ones. In a contrast, at the beginning of 2022, there was less share of the hashrate competed among these five mining pools.

Bitcoin, however, poses a significant threat to its stability because of its highly centralized mining system. Alternatively, the miners could decide to reject transactions that don’t meet a set of parameters, thereby resulting in the possibility of a 51% attack.

In a crypto environment, centralization is always going to be a concern. There are some mainstream users who may become concerned about the statistics above because they are unfamiliar with how pools and teams work, and do not know how to understand them. As a result, they are afraid that Bitcoin is not a reliable enough currency and may choose to stay away from it.

However, mining pools might not do that, on the other hand, there is a risk that the credibility of a blockchain will be weakened if a 51% attack occurs on it. It is therefore likely that if there is a problem with Bitcoin, the mining pools will be affected as well. The same thing has happened in Ethereum in the past few years, and we’ve seen it happen there as well.

Maybe some regulations in other countries and the plans to support mining pools with renewable energy may help the status change. More mining pools can be added to the system and increase their share while decreasing the share of the dominant pools.