The Bitcoin Price is wavy if the price action of the last few days leads. Overall, the market confidence is bullish considering supporting news and the increasing development in the Bitcoin and crypto scene.

While the fake news around the adoption of Litecoin by Walmart sparked action, it couldn’t last the same day when there was clarity from the Litecoin Foundation and the world’s largest grocer.

Even so, this roused the market for the better, lifting Bitcoin and quite literally every other cryptocurrency in the last few days.

Bitcoin Mining and Trading in Laos

At present, Bitcoin remains steady and looking up, judging from the technical candlestick arrangement in the daily chart.

This could be sparked by news out of Laos—a carbon-neutral country—who are pushing into crypto mining and trading. The country predominantly uses renewable energy, which powers crypto and Bitcoin mining activities.

Despite the massive consumption by the network, China’s exit now helps make Bitcoin more robust from the resulting redistribution.

Hash Rate Recovers despite China’s Ban

With Laos in the mix, Bitcoin miners seeking options and needing redeploying can confidently set up rigs in the country, tapping on renewable energy sources.

Thus far, the overall Bitcoin hash rate, a measure of computing power tied to the level of participation, has increased 54 percent from June 2021 lows below 100 EH/s.

China shuts down mining. 😱#Bitcoin hash-rate be like k baiiiii🖕

Arguably the most powerful country in the world actively put its force behind destroying the heart of #BTC.

It fails.

This is bullish. pic.twitter.com/67PIu02yui

— This is Bullish (@thisisbullish) September 16, 2021

This news came despite the announcement from Hubei—a province in China—of their banning of crypto and Bitcoin mining activities, maintaining that these acts obstructed their drive of conserving the environment.

Bitcoin Price Analysis

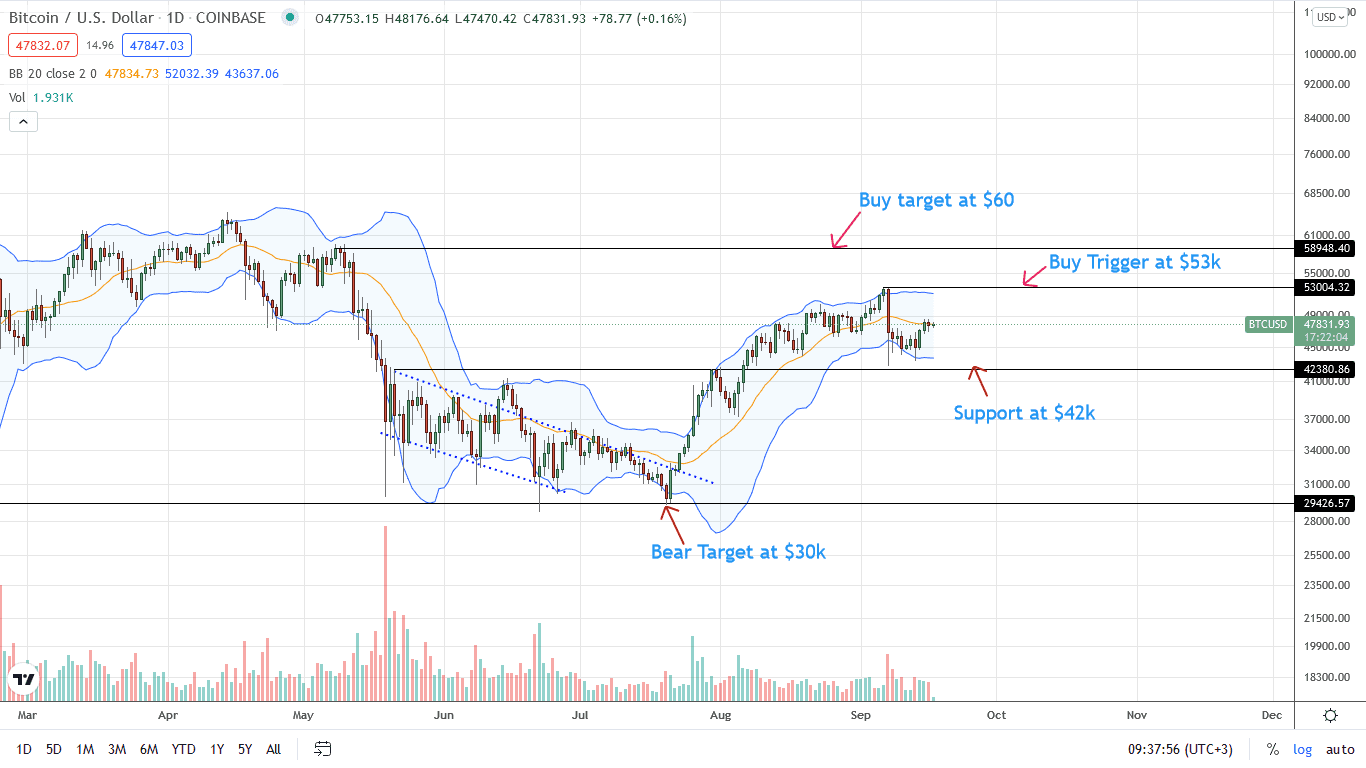

The Bitcoin price is printing higher highs but largely stable at the time of writing.

A look at the daily chart indicates that buyers are in the driving seat with encouraging higher highs.

Even so, despite the market confidence, BTC prices are trending inside September 7 bear bar. Technically, this signal weakness from a volume analysis perspective, meaning buyers must rewind losses of last week for the uptrend to be valid.

If bulls are successful and BTC prices climb higher over the weekend, the odds of even more gains towards $51k would be high.

On the reverse side, there might be calls for concern if there is a dump down below $42k—January 2021 highs and critical support—previous resistance level. In that case, Bitcoin may tumble back to $36k in a retest.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news

![Bitcoin [BTC]](https://crypto-economy.com//wp-content/uploads/2021/04/andre-francois-mckenzie-JrjhtBJ-pGU-unsplash-e1618324096656-1024x576.jpg)