Bitcoin is cooling off, and some traders are already ducking for cover. There could be selling pressure explaining losses of the past three days.

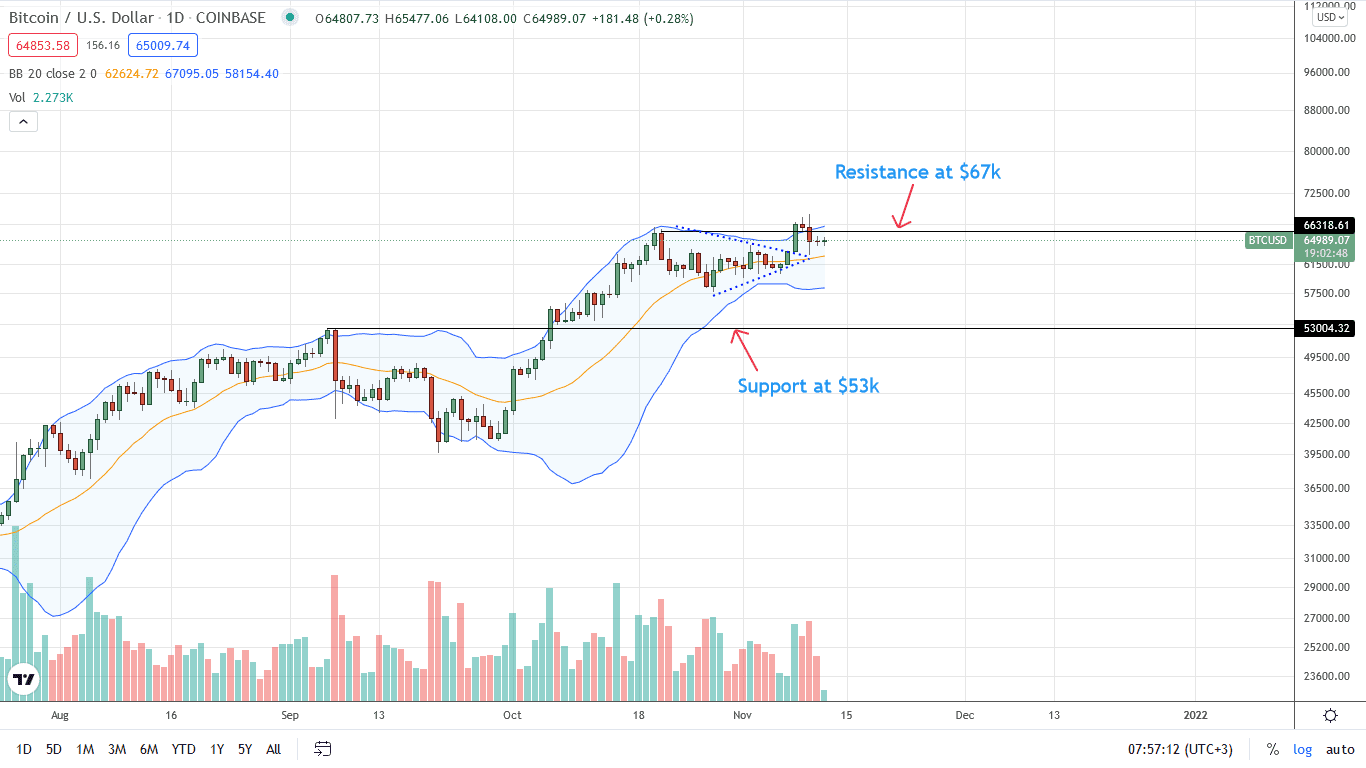

However, BTC/USDT prices are firm to the upside, reading from the candlestick arrangement in the daily chart.

If anything, every low may offer entries for the optimistic type of buyer angling for a race back to $67k or better in the immediate term.

Inflation Concerns

Behind Bitcoin’s resurgence are several tailwinds.

On the one hand, institutional interest stems from the SEC’s approval of the first Bitcoin Futures ETF with more jurisdictions following suit, signaling acceptance.

Yet, on the other, there are concerns about the state of inflation in the U.S. Bitcoin and most cryptocurrencies with fixed supply are meant to be deflationary, cushioning holders against the harsh effects of inflation.

The rise of inflation, though the FED insist as transient, could gnaw value and erode purchasing power for USD holders.

This is where Bitcoin steps in as a store-of-value and hedge against inflation.

The spike in inflation figures can be blamed squarely on the interventionist measures by governments and central banks in the past year.

Since then, over 40 percent of USD in circulation were printed and even more minted out of thin air in other jurisdictions for the same purpose.

Bitcoin Bulls Have a Lead

Due to rising inflation, Bitcoin could position itself as a cushion, attracting even more investors and traders.

Accordingly, analysts expect BTC/USDT prices to recover from spot rates, springing higher towards the $100k level in the medium-term.

Bitcoin Price Analysis

The Bitcoin price is retracing from all-time highs when writing.

However, the coin remains within a bullish breakout pattern, reading from the price action of the daily chart.

When writing, aggressive traders may load the dips, buying above $64k—in a retest—while targeting a reclaim of $67k in the short term.

Based on BTC/USDT price action, a breach of $67k and November highs may see bulls flow back, thrusting price higher. The immediate target lies at $94k—the 1.618 Fibonacci extension level of the H1 2021 trade range.

Even so, if Bitcoin sellers take control, unwinding the solid gains of early November below $64k, BTC/USDT may sink back to within the $58k to $60k support zone. Further losses open up BTC for $53k—or worse—in subsequent sessions.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news