In general the market has experienced reccently an interesting downturn and has caused much fear on the part of investors and traders, enough for them to withdraw part of their capital, causing a massive capital flight from the market. The FUD is spread like a virus and causes many to fall into manipulations, that is why it is vital to observe the market from the most objective point of view. On this note lets see through Technical Analysis, how the first 10 currencies in capitalization according to Coin Market Cap are doing.

Bitcoin, BTC / USD

Paying attention to the BTC / USD pair in the BitFinex exchange house, it is observed that the price shows the same upward channel of green color, at this moment it seems to have broken the lower part of the channel, so it is possible that it will Pull back towards that area. Besides, when drawing the trend line (red) using the 3 most important highs of this year, it is visible that the price continues to respect that resistance. And when doing the same with the 3 most important minimums of this year, it is easily observed that the price broke the trend line (blue) that served as a great support. The volume was high at the time of the support breakage, a volume that did not appear for some time, so no doubt you can say that there was push. All this can be a bears trap, but the truth is that it does not look like a trap, but rather a movement in the direction of the current trend.

- Some supports and resistances remain in use, after the support of the $ 7,500 area has been broken again and converted into a resistance. If BTC decides to rebound, you can find resistance in the areas of $ 7,000 (psychological level), $ 7,200, $ 7,500, $ 8,000 / $ 7,900 (a psychological level), $ 8,600 / $ 8,700, $ 8,900 / $ 9,000 (other psychological level) and $ 9,300 / $ 9,400. There are many resistances along the way, tough without doubt.

- In case of perpetuating the bearish direction, you can find supports in the areas of $ 6,700 / $ 6,600, $ 6,300 / $ 6,400, $ 6,100 / $ 6,000 (psychological level) and $ 5,900 / $ 5,800. They are good livelihoods, but if it continues with that strength, it may not be enough

Ethereum, ETH / USD

Looking at the ETH / USD pair at the Kraken exchange house, it shows something analogous to the ascending channel examined in BTC, but in this case, although it can be said that it broke the channel on its lower part, being flexible we can also say that it seems have bounced, so it could take direction towards the top of it. In particular, when drawing the trend line (yellow) using the last 2 maximums of the year, the fact that the line remains in a dominant resistance is valued. As in BTC, there was a lot of force to break the lower part of the channel (if its consider that it did) so although all this great fluctuation can be a deception, it is better to be careful, just in case.

- In case of finding a rebound, the currency may encounter resistances at $ 590 / $ 600, $ 645 / $ 650, $ 720 / $ 740, $ 835 / $ 850, $ 890 / $ 900 and $ 975 / $ 1,000, all psychological levels of vital importance. Since the $ 590 / $ 600 support broke one more it became a resistance.

- If ETH decides to extend its descent, it can locate some adjoining supports in the areas of $ 535 / $ 540, $ 460 / $ 490, $ 435 / $ 440, $ 400 / $ 405 and $ 350 / $ 360. Zones that are propped up as possible sustenance.

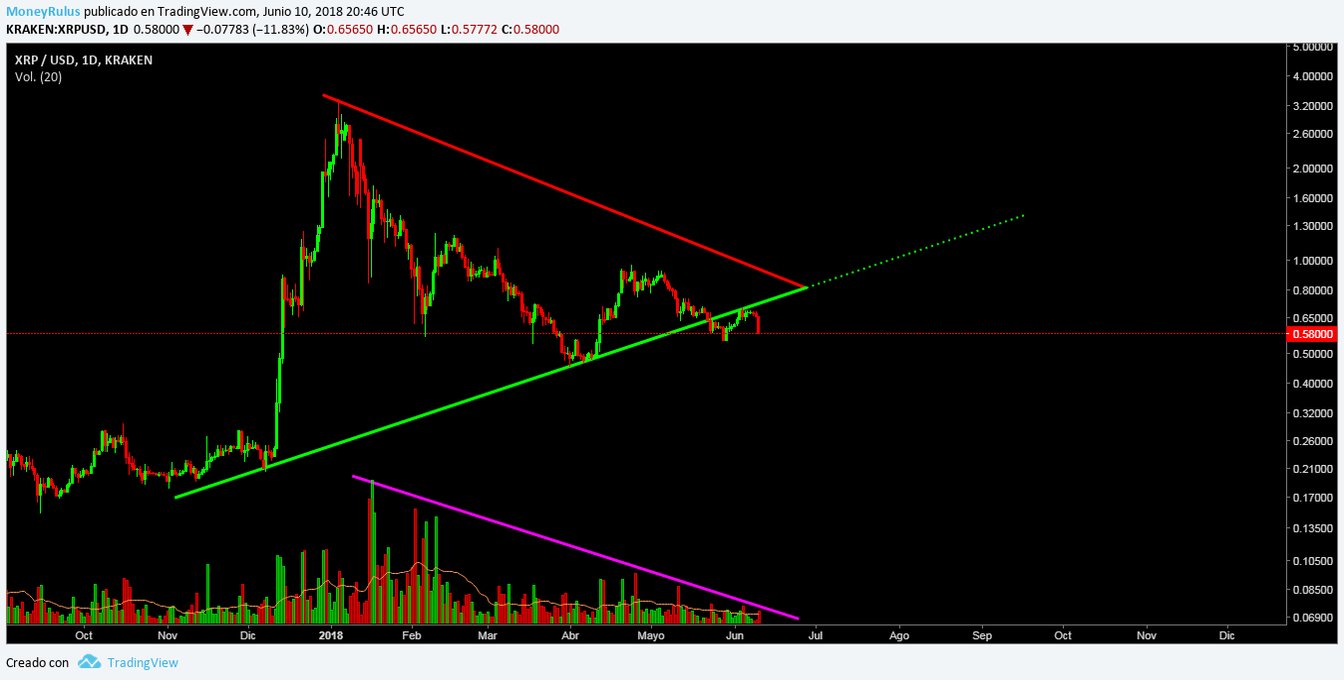

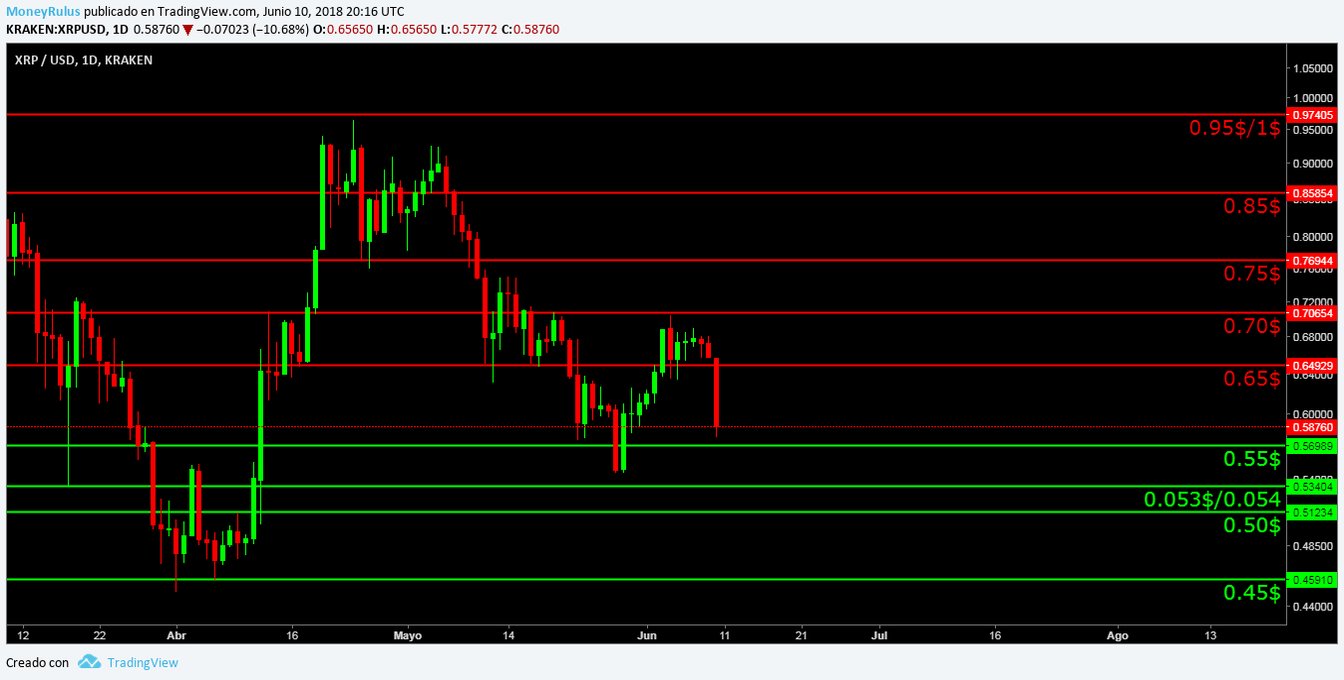

Ripple, XRP / USD

The XRP / USD pair in the Kraken exchange house, it seems that the symmetrical triangle pattern we have been talking about for weeks went invalid, the price broke several days ago the lower trend line (green) that served as support. At the time of the invalidation, the volume increased enough to demonstrate decisive force, that is, it supported the action (see pink line). While it may be a trap, in the past it was excessively flexible which is useless, the graph clearly shows that support was breached and it is possible that the Pull back has already been made. Ideally, be patient, but from now on the old support is emerging as a possible resistance in the future, which undoubtedly will be useful to consider.

- In case of trying a rebound, the currency can discover resistances in the areas of 0.65 $, 070 $, 0.75 $, 0.85 $ and 0.95 $ / 1 $. Resistance remains almost intact, apart from the area of 0.65 $ which became a resistance again, after being broken as support, and the area of $ 0.70 that was recently added.

- It is possible to discover supports in the areas of 0.55 $, 0.53 $ / 0.54 $, 0.50 $ and 0.45 $.

Bitcoin Cash, BCH / USD

Taking a look at the BCH / USD pair in the Kraken exchange house, the same continues with the symmetric triangle pattern similar to XRP, only that it is still valid, a detail that changes everything, the volume has gradually decreased as the pattern evolves (see pink line), affirming it, which undoubtedly is very positive. The price seems to have direction towards the lower part of the triangle, to touch the support of the rising trend line (green), in this area it could find support, but knowing what happened with XRP it is better to be suspicious and be careful.

- In case of finding an upward rebound, BCH can locate resistances in the areas of $ 1,130 / $ 1,150, $ 1,450 / $ 1,500, $ 1,750 / $ 1,800 and $ 1,950 / $ 2,000 (a transcendent psychological level for a while now) . The resistance of the area of 1,130 $ / 1,150 was recovered, as it yielded as a support.

- If the pair continues in the direction of the fall, you can stop with supports in the areas of $ 960 / $ 980, $ 850 / $ 870, $ 770, $ 700 (an important psychological level) and $ 640, a newly added support.

EOS, EOS / USD

The EOS / USD pair in the BitFinex exchange house apparently broke the line of upward trend (green line) that was maintained during the previous weeks, in spite of that it is perpetuated with the Cup & Handle pattern (pattern that as you know, it is very bullish ) that we have inspected, so the upward possibility remains valid, but weakened by the breakdown of this strong support. The volume shows a lovely support (see pink lines), but while this is true, so is the fact that it showed a devastating force in the breakup that made the price, this is something necessary to limit, as it is undoubtedly a demonstration of courage on the part of the bears. At this time it is best to be patient, because both facts are important.

- In case of rebouncing, the pair may show resistances in the areas of $ 11.8 / $ 12, $ 15, $ 17, $ 18.9 / $ 19 and $ 23 (the historical maximum). Resistances remain intact since last week, in addition to the area of $ 11.8 / $ 12 was added, since it broke as a support.

- In case of staying in the descent, the areas of $ 10, $ 9 and $ 8 may be used as supports, significant psychological levels that may become the protagonist in the future.

Litecoin, LTC / USD

Checking the LTC / USD pair in the Kraken exchange house, it is possible that the symmetrical triangle pattern has broken the low, breakage that was also reflected with strength in volume (see pink line), which shows ferreous decision on the bearish part, and some weakness on the bullish part. Also, the price broke the ascending channel that we were seeing, and it is possible that it also made the corresponding Pull back, and we were flexible with LTC, so it is useless to turn a blind eye and ignore the facts. The possibility that it is a deception is still valid, but it seems small.

- If it decide to persist in its movement to the downside, it can show certain areas as supports close to $ 100, $ 90 and $ 80. Supports that are important psychological levels, and that in the unknown future, may be very useful.

- Some resistances can be found in the areas of $ 109, $ 120, $ 132, $ 152 / $ 155, $ 165 and $ 185. The resistances remain intact and has been reinforced with two more zones, the areas of $ 109 and $ 120, areas that are undoubtedly transcendental.

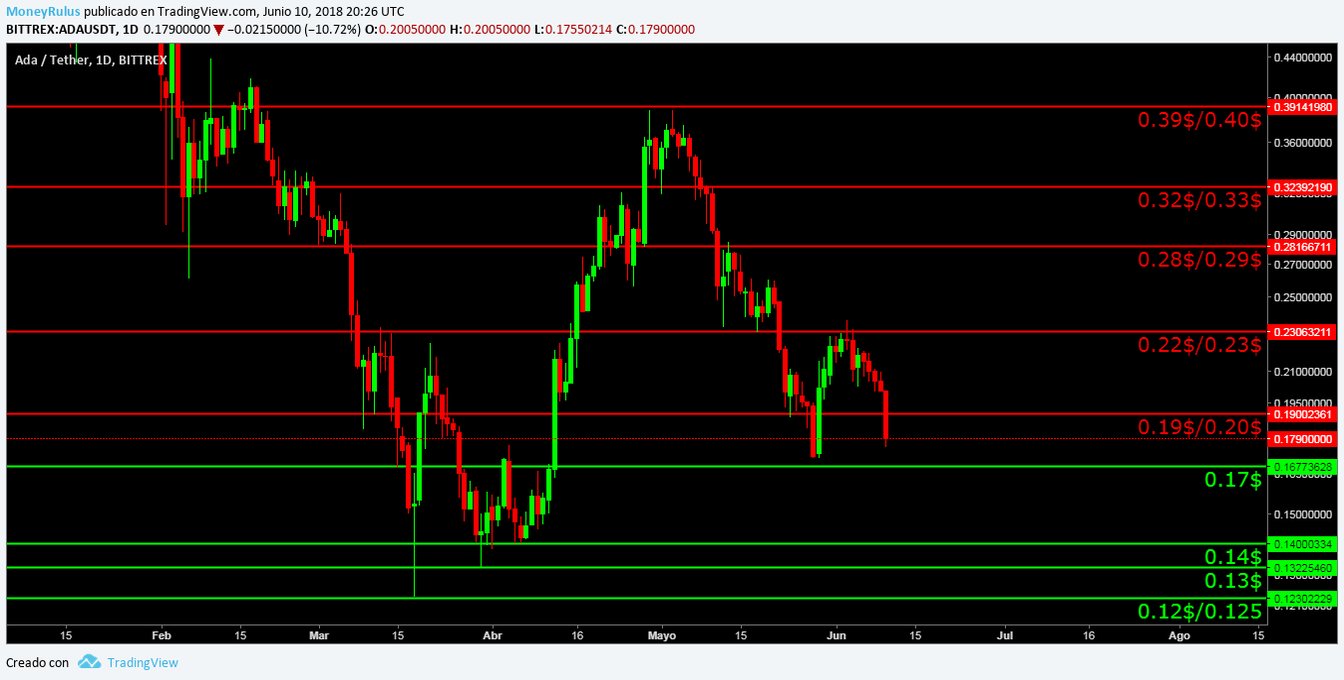

Cardano, ADA / USD

The ADA / USD pair in the Bittrex exchange house shows that the price has broken the ascending channel towards the downside, it is possible that it has already carried out the Pull back in the same way, so it could try to keep going down, in search of a new course. The volume showed a lot of support in the descent, which undoubtedly adds a lot of moral strength to the bears and is subtracted from the bulls.

- They show resistances in the areas of 0.19 $ / 0.20 $, 0.22 $ / 0.23 $, 0.28 $ / 0.29 $, 0.32 $ / 0.33 $ and 0.39 $ / 0.40 $. The same resistances that were held since last week, plus the area of 0.19 $ / 0.20 $, which after having been broken as a support, went to being a resistance.

- There may be supports in the areas of 0.17 $ (a strong area), 0.14 $, 0.13 $ and 0.125 $ / 0.12 $. Areas that may provide ground during price fluctuations, something undoubtedly very valuable.

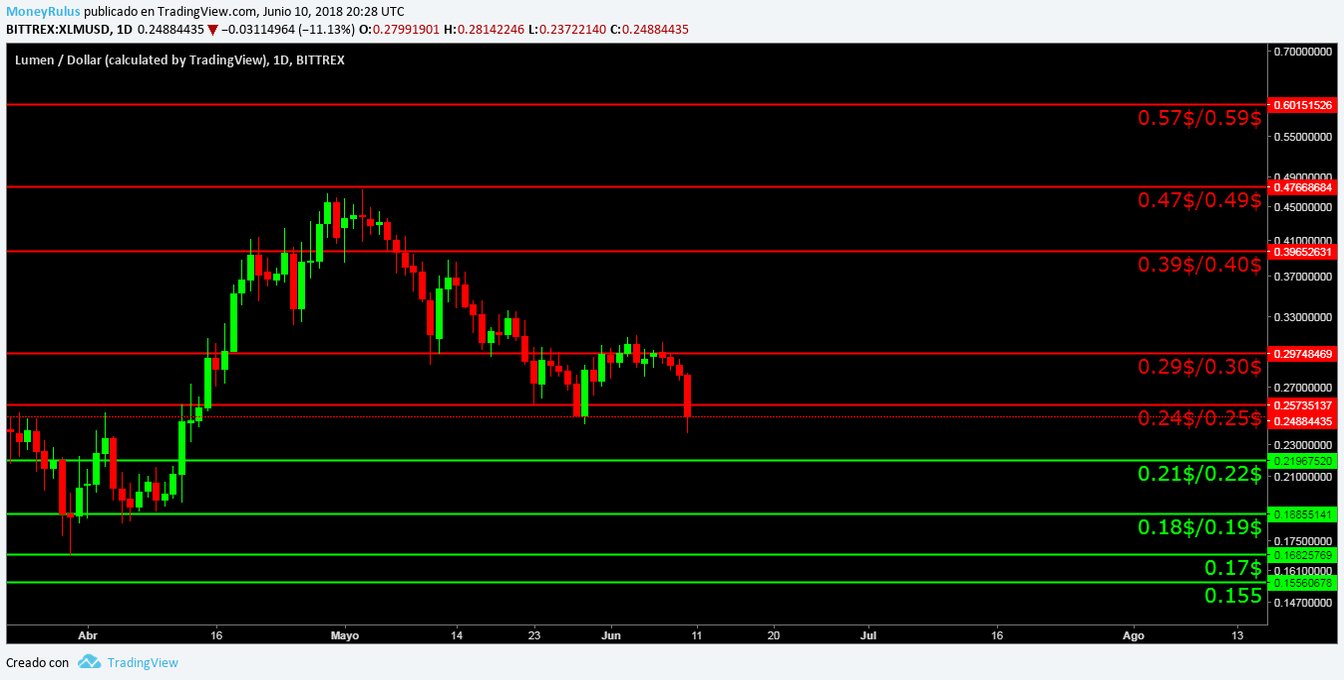

Stellar Lumens, XLM / USD

The XLM / USD pair in the Bittrex exchange house, exemplifies a possible break of the ascending channel of which we have spoken, being thus, something possible that the price can make a pull back or simply return to the channel after a deep puncture . If it were only a very deep puncture, the symmetrical triangle pattern we know would still be valid. The volume (pink line) testifies to the seriousness of the pattern, which could remain effective. Unlike the previous coins, XLM does not show volume anywhere, it seems that this coin lost its pulse, because no palpable movements of the volume in relation to the movement of the same, something that is undoubtedly very curious, and a sign to remain suspicious.

- If it manages to rebound upwards, the currency may encounter resistances in the areas of 0.24 $ / 0.25 $, 0.29 $ / 0.30 $, 0.39 $ / 0.40 $, 0.47 $ / 0.49 $ and 0.57 $ / 0.59 $. The 0.29 $ / 0.30 $ area was transferred after having become a support, so once more it becomes a resistance. Like the area of 0.24 $ / 0.25 $, which was also converted.

- Support can be found in the areas of 0.21 $ / 0.22 $, 0.18 $ / 0.19 $, 0.17 $ and 0.15 $, attractive areas to contemplate and which have been standing since last week.

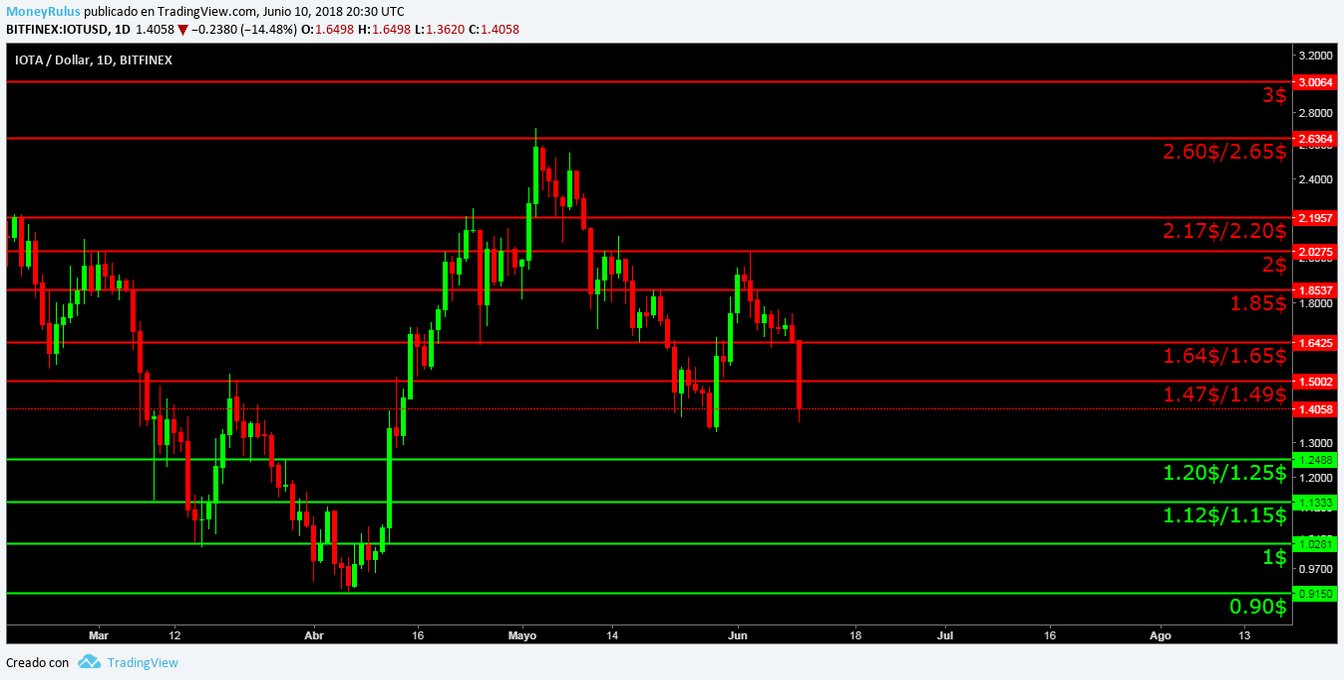

IOTA, IOTA / USD

We analize the IOTA / USD pair in the BitFinex exchange house, which remains above TRX in its constant struggle (moving up and down the rank in the top 10). The price shows the same ascending channel of the previous week, but at this moment it seems to be puncturing it in a slightly more daring way, even without breaking it altogether, in case of bouncing in the lower part of the channel, it could try to head upwards to touch the top of it. Separately it remains showing the symmetrical triangle pattern of which we have already spoken, for now it may be only inciting a little support, as a kind of test to see where the territory of each one reaches. The volume (see pink line) showed strength in the last drop that was presented, which undoubtedly must be taken into account, this mentiones, wait to see what decision the currency takes, patience is vital.

- If the market decides to rise upwards, the price may reveal resistances in the areas of 1.47 $ / 1.49 $, 1.64 $ / 1.65 $, 1.85 $, 2.17 $ / 2.20 $, 2.60 $ / 2.65 $ and $ 3. The areas of the $ 1.47 / $ 1.49 and $ 1.64 / $ 1.65 were broken after becoming supports, and now they are resistances again.

- It is possible to run into supports in the areas of $ 1.20 / 1.25 $, $ 1.12 / $ 1.15, $ 1 and $ 0.90. Areas that still survive since some supports were broken last week. This is important to have in mind, because in details like these are great improvements.

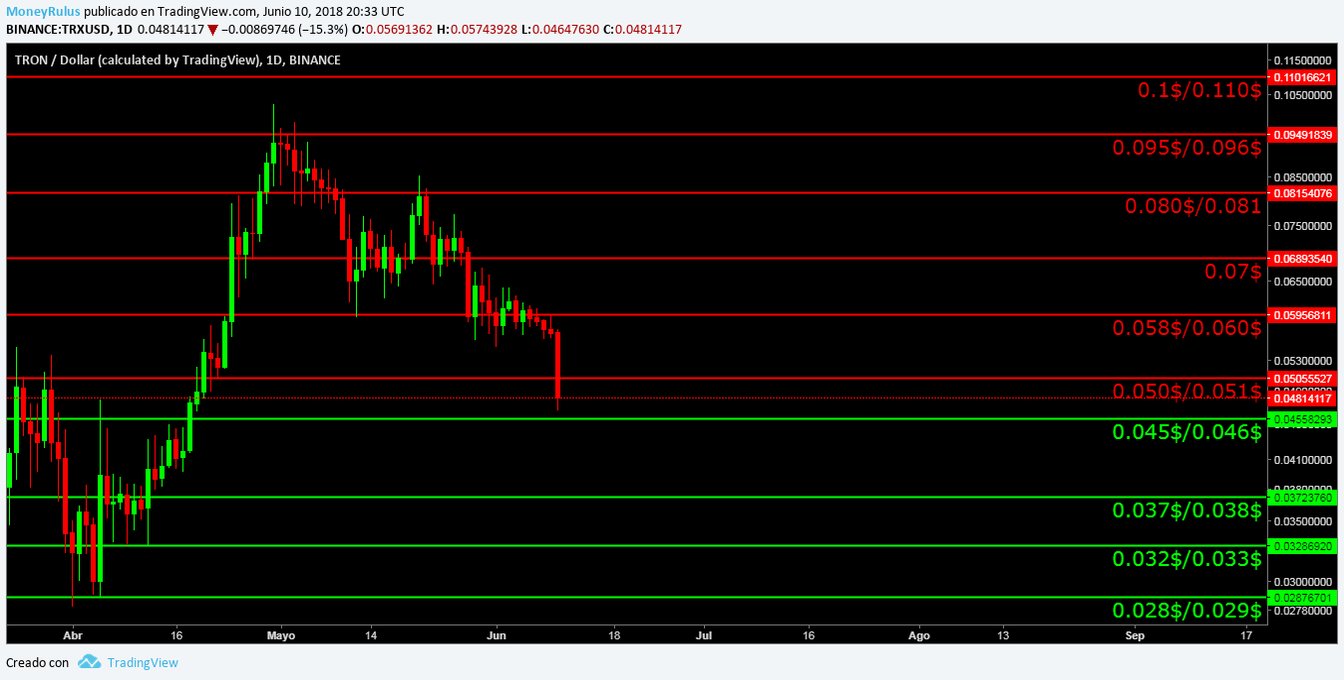

Tron, TRX / USD

Concluding, we note the TRX / USD pair in the Binance exchange house, at this time continues to respect the trend line (orange) that serves as a resistance and has been doing this for more than 3 weeks, so without a doubt it is a resistance that increasingly gains strength. Something interesting is that the price has not managed for weeks to touch again the uptrend line (green) that at some point was a support, which shows the clear direction that the price may have in the future in the case of not altering its course. Lately the coin dropped a lot and the volume (see pink line) accompanied the movement, so we can notice that there is still some strength to the downside.

- If TRX decides to rise upwards, it can find resistances in the areas of 0.050 $ / 0.051 $, 0.058 $ / 0.060 $, 0.07 $, 0.08 $ / 0.081 $, 0.095 $ / 0.096 $, 0.1 $ / 0.110 $ and 0.13 $ / 0.14 $, territories contiguous to psychological levels that have been maintained and nurtured since the previous week. And with this big drop in recent days, the areas of 0.050 $ / 0.051 $ and 0.058 $ / 0.060 $ that were previously supports broke and now they are outlined as a resistance that can be very strong in the future.

- In case of a prolonged decline in recent days, the price may run into supports in the areas of 0.045 $ / 0.046 $, 0.037 $ / 0.038 $, 0.033 $ / 0.033 $ and 0.029 $ / 0.028 $. Areas that are undoubtedly reasonable due to their proximity to psychological levels.