TL;DR

- Venture capital investment in the crypto industry decreased in January, despite the launch of Bitcoin ETFs and a growing market.

- There were 113 investment projects in January, according to a Wu Blockchain report based on RootData statistics, marking a 10.8% increase from the previous month.

- Although the total amount raised was $650 million, 28.6% less than in December 2023, the DeFi sector led the investment rounds.

In January, the crypto industry faced a particular situation: despite the excitement generated by the launch of Bitcoin ETFs and a market showing signs of vitality, venture capital investment in the sector decreased.

According to the report published on February 5 by Wu Blockchain, based on RootData statistics, there were 113 publicly disclosed crypto investment projects in the cryptocurrency venture capital space in January, representing a 10.8% increase from December 2023.

The DeFi Sector Led Crypto Investment Rounds

However, despite this increase in the number of projects, the total amount raised was $650 million, marking a 28.6% decrease from December 2023. This figure, although higher than the total raised in January 2023, indicates a downward trend in crypto project financing. Specifically, decentralized finance (DeFi) emerged as the dominant sector, representing 19% of the total, followed by infrastructure projects, NFTs, and GameFi.

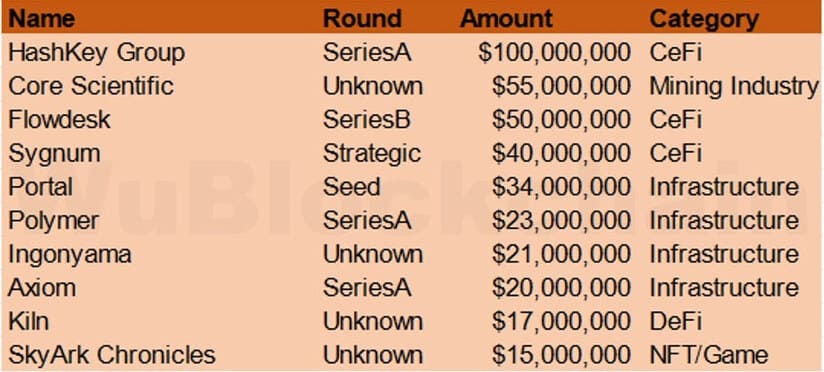

Among the notable projects that managed to raise funds in January is HashKey Group, which led the increase with a Series A funding round that raised almost $100 million. Additionally, companies like Core Scientific announced the final results of their $55 million capital offering, which was oversubscribed. Likewise, other projects such as Flowdesk, Sygnum, Oobit, Cube, Nibiru, and Pixelmon also managed to raise considerable sums, reflecting continued interest in various areas of the industry.

Despite the encouraging investments, total funding in January was significantly lower than the monthly highs reached in 2021 and 2022, suggesting that investor enthusiasm has not yet fully recovered. However, some metrics show signs of optimism. For example, DeFiLlama reported that total funding in January was $460 million, slightly higher than reported by Wu Blockchain. Additionally, the platform mentioned that February also witnessed significant fundraising by projects like Oobit, Cube, Nibiru, and Pixelmon.

Despite both positive and less favorable results, it is undeniable that the industry continues to develop and expand its horizons. This year still has much to offer, so we will be vigilant for all important developments that arise and the reaction of investors.