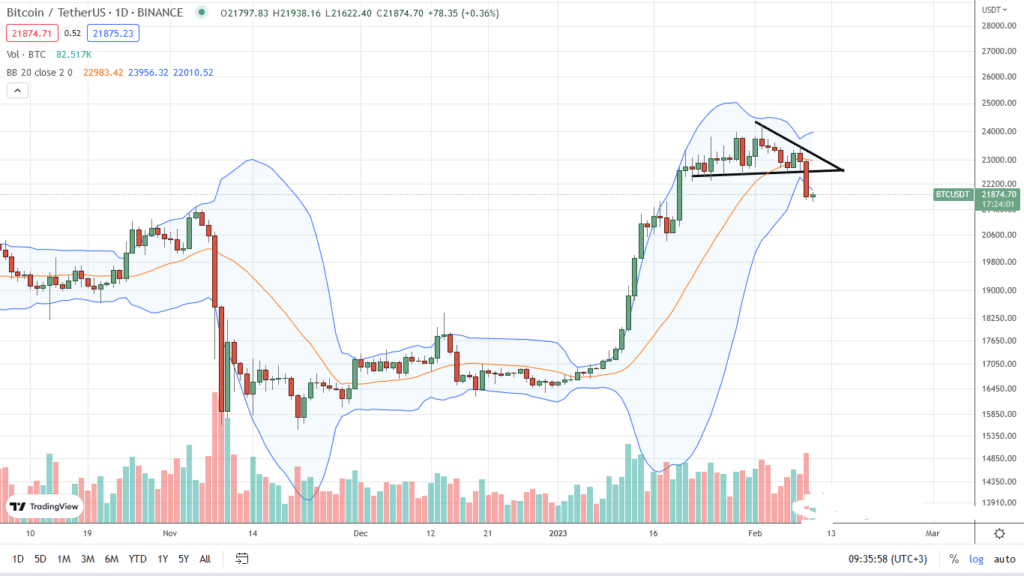

Bitcoin is down four percent in the last trading day. As it is, the coin is pulling back after impressive gains over the past couple of weeks.

Even though buyers might be in charge from a top-down preview, the development in the daily chart swings price action in favor of sellers.

The coin is already down 10 percent from January highs and could register even more losses in the days ahead.

With the coin below a critical support level, breaking out with expanding volumes, traders might want to ride the emerging trend, shorting on every high below the immediate resistance level.

SEC Strikes Kraken, Rumors of Further Enforcements

The trigger follows several enforcement actions from the United States Securities and Exchange Commission (SEC). Already, the agency has settled with Kraken, a crypto exchange, for $30 million on the condition that it shuts down its crypto staking service in the country.

Today we charged Kraken with failing to register the offer and sale of their crypto asset staking-as-a-service program, whereby investors transfer crypto assets to Kraken for staking in exchange for advertised annual investment returns of as much as 21 percent.

— U.S. Securities and Exchange Commission (@SECGov) February 9, 2023

On the same line, the Internal Revenue Service (IRS) is asking for tax information regarding its users. The SEC maintains that the exchange offered unregistered securities while promising high returns, which were not tethered to the current economic realities. Gurbir Grewal, the SEC Division of Enforcement director, added that Kraken didn’t provide any details about the service.

1/ We're hearing rumors that the SEC would like to get rid of crypto staking in the U.S. for retail customers. I hope that's not the case as I believe it would be a terrible path for the U.S. if that was allowed to happen.

— Brian Armstrong (@brian_armstrong) February 8, 2023

Brian Armstrong, the CEO of Coinbase, also said there were rumors that the SEC would completely ban crypto staking in the country. Although nothing has been confirmed, he added that should it happen, the country would be taking a terrible path.

Bitcoin Technical Analysis

Noticeably from the chart, the bear bar of February 10 is with rising volumes, indicating participation. Besides, the bar is along the lower BB, signaling intense selling pressure.

Based on this, and after a nearly 40 percent march of BTC prices from December lows, traders may look to sell on every high.

Unless there is a sharp expansion above $24k, every high will be a liquidating opportunity as traders target $21.5k and $20k.

Technical charts courtesy of Trading View.

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news.