TL;DR

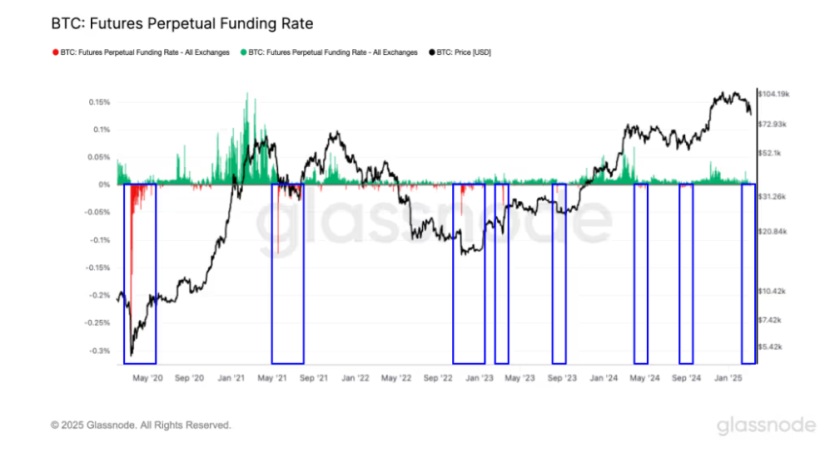

- Bitcoin’s perpetual funding rate has fluctuated between positive and negative, reflecting significant market uncertainty.

- Recently, the rate reached a negative value of -0.006%, indicating pessimism, which has coincided with major BTC drops in the past.

- BTC futures are trading at a discount, and short-term yields have fallen to negative levels, signaling weak demand.

Bitcoin is going through a period of uncertainty, reflected in the fluctuation of its perpetual funding rate, which has recently turned negative.

This change has caused considerable concern among traders, as a negative funding rate is typically associated with a potential bottom in the asset’s price. The funding rate is used to balance payments between long and short positions in perpetual futures contracts. When the rate is positive, those with long positions must pay those with short positions; if it’s negative, the situation reverses.

Over the past two weeks, the rate has oscillated between positive and negative, reflecting investor indecision. In bull markets, the funding rate typically stays positive, signaling widespread optimism among traders.

However, recently, the rate dropped to a negative value of -0.006%, equivalent to -2% annualized, indicating the pessimism in the Bitcoin market. This type of fluctuation is not new, as in previous instances, such as the FTX collapse or the Covid-19 crisis, negative rates coincided with significant drops in BTC’s value.

Bitcoin Faces Market Uncertainty

According to the latest data from CoinMarketCap, Bitcoin (BTC) is priced just above $78,000. It shows a 5.15% decrease in the last 24 hours. Its market capitalization has dropped by 4.55%, and its trading volume has surged by 138%.

The uncertainty is palpable. Even though each Bitcoin rally in recent weeks has generated increased demand, prices have failed to hold. This has led to long position liquidations when prices reversed, preventing negative rates from being sustained for extended periods. Investors appear to be seeking clear signals, but the constant fluctuations in the funding rate show that the market still hasn’t found a defined direction.

Investors Don’t Trust an Imminent Rebound

Meanwhile, Bitcoin futures expiring this Friday are trading at a slight discount compared to the reference price, indicating weak demand in the short term. This phenomenon, where future prices are below the spot price, is considered a sign that investors lack confidence in an imminent BTC rebound. Additionally, short-term futures yields have fallen to negative levels for the first time in over a year, a data point that demonstrates the weakness in demand