TL;DR

- CryptoQuant CEO Ki Young Ju has openly admitted his April prediction about Bitcoin’s bull run ending was wrong, as BTC soared from $80,000 to over $123,000 instead.

- He now claims the classic four-year Bitcoin cycle no longer applies because institutional players are changing the market’s structure.

- Current price sits at $116,537.51, down 2.16% in the last 24 hours.

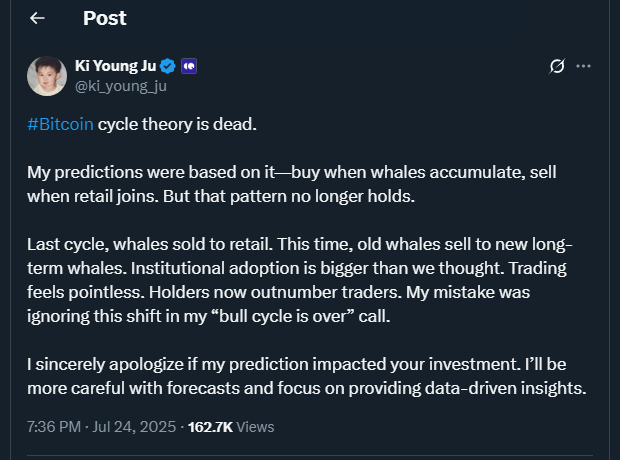

Ki Young Ju, founder and CEO of CryptoQuant, has taken a bold stance by declaring the long-held Bitcoin cycle theory obsolete after acknowledging his missed call earlier this year. Back in April, Ju warned that Bitcoin’s bull phase was finished when the price hovered near $80,000. Months later, Bitcoin defied those bearish signals, smashing through fresh all-time highs and peaking at $123,236 in July. Investors who trusted the old cycle pattern found themselves sidelined during one of the strongest rallies in recent memory.

Ju says the traditional pattern, where whales accumulate during downturns and offload to retail traders in upswings, has broken down due to growing institutional presence. Today’s environment looks different: legacy whales are selling to corporate treasuries, pension funds and long-term institutional investors. According to Ju, this shift creates a steadier holder base and dampens the impact of short-term speculation.

Institutional Demand Sparks New Holding Patterns

Recent market data supports Ju’s argument. Large institutions are deepening their involvement with crypto assets through significant Bitcoin and Ethereum purchases. Ethereum’s staking queue has surpassed 519,000 ETH since January 2024, equivalent to nearly $2 billion locked up and off exchanges. This trend, combined with upcoming U.S. ETF proposals from big names like Fidelity and WisdomTree, reflects a maturing market where traditional retail-driven booms and busts may fade.

While Ju dismisses the four-year cycle, others disagree. Fidelity’s Jurrien Timmer recently pointed out that Bitcoin’s price movements still closely align with the classic halving-driven cycle.

Regulatory Moves And Macro Shifts Shape The Path Ahead

Despite growing institutional support, global policy remains a puzzle for crypto expansion. South Korea still blocks crypto ETFs from adding more coins to their funds, citing outdated rules. Meanwhile, Citadel Securities has asked the SEC to resist relaxing guidelines for tokenized equities. At the same time, in the U.S., Treasury Secretary Benson’s calls for lower rates could push more capital into risk assets like crypto if monetary policy turns looser.

For now, Bitcoin sits at $116,537.51, down 2.16% in the past 24 hours but still well above its April levels.