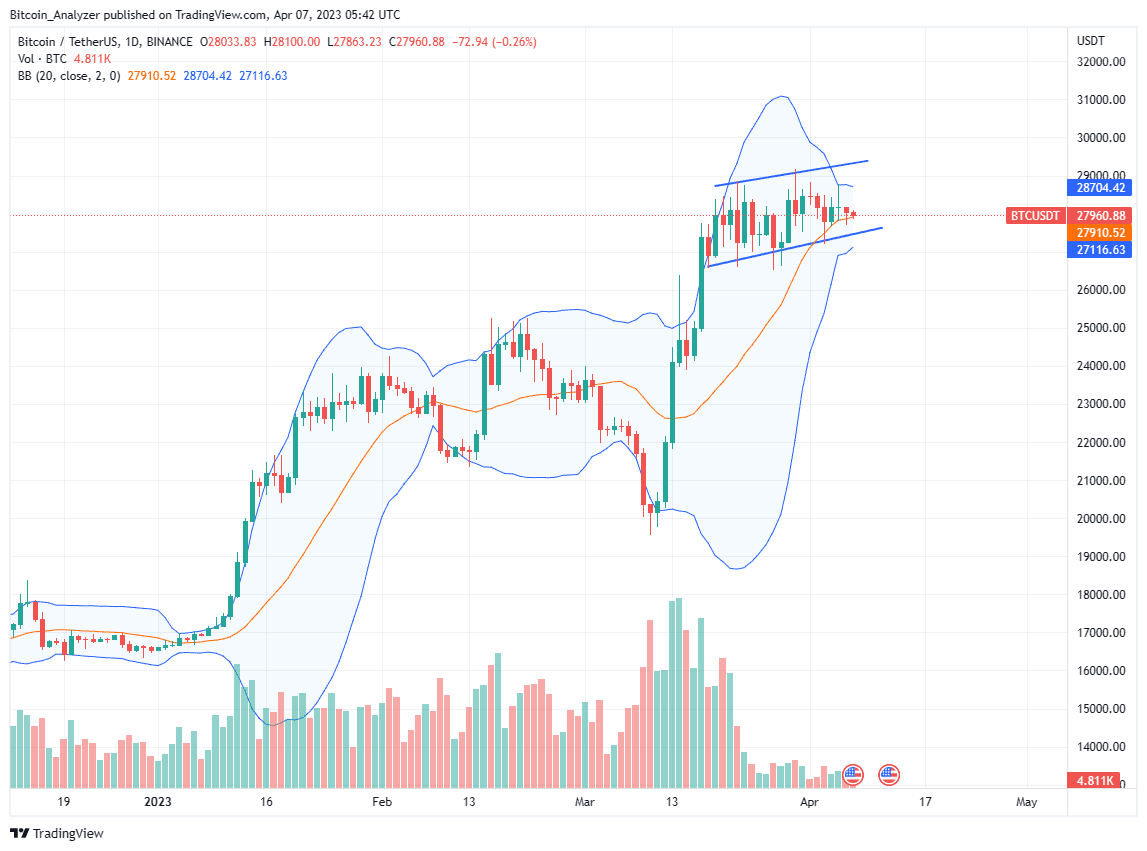

Bitcoin price action remains dull, looking at the performance in the daily chart. To illustrate, the coin has been weaving around $28k for the better part of this week.

Moreover, BTC remains within the March 17 trade range, pointing to strength in the medium term. Overall, the uptrend remains, and buyers expect prices to break above recent resistance levels, aligning with the formation of Q1 2023.

Even so, before then, it is important that BTC stays above $26.6k and shakes off attempts of lower lows, as witnessed on April 6. Besides, should there be a breakout, the leg above $29k ought to be with rising volumes, signaling strength behind the bull definition.

Apple Saves BTC Whitepaper

It has emerged that Apple has been distributing the original Bitcoin whitepaper with every Mac they sold since Mojave in 2018.

Hidden deep within the computer’s files, the whitepaper has been tucked safely for many users, only made available to the curious. Saved as a pdf file with an altered name, the copy has been retained on every subsequent Mac update.

It is not clear whether Apple purposefully chose to hide the file. What’s clear is that the Bitcoin community remains ecstatic.

Here's a mystery: why do I have an Image Capture device called Virtual Scanner II on my Mac? It shows a preview of a painted sign that for some reason closely resembles a photo by @thomashawk on 'clustershot'? But not exactly — the scanned version looks more weathered. pic.twitter.com/jPb5kx3NyS

— Josh D (@schwa23) November 28, 2020

Apple remains non-committal regarding Bitcoin and crypto. However, it is pro-technology, and whether they will, in the future, integrate BTC payment will be seen with the fullness of time.

Meanwhile, Paxful, the peer-to-peer trading platform, is winding down operations amid legal battles.

Bitcoin Price Analysis

BTC prices are stable when writing but are relatively trading higher at spot rates.

Though prices are in a rising channel, the consolidation of the past few days mean the uptrend is valid. Resistance lies at March 2023 high while support is around $26.6k, coinciding with March 22 lows.

For the uptrend to remain, traders must keep prices above $26k and possibly break above $29k. This will allow conservative traders to buy the dip, targeting $32k. Supporting this preview is the fact that prices remain within the March 17 bull bar. At the same time, subsequent bars have low trading volumes. Buyers have the upper hand from an effort versus result perspective.

Conservative traders can wait for a clean break out before committing, aware that losses below $26k may force the coin towards $24k in a retest.

Technical charts courtesy of Trading View. Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news.