Amidst a deepening banking crisis all across the world, Bitcoin (BTC)has managed to outshine Wall Street banks stocks accumulating a staggering growth of more than 27% over the past week. In tandem with the largest cryptocurrency, Ethereum (ETH) along with major altcoins have also jumped substantially, trading in green.

The cryptocurrency market is showing signs of greater resellience despite macroeconomic headwinds such as impending recession, labor shortages, global conflicts and soaring interest rate hikes. The predicament has further deterioted due to the banking crisis following the collapse of Silicon Valley Bank (SVB) and Signature Bank in the United States.

The episode turned into a full blown financial meltdown after the collapse of Europen banking giant, Credit Suisse. Despite such looming threats, the digital assets industry has performed significantly well in the past seven days. It seems the upcoming Federal Open Market Committee (FOMC) meeting this week will be a major market-moving factor that may trigger another round of upsurge in the crypto sector.

BTC Defies Ongoing Banking Crisis to Breach $28K

According to CoinMarketCap,Bitcoin’s market capitalization has added nearly $194 billion since the onset of 2023, representing a whopping 66% gain year-to-date (YTD), outperforming tradional stocks.

At the time of writing, Bitcoin (BTC) surged 4.63% in the last 24 hours to trade at $28,264. The world’s larget digital token jumped more than 27% over the past seven days gaining over 37% against the U.S. dollar. Bitcoin’s dominance increased 1.03% in the past 24 hours to 46.36%. The current analysis shows that buyers are firmly in control as the bellwether token races to breach the long awaited $30K mark.

In a statement Shivam Thakral, CEO at BuyUcoin explained the collapse of US banks like SVB and Signature has rekindled the debate on the importance of decentralized finance (DeFi) and digital assets. He specified that Bitcoin is poised to test $30,000 very soon but may face some resistance at that level. In another statement, Edul Patel, CEO at Mudrex noted,

“With instability in the banking sector, inflation data that exceeded expectations, and renewed optimism about a dovish Federal Reserve, Bitcoin has reached levels unseen in approximately nine months.”

Is Bitcoin Hitting One Million Soon?

On March 18, Balaji Srinivasan, former a16z partner and Coinbase CTO, took to Twitter to announce that Bitcoin (BTC) will be worth over $1,000,000 in the next 90 days. He placed a bet of a massive $2 million on Twitter on his view of the U.S. economy’s future citing the ongoing U.S. banking crisis would trigger a hyperinflation scenario leading to the seven-digit Bitcoin (BTC) price. Srinivasan pointed out that hyperinflation is inevitable due to the insolvency and ignorance of the bank system and financial regulators in the United States. He wrote,

“The central bank, the banks, and the bank regulators have bankrupted all of us. They hid their insolvency from you, the depositors. And they’re about to print $2T to hyperinflate the dollar.”

I will take that bet.

You buy 1 BTC.

I will send $1M USD.

This is ~40:1 odds as 1 BTC is worth ~$26k.

The term is 90 days.

All we need is a mutually agreed custodian who will still be there to settle this in the event of digital dollar devaluation.

If someone knows how to do this… https://t.co/tcuBNd679T pic.twitter.com/6Aav9KeJpe— Balaji (@balajis) March 17, 2023

Altcoins Trade with Mixed Sentiments

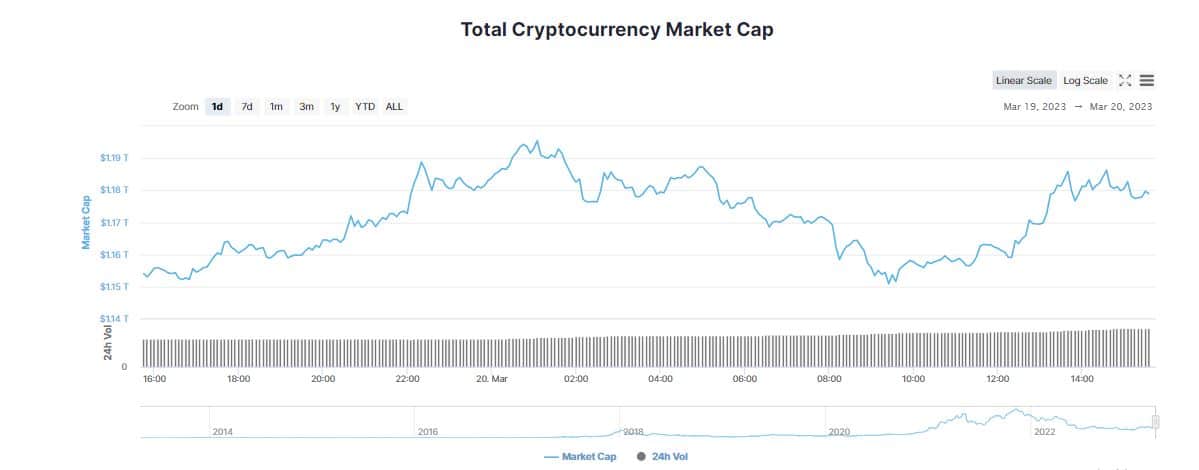

Meanwhile, the global crypto market cap experienced an uptick of 2.56% in the past 24 hours to $1.18 trillion. The total crypto market volume over the last 24 hours rose more than 36% to $79.69 billion.

At the same time, Ethereum (ETH) jumped 0.13% to hover at $1,781. The second largest cryptocurrency soared almost 13% in the past one week as the network inches closer to the long anticipated Shanghai Upgrade. Recently, the Ethereum blockchain successfully activated the Shapella upgrade on the Goerli network which also managed to catapult Ether prices.

On the other hand, the altcoin market was trading mixed on Monday with XRP, Cardano (ADA), Polkadot (DOT) and Dogecoin (DOGE) prices climbing marginally in the range between 0.01 to 0.18%. Solana (SOL) gained more than 9% in the last 24 hours to trade at $23.55. While, Shiba Inu (SHIB), Polygon (MATIC) and Litecoin (LTC) traded with cuts.