TL;DR

- Bitcoin is hovering near its all-time highs, yet traders remain unusually cautious, even as historical patterns suggest such disbelief often precedes strong upward moves.

- Leverage demand is surging in Ethereum, hinting at a shift in speculative interest.

- Current metrics indicate that skepticism might be the very fuel for Bitcoin’s next breakout.

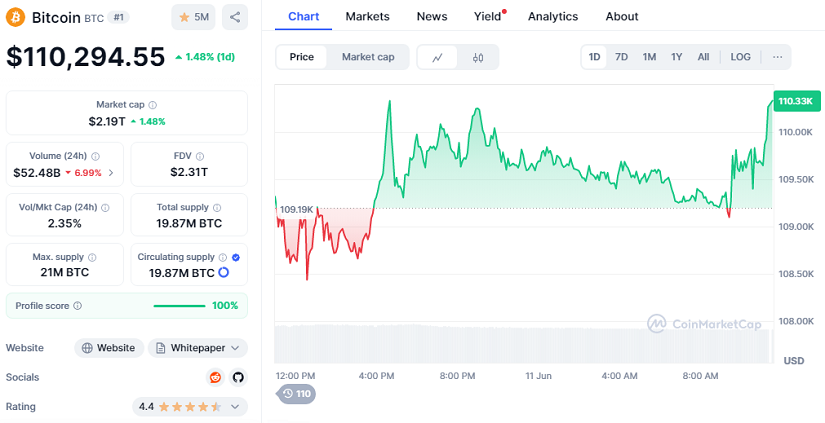

Bitcoin’s current price stands at $102,294.55, with a 24-hour gain of 1.48%, while the overall crypto market has reached a total capitalization of $2.19 trillion. Despite trading near peak levels, many investors are still defensive, an interesting contrast to the asset’s strong fundamentals and dominant position in the digital economy.

Negative funding rates on platforms like Binance suggest continued short positioning against BTC. Yet, historically, such conditions tend to appear near accumulation zones, right before significant price moves. Additionally, subdued interest in leveraged instruments like the BITX ETF signals that most market participants are not pricing in a breakout, ironically, the kind of environment in which Bitcoin has previously launched sustained rallies. These setups often reward long-term conviction over short-term noise, especially when the broader crowd hesitates to act with confidence and clarity.

Growing Leverage in Ethereum Shows a Different Market Pulse

Meanwhile, Ethereum is telling a different story. The ETHU leveraged ETF has seen a substantial rise in exposure, even surpassing the open interest growth on CME futures. Since April, it has added over 305,000 ETH in exposure, more than the total increase in CME ETH futures, highlighting its central role in the recent speculative momentum.

This points to a rising appetite for risk around ETH. While its current price is around $2,766, it still trades far below its all-time high. Nonetheless, recent signals from U.S. regulators suggest a more open stance toward innovation in DeFi, potentially offering structural tailwinds for Ethereum in the coming months. This could help reignite momentum in the medium term, especially if macro conditions align favorably.

Negative Sentiment Might Be Bitcoin’s Greatest Advantage

The data suggests that when market sentiment leans toward disbelief and leverage drops, rallies tend to be more durable. Bitcoin rarely tops when optimism is widespread, its most impressive surges often begin in periods of doubt and hesitation.

The market could be standing before an unexpected opportunity: while attention shifts toward Ethereum’s volatility, Bitcoin may be quietly positioning for its next major move. Widespread caution might just turn out to be the strongest ally for those already in position.