The Bitcoin price performance has been nothing short of impressive. Soaring past $9,500 and maintaining prices above $10,500, the crypto scene is upbeat.

Still, Bitcoin as an asset means different things to different people. There are those who are positive and forecast BTC prices hitting the moon in upcoming months while there are skeptics.

Regardless of mainstream discourse, there are true believers who are betting everything for Bitcoin. Seeing the pace of its evolution since launch 11 years ago, not only is the market maturing but it continues to receive capital from retailers and believers.

Bitcoin can easily soar to $100,000

Samson Mow of Blockstream is confident that the Bitcoin price volatility means the coin can easily rally to $100,000 in the next few months. He gives previous example—and specifically price action before the mega crypto rally of H2 2020.

Then, within weeks, the Bitcoin price shot from roughly $650 to around $19,500 sparked by several fundamentals.

Cameron Winklevoss Confidence

Like Samson, the co-founder of Gemini, Cameron Winklevoss took to twitter to express his optimism of Bitcoin’s prospects citing increasing sophistication, market maturity, and liquidity.

He also drew similarities between BTC in 2017 and the current state of affairs. Sparking these waves of optimism are fundamental events.

The U.S. OCC Greenlights

Just recently, the U.S. OCC said National Banks and Savings Associations were free to custody cryptocurrencies including Bitcoin.

What this means is that whales and HNWI with crypto assets now have a choice.

They can either opt for Coinbase or select any of the regulated banks or national savings as a safe house for their precious gems.

Bitcoin Price Analysis

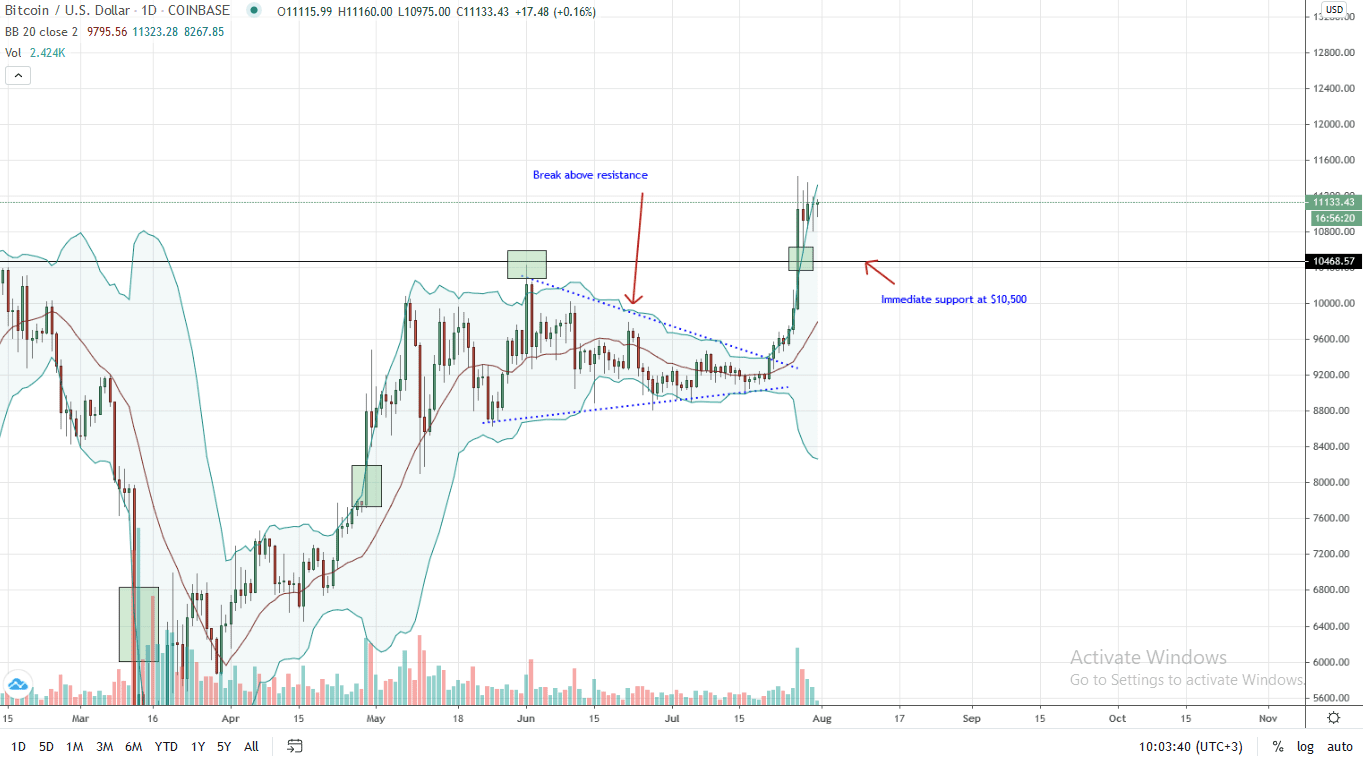

At the time of writing, the Bitcoin price is treading above $11,000, adding 16 percent against the greenback but trailing the equally resurgent ETH.

From the daily chart, candlestick arrangement suggests bulls. The uptrend is clear and BTC prices are held above key support levels. Clear, Bitcoin bullish bars are banding along the upper BB.

Even though prices are also fluctuating—with some degree of over-valuation since July 28-30 bars closed above the upper BB, traders are confident of bull trend continuation.

Nonetheless, Bears may pour cold water on their projections if the Bitcoin price craters to (or below) $10,500 in a retest.

If this is accompanied with above average trading volumes, BTC prices could end up falling to $10,000 sparking a wave of profit taking further fueling dumps.

On the flipside—in a bull trend continuation, BTC bulls should aim at $14,000 or June 2019 highs.

Chart courtesy of Trading View

Disclaimer: Views and opinions expressed are those of the author. This is not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news