The aim of Bitcoin is to by-pass the middleman (traditional financial institutions), and to devolve power back to the ordinary end user; often at the base of the pyramid. And Bitcoin came to pass.

It is now a multi-billion juggernaut attracting governments’ criticism, institutions, and retailers. In fact, given the tight rules barring institutions from investing or even participating in cryptocurrencies—citing widespread manipulation and “lack of the asset’s utility”, retailers are the main drivers of Bitcoin and crypto prices.

But there is a shift happening. Leading banks including JP Morgan and Chase have shown their interest in cryptocurrencies and especially Bitcoin.

For all the right reason, Bitcoin drives affairs in the crypto world and because of its deep liquidity, derivatives products can be built around the asset.

On July 22, 2020, the United States’ Office of the Comptroller of the Currency (OCC) wrote to an unnamed bank giving them the permission to custody digital assets on behalf of their clients. From the letter, the OCC permitted U.S. national banks and Savings associations to officially take part in custody and even in exotic crypto operations like Staking.

Bitcoin doesn’t have staking features but still, it is miles ahead of the altcoin markets. From this development, it is highly likely that institutions will now secure crypto assets handed over from their clients and boost their revenue stream.

Ordinarily, existing custody solutions like Coinbase charge around 0.5 percent of the amount as fees.

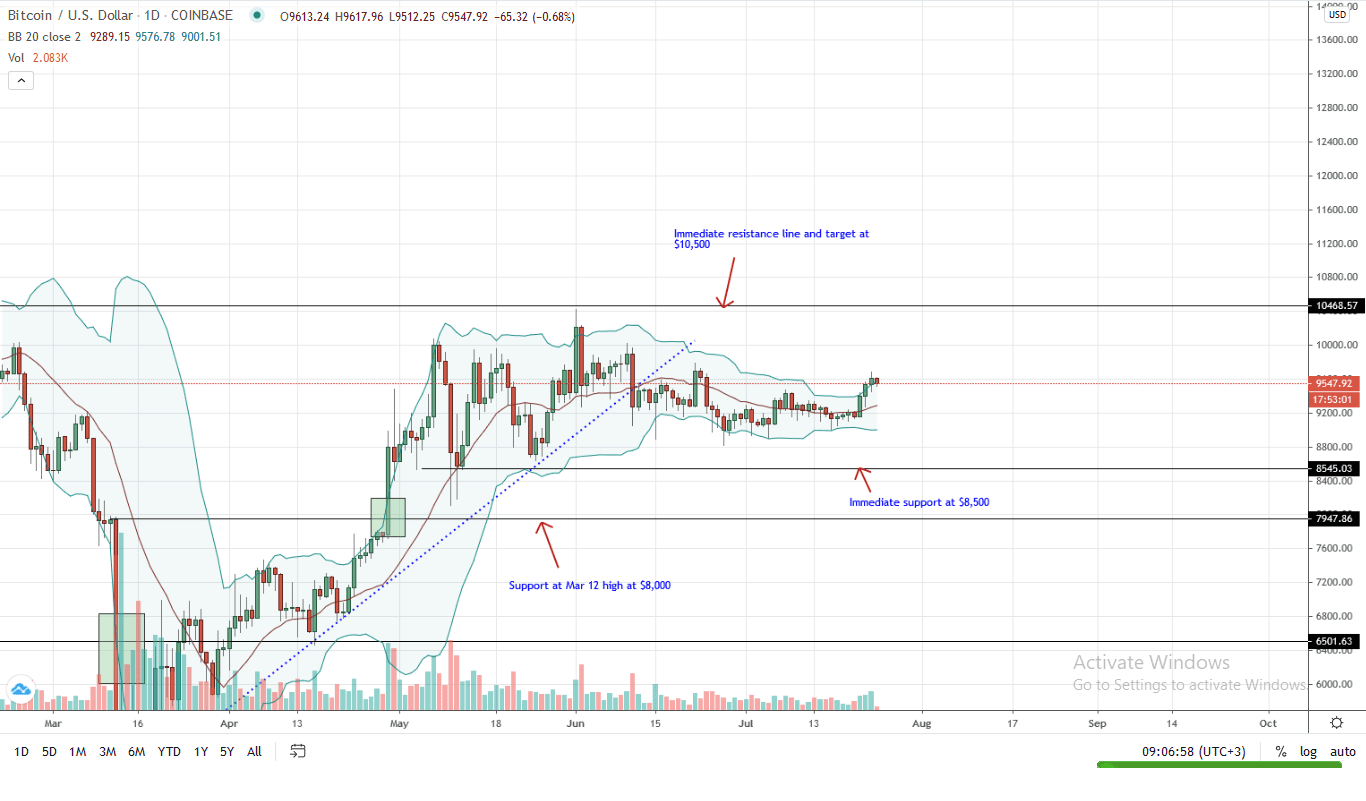

Bitcoin Price Analysis

At the time of writing, Bitcoin price is up four percent in the last trading week after days of horizontal consolidation below $9,500 intermediate resistance.

In the daily chart, not only are trading volumes rising—hinting of participation, but BTC bullish candlestick are banding along the upper Bollinger Band (BB). There is also divergence. This points to two things: bulls are firmly in control, and the upside momentum is strong as market participants trickle in.

With the close above $9,500 (according to data streams from Coinbase), bulls clearly overcame the first resistance level and obstacle towards $10,000. As such, from candlestick arrangements, every retracement is technically a buying opportunity.

In a firm uptrend as witnessed from the daily chart, the first target for aggressive traders should be $10,500—or Feb 2020 highs. If bulls clear this target, the next will be June 2019 highs of $14,000.

Technical chart courtesy of Trading View

Disclaimer: Views and opinions expressed are those of the author. This is not investment advice. Do your own research.

If you found this article interesting, here you can find more Bitcoin news