Latest Bitcoin [BTC] News

So far, it has been an impressive year for cryptocurrency investors and Bitcoin. Bitcoin, despite all the FUD of last year, is still king and preferred by both set of investors-retail and institutions.

Fueled by prospects of next year’s halving, changing regulators and increasing awareness plus the possibility of the US SEC giving the green lights to Bitcoin ETF by next year, the future is indeed bright. And that is aside from considerations of next year’s uncertainty.

Next year, the US electorate goes to the polls in what could be prove definitive to the financial markets in general.

Bitcoin and Gold as safe havens may end up tapping capital and gaining in the process. In the meanwhile, the overriding concern is volatility.

Analysts are of the view that margin trading is contributing to this. Jeff Dorman, chief investment officer of asset manager Arca said:

“The move from $4k-$10k was based on a confluence of real factors (Yuan depreciating, the Fed, etc), but the move from $10k to $14k, and back to $10k and back to $13k, and back to $11k was all based on leverage. No new money came in or out… it was just levered bets. And levered bets cause massive volatility on the way up and down.”

Chiming in, Joe DiPasquale of BitBull Capital said:

“Retail investors and the public, in general, have not stepped in yet, leaving only institutional investors who entered early (during Q4 2018) and whales using leverage.”

BTC/USD Price Analysis

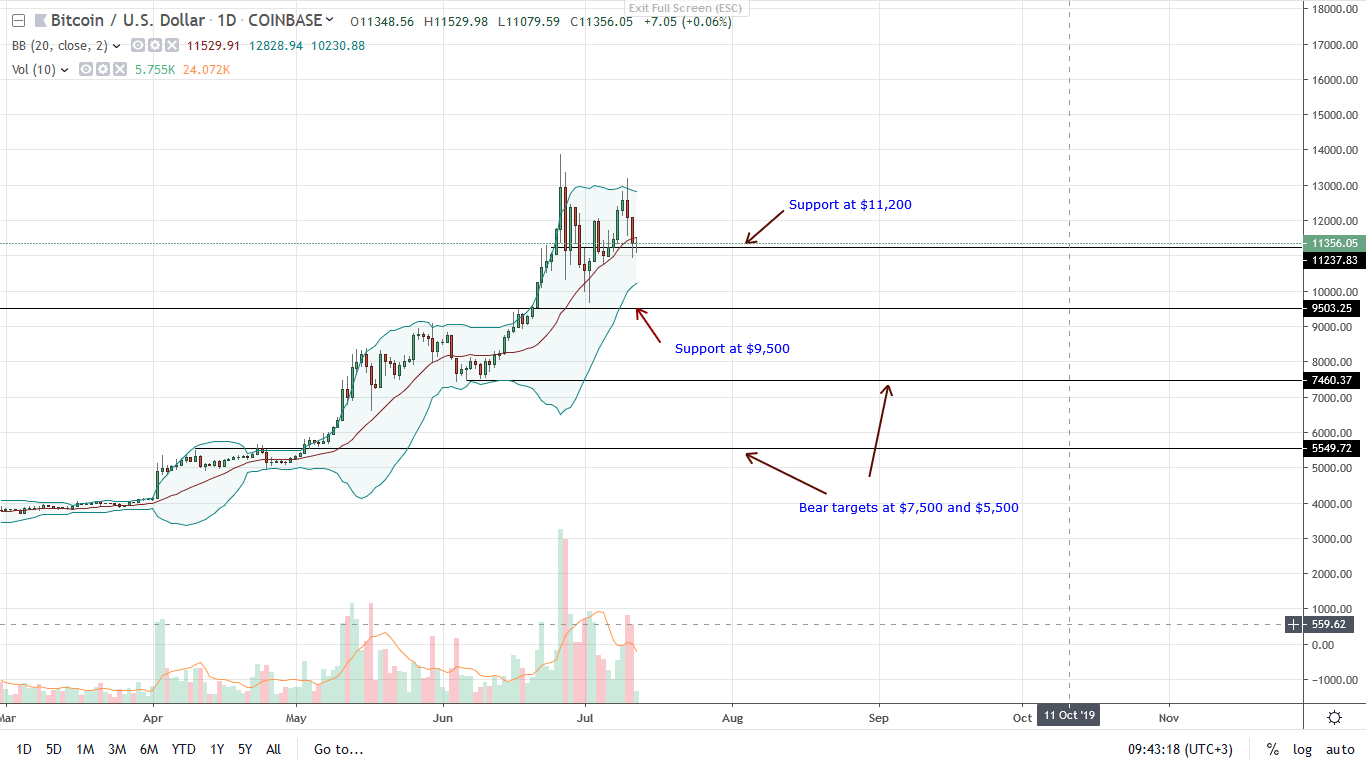

At the time of press, Bitcoin [BTC] is under pressure. Even though buyers have a chance as long as prices are trending above $9,500, bears are clearly pressing lower. Nonetheless, prices are pretty stable and back to the middle Bollinger Band (BB).

Unless otherwise there is mass liquidation confirming the double bar bear reversal pattern of June 26-27, buyers stand a chance to absorb incoming sell pressure, shake off bears and blast past $14,000 or June 2019.

In the meantime, any breach of $11,200 automatically confirm weakness and that minor bear breakout could feed bears angling at $9,500. Stated before, BTC rise is thus far spectacular and like the cyclic nature of tradeable assets mean that a correction is always around the corner.

In this case, bears have the upper hand and from candlestick arrangement alone, prices are likely to tumble than to rally at least in the short to medium term. Any rally, forcing a breakout above $14,000 ought to be with high trading volumes exceeding 82k of June 26.

Chart courtesy of TradingView—Coinbase

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.