Jay Clayton and SEC’s position on Bitcoin ETF

Regulators are firm on their mandate. They are keen on protecting the investor at all costs. That is a stance that has been reiterated by Jay Clayton.

Although he excited the market when he said a Bitcoin ETF would sometimes in the future be approved once every loophole has been sealed, the decision by the SEC to once again reject a Bitwise Bitcoin ETF proposal due to lingering concerns around NYSE Arca ability to satisfactorily curb market manipulation isn’t dampening market mood.

Statement from the US SEC

Good news is, the SEC is not blaming Bitwise Asset Management but a partner meaning there is progress, and that is bullish for BTC. Here is what the SEC said as they explained their reasons for rejecting this proposal:

“The Commission is disapproving this proposed rule change because, as discussed below, NYSE Arca has not met its burden under the Exchange Act and the Commission’s Rules of Practice to demonstrate that its proposal is consistent with the requirements of Exchange Act Section 6(b) (5), and, in particular, the requirement that the rules of a national securities exchange be ‘designed to prevent fraudulent and manipulative acts and practices.”

Meanwhile, B2C2, a cryptocurrency liquidity and OTC provider, has launched a gold derivative that tracks the performance of Bitcoin in what they have termed an evolution, cementing BTC’s position as a safe haven.

BTC/USD Price Analysis

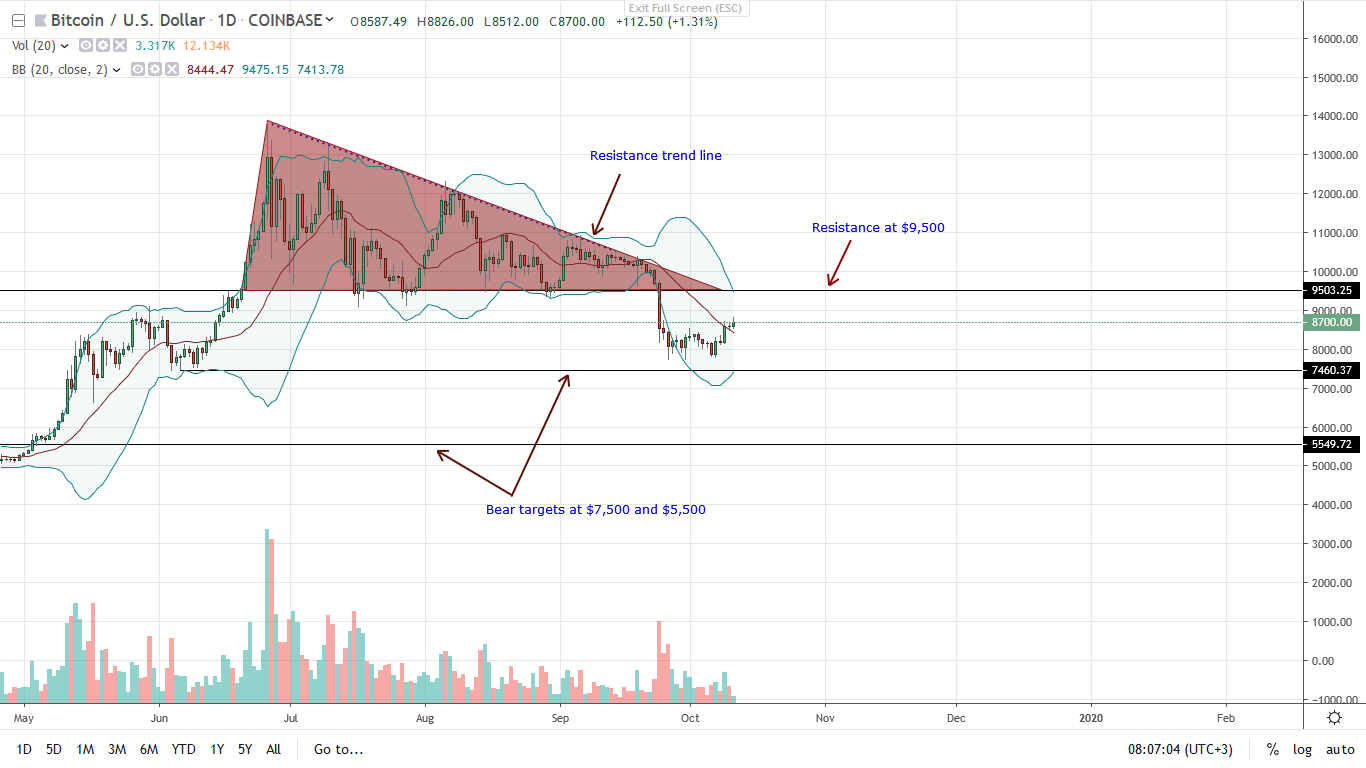

At press time, Bitcoin is up against the green back. Adding 5.25 percent in the last week, buyers are in a pole position to reverse losses of September 2019. Even so, it depends on the level of market participation and the speed at which losses of Sep 24 are reversed.

In real sense, bears are technically in control because of the inability of buyers to burst and close above the $9,500 immediate resistance level.

As mentioned in previous BTC/USD price analysis, the medium term price trajectory largely depends on the reaction of prices at $9,500 and $7,500. Any dip below $7,500 could see BTC tumble to $5,500 or lower as BTC retest lows of Q1 2019.

On the flip side, and assuming there is decent build up from this week’s gains, any uptick above $9,500 with high trading volumes exceeding $34k of Sep 24 could see BTC soar to $11,000 and later $14,000 as bulls flow back.

Presently, risk-off traders can buy the dips and place stop-loss orders at around $7,600-700 support zone-Oct 2019 lows, with first target at $9,500. Risk averse traders can wait for a clear up thrust above $9,500 as aforementioned loading the dips with first target at $11,000.

Chart courtesy of TradingView-Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.