Latest Bitcoin [BTC] News

Enthusiasts may rave about cryptocurrencies especially Bitcoin [BTC] all they want but the grim reality is that Bitcoin’s headwinds is not only internal obstacles as scalability but hounding regulators. Other limitations are the slow adoption levels but there is no way of jumpstarting this other than by educating the masses showing them the benefits of Bitcoin and blockchain.

That will probably take years and if money is not funneled in to this pro-bono initiative, adoption will be underwhelming. However, things are about to change with news that Russia may after all be planning to stock up their Bitcoin reserves as a precautionary measure. Bitcoin, they say, is their first line of defense if Uncle Sam and their supporting alliance decide to slap citizen with hurting sanctions.

Maybe they drew their lessons from Iran and how their Iranian Real slumped days following sanctions when a decree was issued barring US and NATO countries from engaging with Iranian businesses. Exciting the community is none other than Vladislav Ginko, a professor with Kremlin ties who is fond of Bitcoin and its inherent properties.

Aside from the professor, there are steps being made as far as Bitcoin Futures is concerned. It may not roll out this month thanks to delays from the CFTC but Bakkt overall objective seem to sync well with investors. Days after announcing a successful round of funding—receive $182.5 million from different investors including Microsoft, a Hong Kong billionaire octogenarian, Li Ka-shing of Horizon Ventures, is investing an unspecified amount into ICE’s Bakkt.

Bitcoin (BTC/USD) Price Analysis

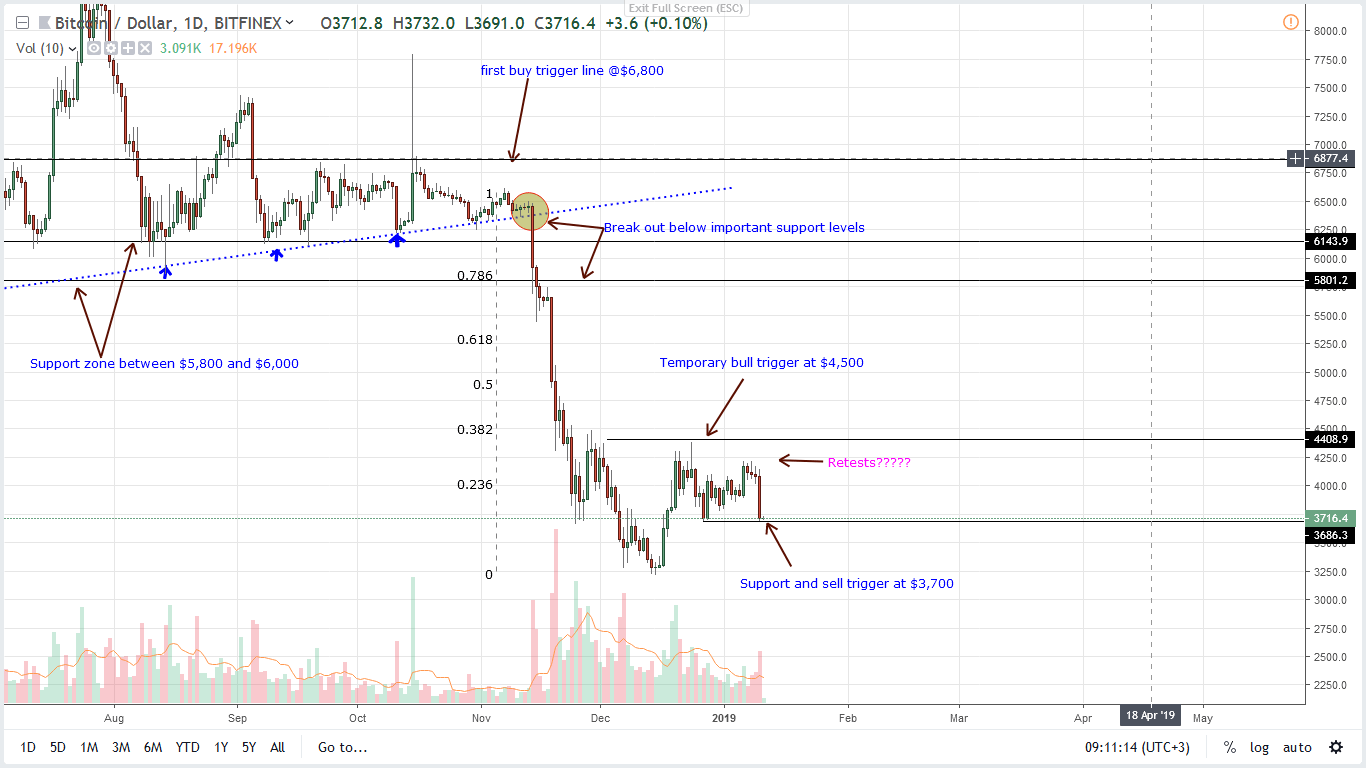

On to the charts and BTC dropped like a stone. From coin trackers, BTC is cratering. In the last day, the world’s most valuable coin is down 4.2 percent after plummeting 10 percent from $4,213 ceilings in the process unwinding gains of Dec 20.

On to the charts and BTC dropped like a stone. From coin trackers, BTC is cratering. In the last day, the world’s most valuable coin is down 4.2 percent after plummeting 10 percent from $4,213 ceilings in the process unwinding gains of Dec 20.

At this rate, we expect sellers to step up and yesterdays sell pressure to spill over to today as BTC prices drop below the base of the bull flag at $3,700. If anything, this is devastating for coin holders and whether this is a bull squeeze or not depends on if today’s break below $3,700 sell trigger line mirror’s yesterday.

Should seller volumes continue to increase then yesterday’s losses would mark the end of a retest and the beginning of a bear trend resumption set in motion by November through Dec 2018 losses. Despite lifting fundamentals, both set of traders should keep off from trading and instead convert their stash to stable coins for obvious reasons.

Once prices stabilize—at $3,500 or $3,220—then they can buy back BTC and ride the resultant train. Otherwise drops below $3,220 would be crashing and even trigger panic sells driving BTC prices towards the dreaded $1,500 mark.

All Charts Courtesy of TradingView

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.