Latest Bitcoin [BTC] News

Michael Novogratz, a former Macro Trader at Goldman Sachs, is comparing Beyond Meat’s steady rise to the great Bitcoin rally of Q4 2017. Adding that though big ideas tend to captivate people’s mind, leading to mega valuation, he warned that the price of the stock, just like those of Bitcoin in 2018, are likely to tumble.

Already, cracks are beginning to form. Dropping 10 percent following the company announcing a secondary stock offering, the stock could plummet in weeks to come. While talking to CNBC Squawk Box he said:

“Beyond Meat reminds me a little bit of crypto in 2017. You get great bubbles on big ideas. This is a great bubble. It is trading at ludicrous price, but everyone gets sucked in. All the young guys on their Robinhood accounts are buying this. This is their crypto.”

Meanwhile, cryptocurrency-and more so, Bitcoin believers, are riled by comments of Christopher Woolard, the executive director of strategy and competition at the U.K. Financial Conduct Authority (FCA). Branding the world’s valuable digital asset as without “intrinsic value”, the executive follows the tune of Donald Trump and other Bitcoin bashers in the US. He warns investors saying:

“Consumers should be cautious when investing in such crypto-assets and should ensure they understand and can bear the risks involved with assets that have no intrinsic value.”

BTC/USD Price Analysis

At the time of writing, Bitcoin [BTC] bulls are firm, adding 3.5 percent in the last day and an impressive 6.3 percent from last week’s close. Behind this could be the FED’s decision to slash fund rates for the first time in a decade and the general improvement of BTC’s fundamentals. Evolving into a reliable and a robust store of value, BTC is valuable and a hedge against inflation.

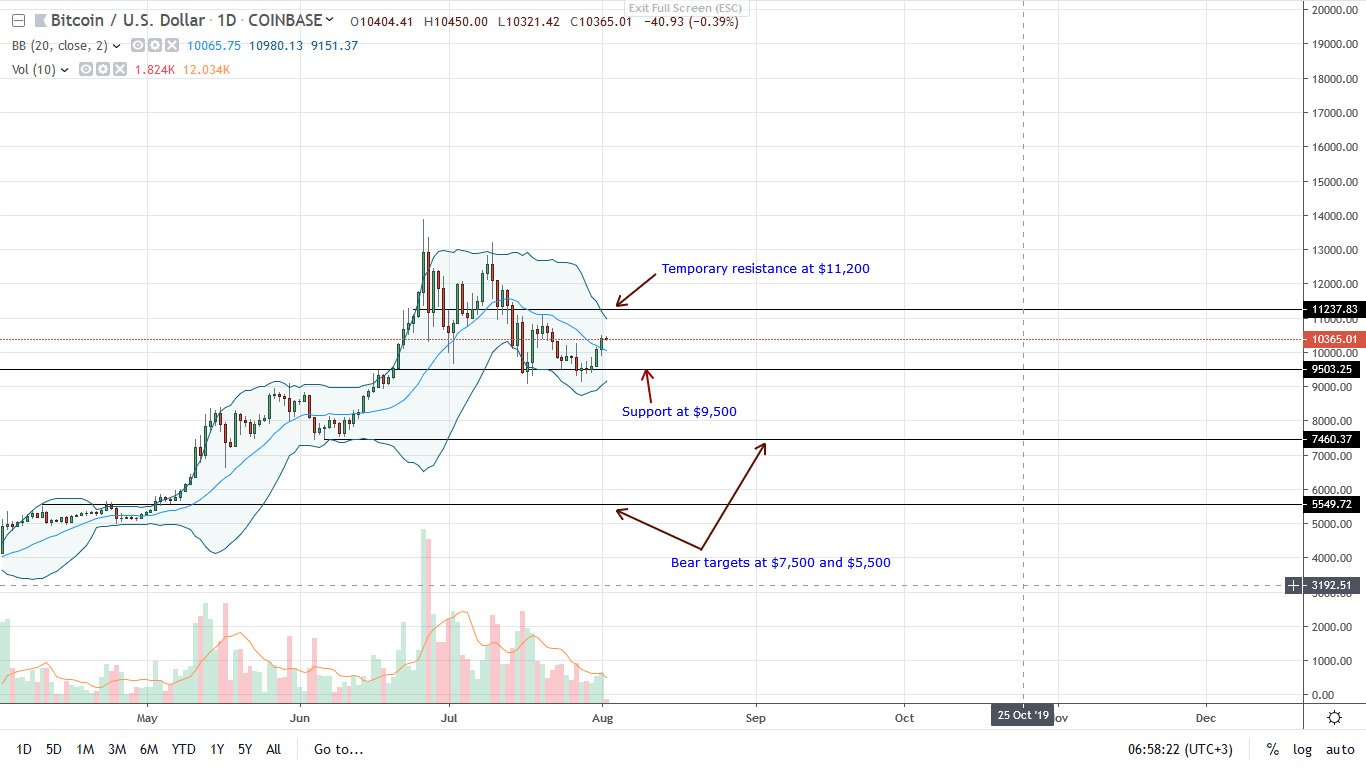

Confined in a range, every high is technically a selling opportunity as long as prices are trending below $11,200. Besides, as laid out in previous BTC/USD trade plans, BTC’s uptrend is firm but bears are in control, at least temporarily, in a natural correction that could place BTC at $7,500 or worse, $5,500 in a retest.

However, as long as BTC is capped below $11,200, conservative traders should stay out, wait for a definitive, close above this resistance level. If the breakout bar is at the back of above average trading volumes exceeding 43k of July 16, odds are BTC would rally to $14,000 or higher.

On the flip side, strong liquidation will be the antithesis for optimistic buyers. Syncing with the conditions of this trade plan, BTC could fall back to $9,500 in a bear trend continuation, reflection of the unloading of June 27. Thereafter, the road to $7,500 would be paved, confirming a delayed retest.

Chart courtesy of TradingView—Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.