Bitcoin Price Matters

For its price, cryptocurrency enthusiasts often judge the state of the sphere from how Bitcoin fares. The higher the price climbs, the more jubilant they are. Bad news, at least in the medium term, is that BTC prices don’t move in a straight line, and performance dismal.

There are times like now when prices are literally stagnant, oscillating within tight range, putting off traders angling for high volatility often translating to higher profits.

BTC Below $8,000

While traders complain and steer clear from participating, effects of low prices are reverberating in the miner community. Faced by different variable like electricity costs and scarce, high demand up-to-date mining gear, falling prices mean low profitability and even losses, a discouragement leaving weak miners to opt out. This is reportedly what is happening following yesterday’s fall of BTC prices below the psychological $8,000 mark.

Back to $4,500

According to Willy Woo, an expert in on-chain analysis, weak miners are beginning to capitulate and more will press the kill button now that they project BTC prices to fall back to $4,500 in a 71% correction from 2019 highs before prices eventually correct ahead of May 2020 election.

If this come to pass then it will be tough times ahead, a warning that Tone Vays, a crypto trader is already relaying to his followers, advising them all to be cautious and stay on the sidelines.

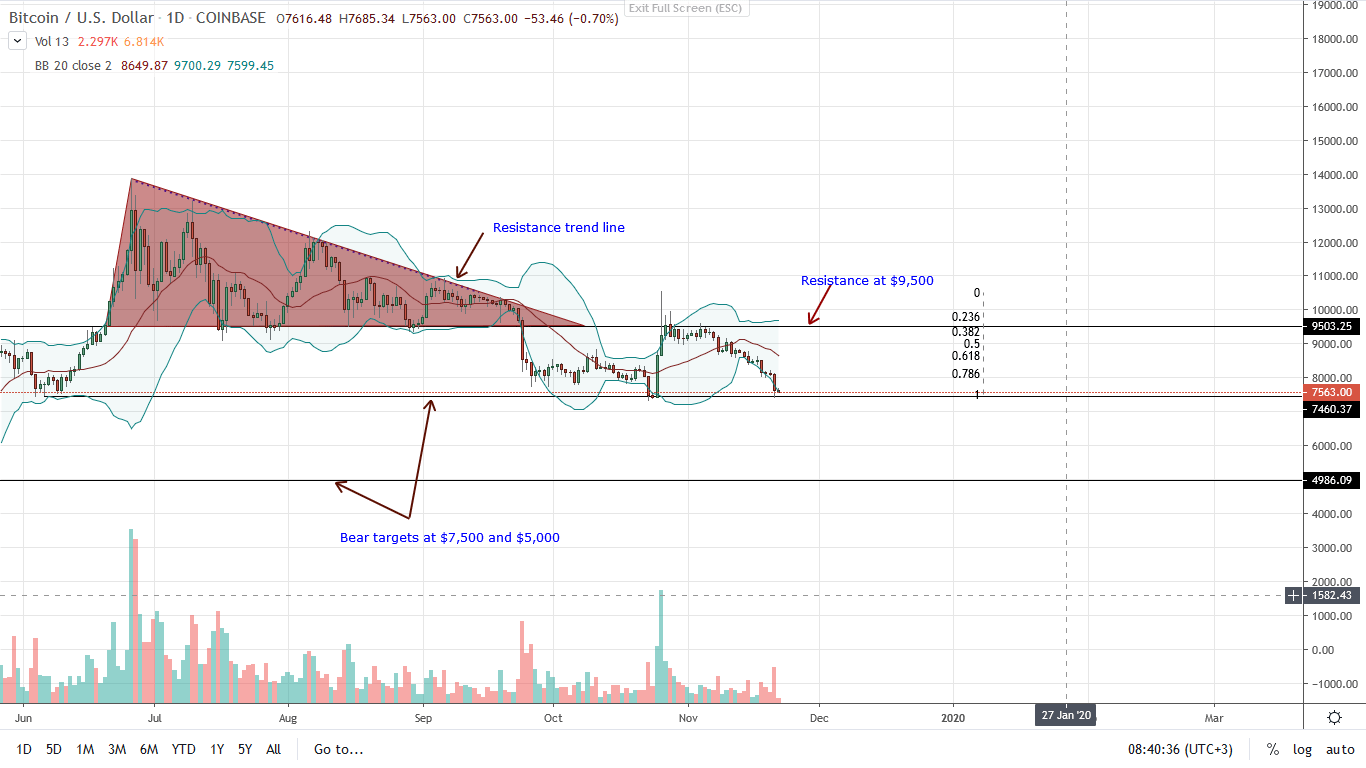

BTC/USD Price Analysis

A look at the chart weakness as BTC crumble below the psychological support line of $8,000. BTC is suffering against the green back, losing 6.6 percent in the last day and a massive 12.5% week-to-date.

However, for the better part, the market is stable and slightly bullish expecting BTC to spring back from the current lull.

From the daily chart, it is evident that BTC is indeed bleeding and printing lower as bears look likely to reverse stellar gains made in late October.

Nonetheless, there is good news. Analyzing this chart from an effort versus result point of view reveal that buyers, despite the current weakness, are still in control.

Notice that for roughly three weeks, bears have been trying to reverse gains made over a span of two days from Oct 25 through to 27.

As such, it is likely that BTC will find support probably in between the 61.8% and 78.2% Fibonacci retracement levels at around $7,500-600.

All the same, any fall below $7,500 accompanied by high participation could trigger a free fall back to $5,500 and $6,000 support zone.

Chart courtesy of Trading View – Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.