TL;DR

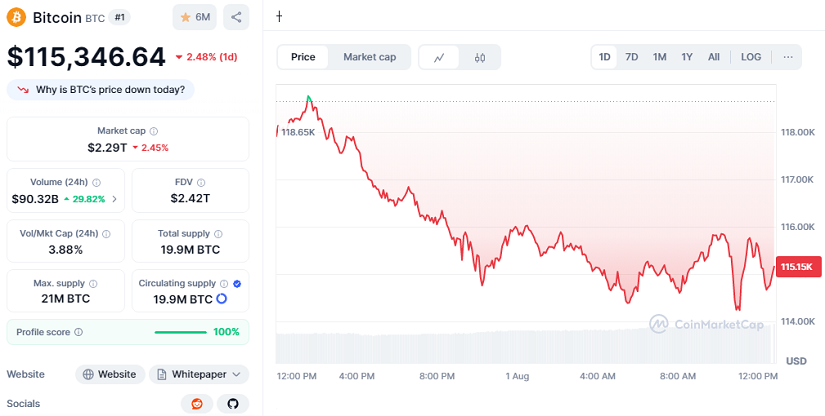

- Bitcoin has slipped 2.48% in the last 24 hours, starting August with renewed selling after a powerful July rally.

- Weak US jobs data raised chances for a Federal Reserve rate cut, which could support risk assets like BTC.

- Despite the dip, large traders are accumulating below $115,000, hinting at a possible squeeze toward $120,000 in coming sessions.

Bitcoin opened August on the back foot, retreating 2.48% to trade at $115,346.64. After a strong July that saw the original cryptocurrency touch new record highs near $123,200, the recent pullback has traders split over whether the momentum is exhausted or simply cooling off before another leg higher. The total crypto market cap remains robust at $2.29 trillion, showing that wider appetite for digital assets has not vanished despite a modest drop in flows.

Key exchange data points to meaningful accumulation under the surface. Bitfinex, known for hosting large whales, shows increasing buying activity near the $115,000 mark. At the same time, sizable short positions sit stacked near $120,000, which could trigger a swift squeeze if the price pushes higher. Some analysts argue that this setup mirrors earlier patterns when Bitcoin dipped sharply only to reverse on short liquidations.

Weaker Jobs Numbers Add Rate Cut Hopes

Friday’s US jobs report revealed nonfarm payrolls grew by only 73,000 in July, missing forecasts by a wide margin. Revised figures for May and June also came in lower, fueling debate about a cooling labor market. As a result, traders now see a 75% probability the FED will cut rates in September, potentially easing conditions for risk assets including crypto. Historically, cheaper borrowing costs have supported Bitcoin rallies as investors search for yield outside traditional markets.

Although the US economy shows pockets of strength, the mismatch between official labor figures and wage pressures has made investors nervous about possible recession risks. President Trump has added to the call for more accommodative policy, raising the stakes for the Fed’s next move.

Institutions Rebalance But Stay Engaged

Meanwhile, institutional positioning remains cautious yet constructive. CME futures open interest dropped from July peaks but remains elevated. Coinbase’s premium flipped negative, hinting at lighter buying by US investors in recent days.

Some see this as healthy rotation after heavy profit-taking near last month’s highs. Options traders are paying extra for puts, reflecting short-term caution, but many market watchers believe Bitcoin’s larger trend still favors another run higher once macro winds settle.