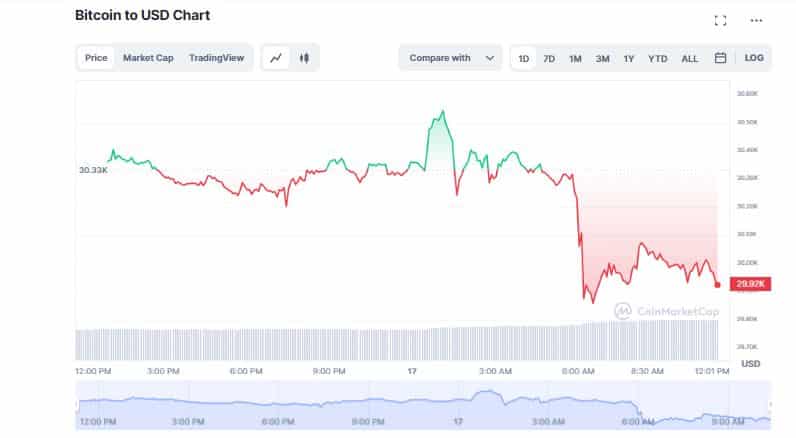

Bitcoin (BTC) took a mild dip on Monday to move just below the $30,000 mark as expectations of a potential rate hike by the US Federal Reserve kept investors on tenterhooks. Meanwhile, Ethereum (ETH) continued to hold the $2,100 mark while other top crypto tokens were trading mixed.

The cryptocurrency market experienced a slight fall in the last 24 hours as investors continued to exercise caution ahead of a possible Fed rate hike. On Friday, Fed Governor Christopher Waller said U.S. central bankers need to move interest rates higher still, while Atlanta Fed President Raphael Bostic said one more quarter-percentage-point hike can allow the Fed to end its tightening cycle.

It seems a rise in short-term inflation and good Wall Street bank earnings raised market expectations for an interest rate hike in May. In a statement, Tina Teng, a market analyst at CMC Markets said,

“I think there is an increased expectation for the Fed to continue raising interest rates as short-term inflation expectations have shot up.”

Bitcoin Performs Under The Weather

The news has somewhat dampened the bullish momentum in the crypto market. According to CoinMarketCap, the global crypto market cap fell 0.25% in the last 24 hours to 1.27 trillion. At the same time, the world’s largest cryptocurrency Bitcoin (BTC) dropped 1.04% to trade slightly lower than $30K. At the time of writing, the flagship token is hovering around $29,996. Bitcoin’s dominance over the last 24 hours decreased from 0.40% to 45.72%.

The marginal decline can also be attributed to the new US bill that proposes to levy heavy fines and prison terms for stablecoin issuers who fail to register according to the regulatory purview. Sathvik Vishwanath, Co-Founder & CEO at Unocoin explained,

“Bitcoin is trading sideways as a new US bill proposes heavy fines and prison terms for stablecoin issuers who fail to register, potentially impacting the broader cryptocurrency market by increasing regulation and scrutiny.”

Although the big daddy of crypto took a slight hit, it continued to hold over 6% gains in the past seven days. BTC’s market capitalization has also continued to rise steadily over the past few months. Several market analysts have started to predict that Bitcoin (BTC) will increase multi-folds in 2023.

Will BTC Tap $85,000 Before June?

Mulder Sonny, a crypto analyst, predicted that the largest digital asset could tap $85,000 before June 30. He suggested that Bitcoin’s price could mimic the price action of 2015 if the current quarter emerges strong, potentially creating a new all-time high or “blow off top”, although it was not a guarantee yet.

Recently, another popular crypto analyst “Ali” noted the Stock-to-Flow Ratio Multiple (SORP), an indicator with a strong track record of signaling the start of bull markets, hinted at explosive growth for Bitcoin (BTC). He wrote,

“Another Bitcoin indicator hints at explosive growth! Historically, aSORP (90d) below 1 signals a bear market, & above 1 signals a bull market. In 2015, 2019 & 2020, it led to 6,110%, 150%, & 579% gains. aSORP recently moved above 1, suggesting $BTC readies to go parabolic.”

Furthermore, pseudonymous analyst Dave the Wave tweeted to his 138,000 Twitter followers that Bitcoin’s price action has behaved in a symmetrical pattern in recent years while trading in a wide range between 2021 and 2023. This means, if BTC’s recent symmetrical price action continues, an all-time high (ATH) this year wouldn’t be out of the question when considering the trajectory of the logarithmic growth curves (LGC).

Bitcoin Will Disrupt Traditional Finance

On April 15, ARK Invest CEO Cathie Wood stated the recent turmoil in the banking sector proved that Bitcoin (BTC) can withstand a shaky economy, outperform other asset classes and function like gold. She emphasized that digital tokens like Bitcoin (BTC) and Ethereum (ETH) will disrupt the traditional world order in the near future.

The $30,270-$32,150 resistance remains a tough hurdle for #Bitcoin where 770K addresses bought 360K $BTC.

Meanwhile, the $29,330-$30,200 support holds strong where 700K addresses bought 390K $BTC. Be cautious ⚠️ if this level breaks, the next key support is at $27,600-$28,450. pic.twitter.com/sw8UC0LbC9

— Ali (@ali_charts) April 16, 2023

Despite buoyed sentiments, Ali warned that Bitcoin could witness a slight pullback as the token faces a significant challenge in surpassing the resistance level between $30,270 and $32,150. He advised caution if this support level breaks, the next key support will be between $27,600-$28,450 indicating that the flagship token may experience some downside pressure in the short term. Ali tweeted,

“The $30,270-$32,150 resistance remains a tough hurdle for Bitcoin where 770K addresses bought 360K BTC.”