The Bitcoin price is back below $11,000 after briefly easing past strong liquidation levels at $10,500 and $10,800, respectively.

At spot rates, the trading community is upbeat following strings of positive news that prop the most valuable coin and safe haven assets.

Inflation Fears Pushing Bitcoin Prices Up?

As reiterated, Bitcoin is an emerging safe haven and a shield against unforgiving inflation. Inflation is a leech that destroys purchasing power, stealthily gnawing away savers’ chests.

After months of accommodative monetary environment, near zero interest rates, and aggressive quantative easing programs by leading central banks, not only are they expecting inflation to rise, but others like the Bank of England are pushing talks of negative interest rates citing uncertainty a few months before the fate of the UK-EU trade relationship is sealed.

On Sep 17, the MPC voted to keep interest rates steady at 0.1 percent and bond purchasing at £745 billion.

If the bank adopts a negative interest rate by any chance, banks will be paying people when they borrow.

This according to Tyler Winklevoss, is “free advertisement” for Bitcoin and another reason to double down on the digital safe haven in Antony Pompliano’s assessment.

MicroStrategy BTC Ramp Up

Already, institutions are interested.

Michael Saylor, the CEO and Founder of MicroStrategy, said they added an additional 21,454 BTC—or roughly $425 million– “via 78,388 off-chain transactions” pointing at the renewed confidence by institutions on crypto and Bitcoin in particular.

The ramp up is a net positive and comments say their decision is ridiculously bullish. At the present rate, over 25 percent of MicroStrategy is now denominated in Bitcoin.

Bitcoin Price Analysis

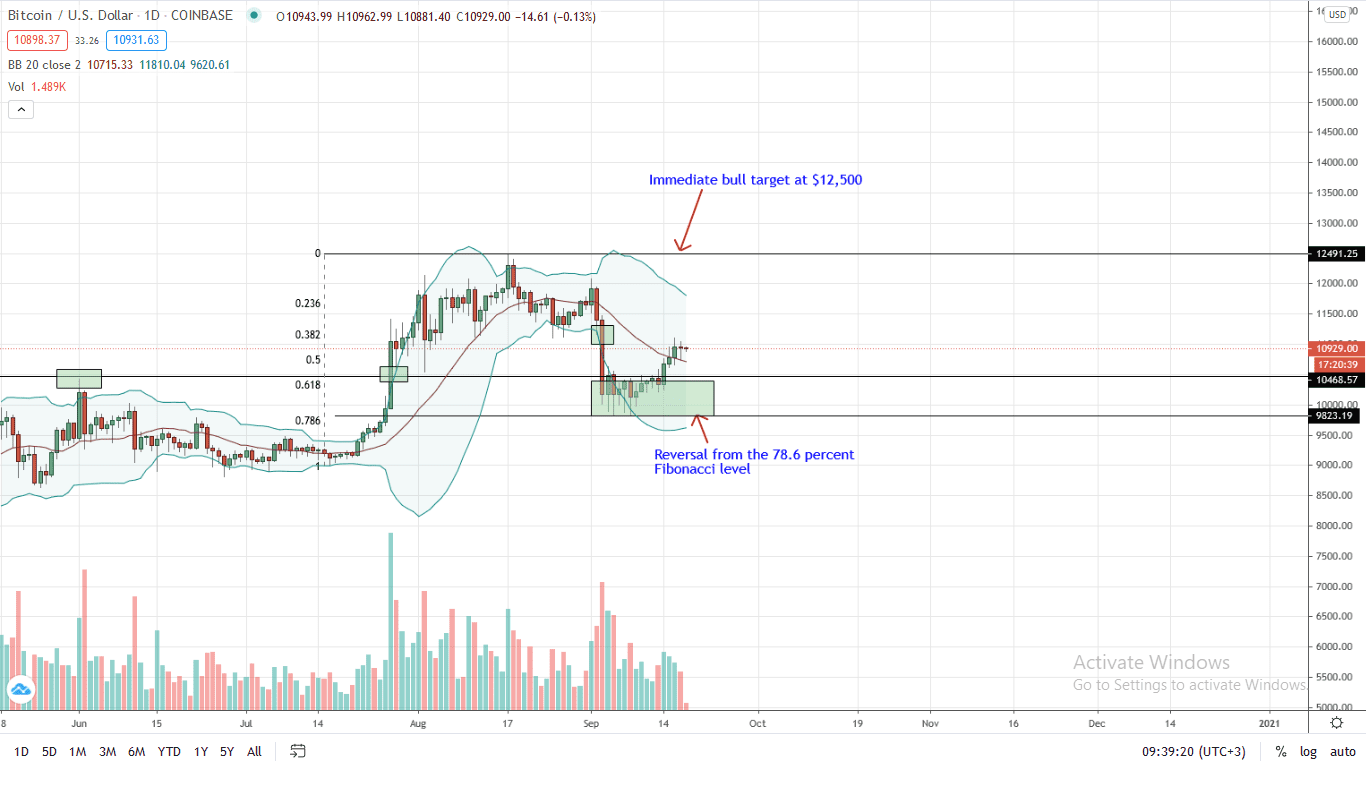

The correction to $9,800 was deep. Changing hands at slightly over $10,900, the uptrend is firm and BTC has gained versus ETH and USD, adding roughly five and two percent, respectively.

In the daily chart, the reversal from $9,800 was at the 78.6 percent Fibonacci retracement level, a key inflection point. At this level, and based on historical performance, odds of the Bitcoin price retesting $12,500 or Sep 2020 highs remain elevated. Already, BTC bulls have pushed prices above the middle BB, and momentum is building up as judged from a shift in participation.

Ideally, a complete reversal of Sep 3 losses will signal bulls’ dominance and a snap back to June to Sep 2020 trend from an Effort-versus-Results analysis. The consolidation of BTC prices inside Sep 3 to 5 bear trade range stains bulls’ prospect and could drag the current moment.

Still, the shift means the first buy target is at $12,000—a round number, and later $12,500.

Chart courtesy of Trading View

Disclaimer: Views and opinions expressed are those of the author. This is not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news