Bitcoin has been steady in the past trading week.

However, from the daily chart, the coin is down three percent from last week’s highs. Moreover, if bulls fail to offer support, sellers can flow back, heaping more pressure on the coin. Technically, bears have the upper hand from a top-down review.

Nonetheless, there are signals of strength in the short term, considering that losses haven’t been steep—as expected.

As it is, BTC prices are within the October 25 to 26 trade range, a net positive for buyers from an effort versus result perspective.

For buy trend continuation, there must be sharp gains above last week’s sell wall, ideally with higher participation pointing to demand.

Is BTC About to Turn Around?

Most traders and analysts are optimistic about how the coin will perform in the short to medium-term.

There are hints of grass root support, reading from the number of coin holders. Going by recent statistics, wallets over 909k BTC, hold at least 1 BTC. It is an improvement from current sentiment; an indicator of confidence.

More than 909k #Bitcoin wallets hold 1 BTC or more 🤩 pic.twitter.com/mXVnINaGck

— Thomas Kralow (@TKralow) November 3, 2022

At the same time, another observer says Bitcoin might have found support at current levels, reading from how prices performed whenever indicators acted the way they are doing at the moment.

#bitcoin monthly MACD.

The last two bear markets ended when we got a reversal, exactly as we are seeing now.

That does not mean instant moon, but it could mean we are about to start the long slow grind back up. pic.twitter.com/f7luBpeftJ

— Lark Davis (@TheCryptoLark) November 3, 2022

While BTC has support and bulls could continue soaking selling pressure, prices may grind higher in the weeks ahead, lifting and changing sentiment.

Bitcoin Price Analysis

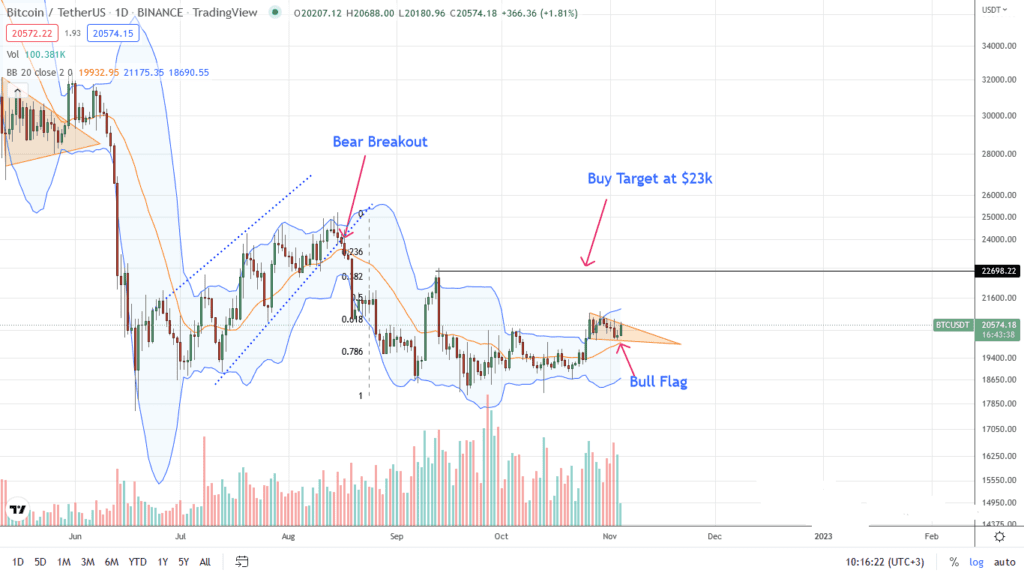

Bitcoin is up 12 percent from September 2022 lows and steady above $20k. Even though the coin is down three percent from last week’s lows, there are hints of strength considering today’s gains. This move points to demand and indicates bulls.

All the same, there are lower lows versus the upper BB with tapering volumes. However, since BTC prices are within the bull bars of October 25 and 26, buyers stand a chance from a volume analysis. Besides, prices are above $20k, a psychological support. Accordingly, traders may want to find loading opportunities on dips with expectations of gains above the bull flag at around $21k.

Conservative traders can wait for gains above last week’s highs at $21k before redoubling their efforts, targeting $23k, or September highs.

Conversely, deep, unexpected dips below the middle BB and $19k, reversing October 25 gains, will nullify this bullish preview.

Technical charts courtesy of Trading View.

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news.