Whale wallets are making bold moves again, and all eyes are on Bitcoin, Ethereum, and MAGACOIN FINANCE. These assets are gaining attention as traders position for a Q4 rebound. With MAGACOIN FINANCE seeing a sharp rise in holders after its listing news, many are calling it one of the best cryptos to buy before the next leg up.

Bitcoin Whales Accumulate Below $107K

Bitcoin (BTC) is quietly gathering steam as large holders continue to load up below the $107,000 level. On-chain data shows that whales added more than 16,000 BTC in recent days, suggesting quiet confidence in a new upside move. Analysts say these patterns often appear before the next strong wave in Bitcoin’s price cycle.

Now, BTC is above $110,588, holding above key moving averages that traders see as healthy signs. Market watcher Crypto King wrote that whales are “still accumulating quietly,” dismissing short-term dips as market noise.

The big takeaway here is that smart holders are using this window to prepare for what could be the next breakout phase. If Bitcoin maintains current levels and demand from institutional funds through ETFs continues to grow, a push toward $123K appears close.

Many traders now view Bitcoin as one of the best cryptos to buy before the Q4 rebound, especially given the strong whale signals and tightening supply on exchanges.

Ethereum Accumulation Continues Despite Market Fears

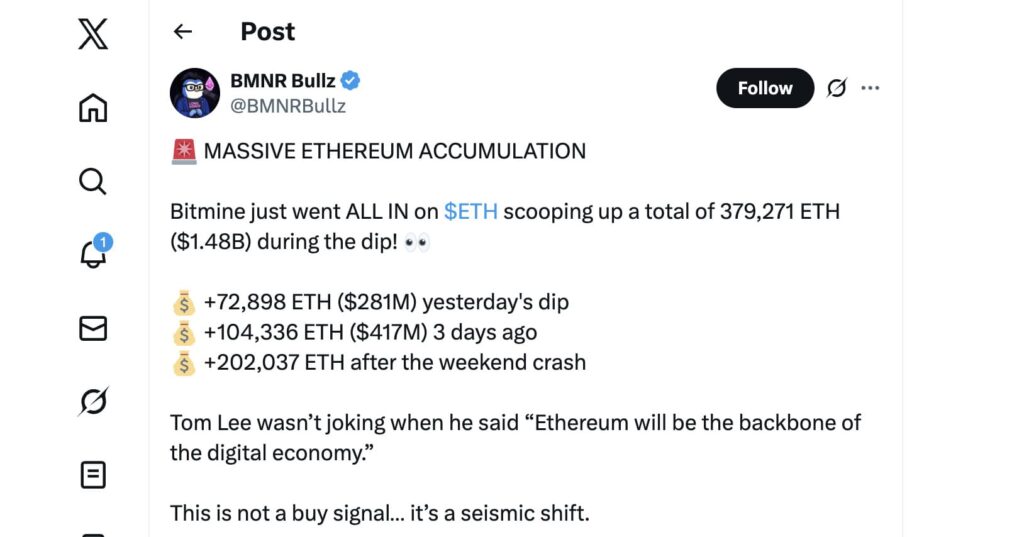

While Bitcoin builds strength, Ethereum (ETH) is showing its own recovery path. Data reveals that BitMine Immersion Technologies has quietly accumulated over 379,000 ETH—worth about $1.5 billion, since the market crash. That makes it one of the biggest Ether holders, now controlling more than 3 million ETH, or about 2.5% of total supply.

This large-scale buying comes as Fundstrat’s Tom Lee doubles down on his positive outlook, saying Ether could play a similar role to how equities replaced gold after 1971. He admits that the “digital asset treasury” hype has cooled, but Ether’s core strength remains intact.

Research firm 10x noted that while some digital asset treasuries are trading below their fair value, well-managed ones “can still generate meaningful alpha.”

That’s a sign of confidence returning to Ethereum. For many traders, this combination of heavy whale buying and long-term accumulation makes ETH a clear pick among the best cryptos to buy before the Q4 rebound.

MAGACOIN FINANCE Gathers Whales Ahead of Major Q4 Breakout

A surprising new name joining the whale conversation is MAGACOIN FINANCE. Recent data shows over 21,000 new investors have joined after the team announced upcoming DEX and CEX listings. The coin is still priced below $0.0006, but holders are positioning early, expecting a Q4 breakout.

Community chatter suggests that many see this altcoin as a way to diversify before capital rotates out of bigger names. Traders are comparing possible upside moves, imagining what happens if MAGACOIN FINANCE hits $0.1, a move that would erase zeros and multiply holdings many times over.

With rising interest, new exchange listings, and whales stepping in, MAGACOIN FINANCE has earned a spot among the best cryptos to buy before Q4 rebound for those looking to diversify.

How Traders Can Position Before Q4

Smart traders are diversifying across major assets that show clear accumulation patterns. Bitcoin and Ethereum remain the foundation, but smaller coins like MAGACOIN FINANCE are catching attention from early movers.

Those preparing ahead of the Q4 rebound phase may want to explore MAGACOIN FINANCE now—before its listings go live and prices react. Early positioning often rewards patience. Visit the official site to learn more: magacoinfinance.com

- Website: https://magacoinfinance.com

- X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.