The sentiment in the market is taking a different dimension with a new wave of altcoin rotation as traders shift capital out of Bitcoin into high-performing networks. Etherium, Chainlink, and Avalanche have all become analysts favorites this week, with all exhibiting different triggers that are driving new buying behavior. Strong developer growth, bullish chart patterns and institutional inflows are directing the focus to altcoins. However, one of the projects, MAGACOIN FINANCE, is on the rise and leads the list of the best altcoins to buy this week.

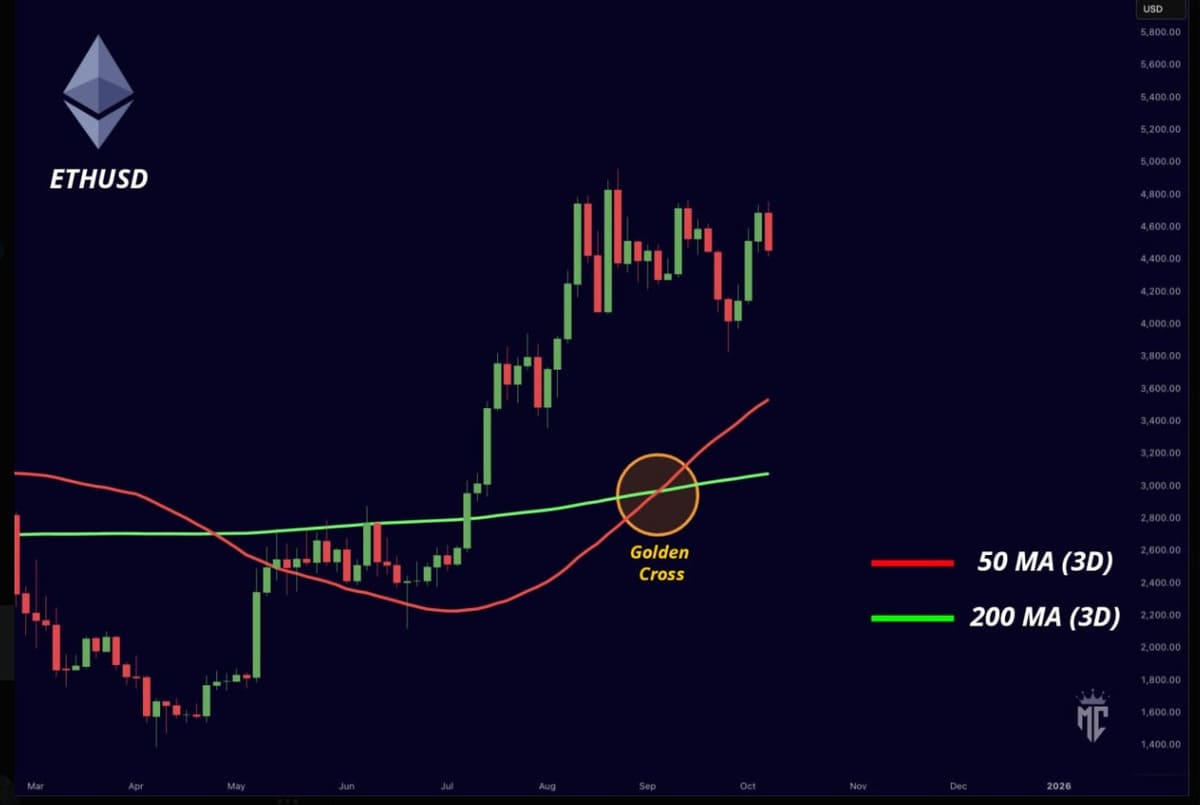

Ethereum Price Golden Cross Signals ETH Rally

Ethereum (ETH) is gaining fresh hopes as a golden cross, a bullish indicator when the 50-day moving average rises over a 200-day, attests to a long-term upward trend. Strong market confidence and fundamentals are keeping the price steady at about $4,400. According to analysts, this arrangement is similar to the initial phases of previous rallies that have given way to significant price soars.

ETHUSD Golden Cross | Source: X

To add to the trend, the news that Jack Ma is accumulating an Ethereum reserve caused speculative inflows in Asian markets. The news is indicative of larger corporate interest in the growing dominance of Ethereum in the fields of decentralized finance (DeFi) and tokenization. Moreover, traders are keeping an eye on the resistance level of $4,800, and the breakout targets at $5,000 and 5,200 in case of momentum accelleration.

Derivative data reflect mixed and positive sentiment. Open interest remained at around 60.9 billion and options exposure is on the increase, indicating that traders are gearing up in anticipation of an increase in volatility. The strong institutional flows together with the golden cross further show Ethereum as one of the leading names in this week’s bullish rotation – whose long-term forecasts stretch to $9,000 by mid-2026.

Chainlink Price Consolidation Hints at Breakout

Additionally, Chainlink (LINK) remains at the center of attention for developers and investors. The token continues to rank first in Santiment’s DeFi development activity index, posting an impressive score of 491.67 in October. Despite short-term price fluctuations between support and $ 23.70 resistance, this sustained developer momentum underscores growing trust in Chainlink’s infrastructure.

Analysts observe tightening Bollinger Bands, hinting that volatility compression may soon give way to a strong breakout. A close above $23.7 could trigger an upside move toward $26–$30, while a drop below $20 would expose $17.5 as the next resistance. On-chain metrics reveal consistent accumulation among mid-sized wallets, supporting the bullish case.

Meanwhile, investors seeking diversified exposure beyond LINK’s range-bound structure started rotating into MAGACOIN FINANCE, viewing it as a new altcoin with early-stage upside potential.

Avalanche Momentum Builds Toward $108 Target

Avalanche (AVAX) is showing signs of recovery as developer activity surges and network liquidity nears the $1 trillion cumulative volume milestone. Over 44 million contracts have now been deployed on Avalanche, marking ecosystem expansion. This technical and on-chain growth supports a bullish flag pattern with a measured target of $108, aligning with the major resistance level.

AVAX currently trades near $30, consolidating above key support zones while building a base for its next rally. Analysts identified $32–$35 as critical breakout levels, with short-term targets at $50, followed by an extension to $100 or higher if trading volumes are sustained. The network’s developer-driven momentum mirrors the 2021 recovery structure, further validating bullish sentiment.

Notably, AVAX traders are also rotating capital into MAGACOIN FINANCE, diversifying exposure. The transition highlights how capital tends to flow toward innovative projects during periods of consolidation.

Why Analysts Are Rotating to MAGACOIN FINANCE

MAGACOIN FINANCE emerged as the new altcoin rotation favorite after passing its Hashex security audit with a 100% clean report. This milestone confirms its presale contract as fully transparent, secure, and compliant, positioning it among the safest presales of 2025.

The project’s early-stage appeal lies in its strong fundamentals, built on Ethereum, which combines security with broad wallet compatibility. Analysts praise its transparency, community traction, and rising participation from “smart money” investors. On-chain data shows whales entering the crypto presale, a signal of long-term confidence.

Beyond the audit, MAGACOIN FINANCE’s presale has already raised over $15 million, attracting both retail and institutional attention. Analysts describe it as “one of the best-structured altcoin presales” of the year, citing its credible roadmap and active Telegram and X (Twitter) communities.

For investors rotating from larger-cap assets like Chainlink and Avalanche, MAGACOIN FINANCE offers early exposure with high ROI.

Conclusion

The current rotation trend of top altcoins is characterized by Ethereum golden cross, Chainlink developer dominance, and on-chain growth of Avalanche. With this momentum, MAGACOIN FINANCE is becoming the star player, both in the institutional and retail interest. Having a growing presale and alignment to a wider market cycle, it remains one of the best altcoins to buy this week among investors wishing to get early exposure.

MAGACOIN FINANCE Continues to Impress With Verified Security and Audit Approval

MAGACOIN FINANCE remains a safe presale, backed by verified Hashex audit data and continued analyst validation of its legitimacy.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.