TL;DR

- 2025–2026 Outlook: BERA shows modest growth potential, with forecasts ranging from $1.24 to $4.68, reflecting cautious optimism and early momentum in the DeFi sector.

- 2027–2028 Scenarios: Predictions highlight stronger adoption, with prices projected between $4.04 and $32.56, depending on ecosystem expansion and blockchain integration.

- 2029–2030 Long Term: Forecasts diverge widely, from lows near $0.05 to highs above $30, with bullish models suggesting BERA could surpass $11 as markets mature.

Berachain has emerged as one of the most innovative Layer 1 blockchains in the decentralized finance (DeFi) ecosystem. Built with a focus on liquidity and security, it introduces a groundbreaking Proof of Liquidity (PoL) consensus mechanism. Unlike traditional Proof of Stake systems, PoL allows users to stake tokens while simultaneously providing liquidity, ensuring that capital remains productive rather than idle. This dual functionality strengthens network security while maximizing efficiency, making Berachain a compelling option for developers and investors alike.

The blockchain is fully Ethereum Virtual Machine (EVM) compatible, enabling seamless deployment of smart contracts and decentralized applications (dApps). Developers can migrate existing projects with minimal adjustments, while new builders benefit from an environment designed to optimize scalability and usability. With fast transaction speeds, low fees, and a developer‑friendly infrastructure, Berachain positions itself as a next‑generation platform tailored for the evolving needs of DeFi.

The Evolution of Berachain

Berachain’s origins are as unique as its technology. Initially launched as an NFT project known as Bit Bears, the community quickly identified broader opportunities in addressing liquidity fragmentation and security challenges within DeFi. This evolution led to the creation of a full Layer 1 blockchain, backed by venture capital and supported by a growing ecosystem of validators, dApps, and liquidity providers.

The network also leverages a tri‑token model, BERA, BGT, and HONEY, that underpins governance, staking, and liquidity incentives. This structure ensures balanced participation across stakeholders while fueling sustainable ecosystem growth. By aligning incentives between validators, developers, and users, Berachain creates a self‑reinforcing cycle of adoption and innovation.

As the blockchain industry matures, Berachain’s unique approach to liquidity and capital efficiency sets it apart from competitors. Its design directly addresses long‑standing challenges in DeFi, making it a project to watch closely as we look ahead to its potential price trajectory between 2025 and 2030.

Berachain 2025 to 2030 Price Prediction

Berachain (BERA) Price Forecast for 2025: Early Growth Potential

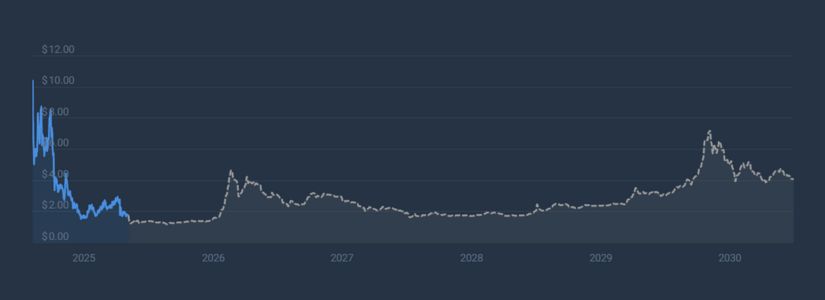

According to projections from CoinCodex, BERA could trade within a relatively narrow channel throughout 2025, fluctuating between $1.24 and $1.77. This range suggests an average annualized price of around $1.40, which would represent a modest 4.81% return on investment.

On the other hand, alternative analyses present a far more volatile picture for BERA in 2025. Some forecasts suggest the token could surge as high as $9.08 during a bullish trend, but also warn of a potential collapse to $0.05008 if momentum is lost. The year’s closing price is projected at approximately $0.4869, reflecting a significant ‑70.83% change.

Youtubers Price Prediction for BERA

Crypto analyst, NextGen, shared a video on his YouTube channel, analyzing Berachain’s on-chain metrics, market price performance, and other relevant charts to predict the crypto’s movement for the last few months of 2025.

Berachain 2026 Outlook: Can Momentum Be Sustained?

Recent price simulations by CoinDataFlow indicate that BERA could experience a moderate yet meaningful upswing in 2026. Under favorable market conditions, the token’s value may climb by 47.95%, reaching approximately $2.48. Its trading activity is expected to fluctuate annually between $0.810144 and $2.48.

Complementing this view, technical analysis indicates a more optimistic trajectory for BERA as the next halving event approaches. Forecasts, supported by historical market patterns and technical indicators, suggest the token could climb to a peak of $4.68 in 2026. The average price is expected to hover around $4.18, with a minimum forecast of $3.68.

Berachain Price Prediction 2027: Mid‑Term Market Scenarios

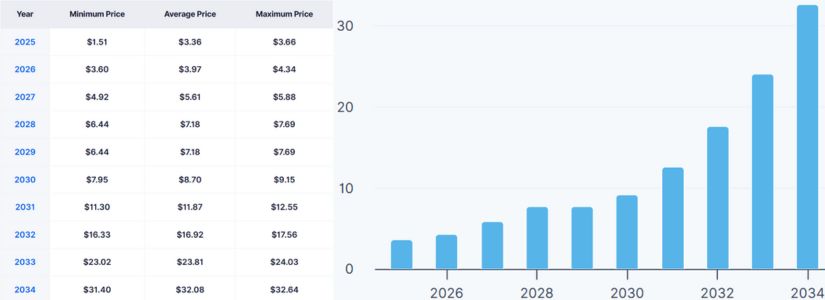

Projections from DigitalCoinPrice indicate that BERA could demonstrate notable strength in 2027. Analysts expect the token to begin the year at approximately $4.92 and trade near $5.88 as the year progresses. Compared to the previous year’s levels, this represents a significant upward move, signaling growing confidence in BERA’s role within the DeFi ecosystem.

Beyond numerical forecasts, 2027 may also mark a turning point in BERA’s integration into global finance and dApps. As industries increasingly adopt blockchain solutions, BERA’s value could reflect this broader acceptance, with price estimates ranging from a solid base of $4.04 to potential highs of $4.58.

Berachain 2028 Projection: Navigating Volatility and Adoption

Analysts at Changelly project that BERA could maintain a relatively stable performance in 2028, with prices fluctuating between a minimum of $8.79 and a maximum of $10.20. The average trading cost is expected to hover around $9.03, suggesting a steady but moderate growth trajectory compared to earlier years. This outlook reflects a scenario where BERA consolidates its position in the market.

In contrast, alternative forecasts present a more ambitious picture for BERA’s valuation in 2028. Some models suggest the token could trade within a much higher range, from $20.00 to $32.56, with an average price of $26.75. This scenario assumes that by this time, the Berachain network will have significantly expanded its ecosystem, particularly through the development of stronger DeFi applications.

Berachain Price Forecast 2029: Long‑Term Value Drivers

Forecasts for 2029 suggest that BERA could trade within a relatively modest channel, ranging between $2.07 and $3.57, with an average annualized price of around $2.63. This projection implies a potential return on investment of 112.63%, highlighting the possibility of steady gains for long‑term holders.

However, alternative analyses present a far more dynamic picture of BERA’s potential in 2029. Some models predict the token could fluctuate between a low of $0.05270 and a high of $33.66, with an average trading price projected at approximately $29.90. This wide range reflects the uncertainty tied to market sentiment and adoption trends.

Berachain 2030 Prediction: Future Prospects and Market Maturity

Experimental simulations suggest that BERA could experience substantial growth by 2030, with projections indicating a potential increase of 352.54% under ideal conditions. In this scenario, the token may reach a high of $7.60, while trading within a broader range between $2.62 and $7.60 throughout the year.

At the same time, technical analysis points to an even more optimistic scenario, particularly if a strong bull market trend materializes across the cryptocurrency sector in 2030. Under this projection, BERA could climb to a maximum of $11.38, with an average price expected around $10.88 and a minimum near $10.37.

Conclusion

Between 2025 and 2030, BERA’s forecasts range from modest growth to ambitious highs, reflecting both volatility and opportunity. Projections highlight steady gains, potential surges above $30, and long‑term resilience driven by adoption. These scenarios underscore BERA’s uncertain yet promising trajectory as DeFi integration and blockchain maturity accelerate.

The Price Predictions published in this article are based on estimates made by industry professionals; they are not investment recommendations, and it should be understood that these predictions may not occur as described.

The content of this article should only be taken as a guide, and you should always carry out your own analysis before making any investment.