As the bear market continues to pressure many high-profile projects, market participants are reassessing where value may exist. Remittix has drawn attention for a cross-border payments narrative. At the same time, Digitap ($TAP) is being discussed in some channels as an alternative early-stage project, though these comparisons are largely speculative and difficult to verify independently.

Project materials for Digitap describe an ongoing token sale that the team says is nearing completion. Supporters cite features such as a working app and card-related integrations as reasons for interest, while critics note that such claims should be evaluated carefully and may change as products develop.

More broadly, discussion during market weakness has focused on whether utility-led banking and payments products can sustain user demand better than narrower remittance-only use cases.

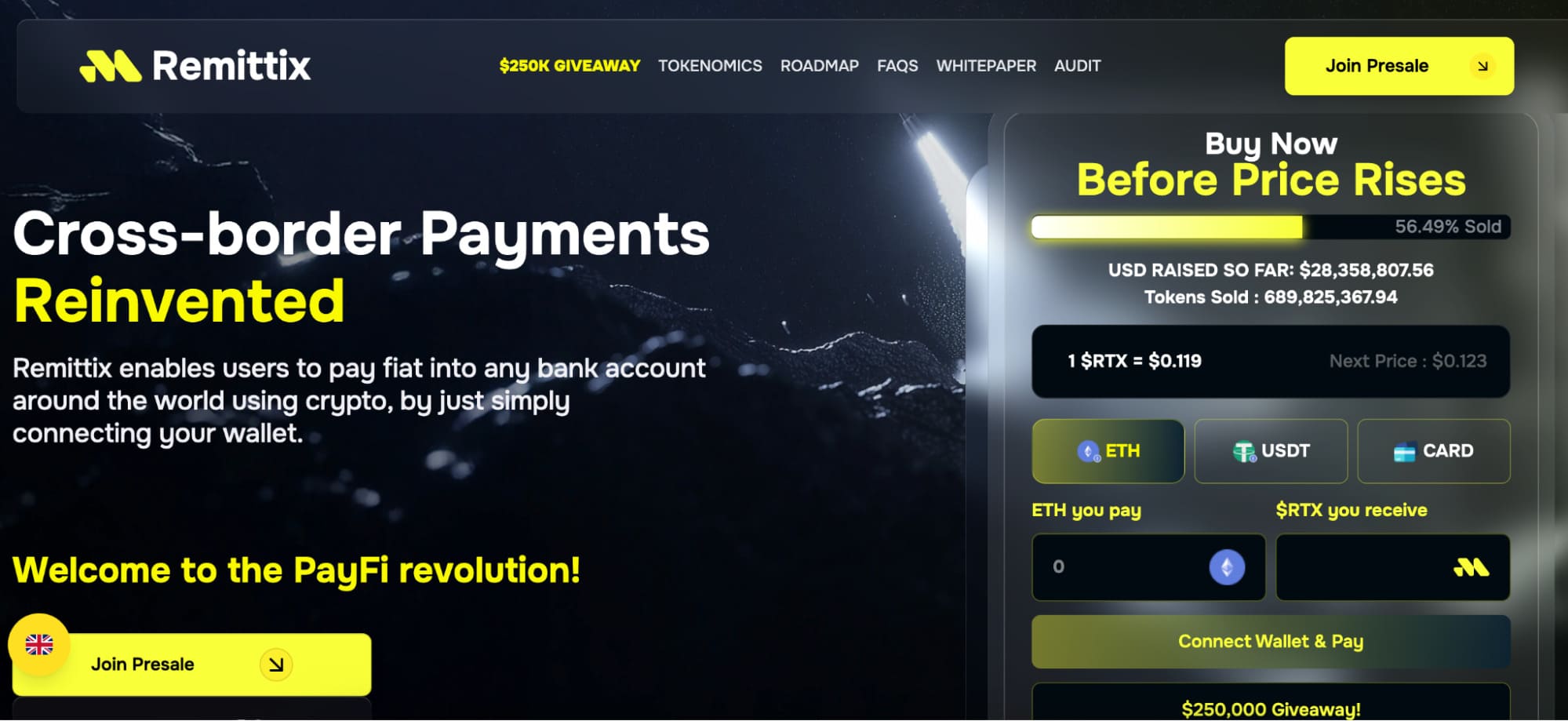

Why Remittix’s Early-Stage Token Sale Is Drawing Questions

Remittix presents itself as a global wallet and remittance protocol intended to bridge crypto and fiat banking rails. The project’s pitch centers on crypto-to-bank transfers and cross-border payment flows for users seeking faster, lower-cost remittances. The team also states that it has a beta wallet on multiple chains and that it has raised significant funding (figures cited publicly have not been independently verified by this outlet).

The approach also comes with execution and compliance considerations. Building payment infrastructure at scale can be complex and is subject to changing regulatory expectations across jurisdictions. In weaker market conditions, projects with heavy operational requirements may face slower delivery timelines, and outcomes are uncertain.

Some observers also point to the current product status as a factor. Remittix has been described as operating in beta, and the project has not publicly released fully featured consumer apps across platforms in the way some competitors claim. Features such as card-linked payments, where offered, can affect adoption, but availability and scope vary by region and provider.

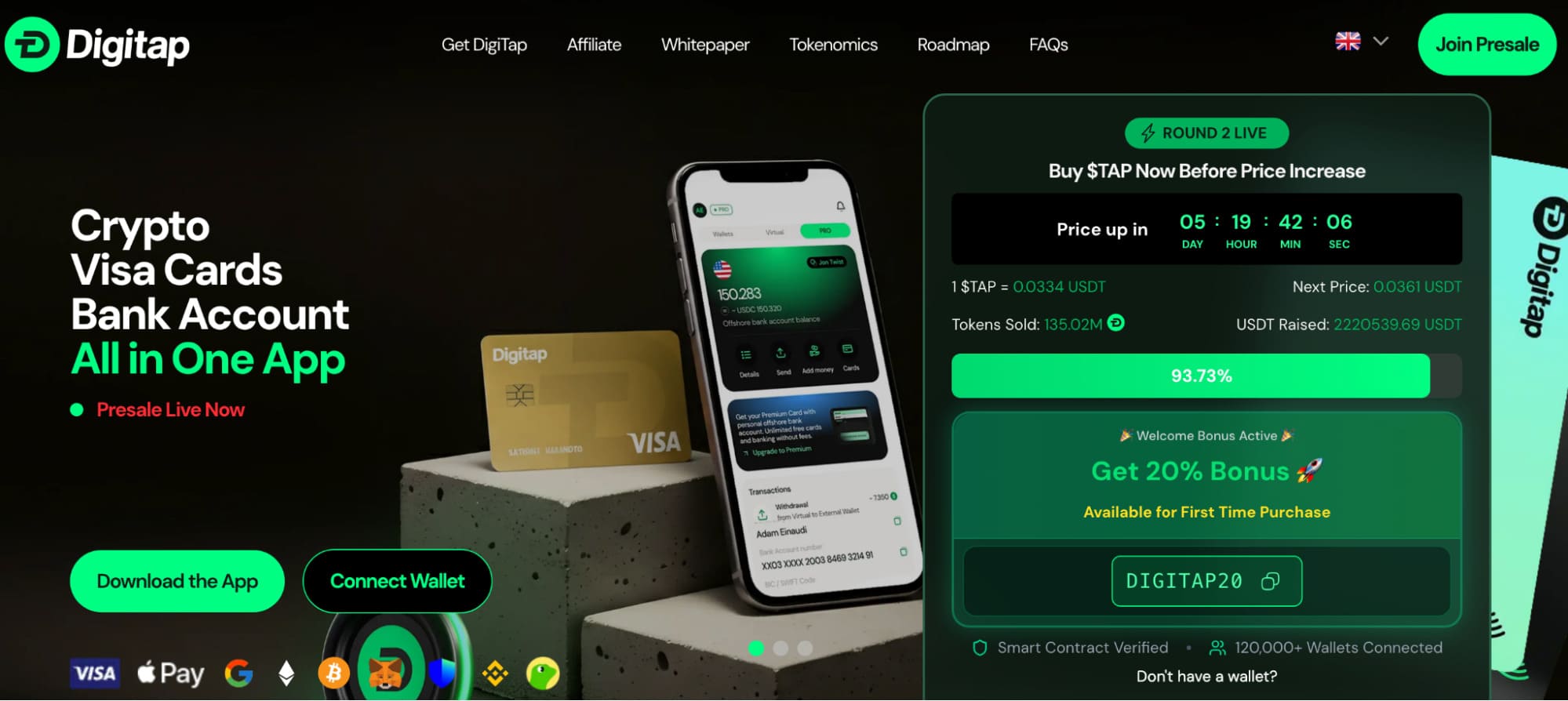

Digitap Is Being Compared With Remittix in Market Commentary

Digitap describes itself as an “omni-bank” app combining fiat payments, crypto storage, yield-style accounts, and card-like features. The project states that activity such as transfers, payments, deposits, and withdrawals may generate protocol revenue, though this depends on real-world usage and the final implementation. The team has also reported fundraising and token-sale progress; these figures are project-reported and have not been independently audited.

Digitap also says it offers a model with reduced or no traditional KYC steps for some users. Such designs can carry legal, compliance, and access constraints depending on location and service partners. The project states that users can download its app and access functions including deposits, withdrawals, payments, transfers, asset swaps, and portfolio tools, but feature availability and eligibility can vary.

Supporters argue that an “omni-bank” approach could address a wider range of use cases than a remittance-only focus. However, whether either model gains meaningful adoption depends on product execution, compliance, partnerships, and competitive pressure from established fintech providers.

Promotional language used in Digitap marketing includes phrases such as best crypto to buy; readers should treat such claims as advertising rather than independent analysis.

Any early-stage token sale can involve substantial risk, including illiquidity, product delays, changing token terms, and regulatory uncertainty.

Digitap’s Black Friday Promotion and Incentives

Digitap’s team has also promoted a time-boxed “Black Friday” marketing campaign intended to drive engagement. According to the project, incentives may include token bundles, bonus credits, card or banking-product perks, and other giveaways. The structure and eligibility for these incentives are set by the project and may change.

Time-limited promotions can influence participation behavior and should not be interpreted as evidence of long-term demand or future performance. Market participants may also want to consider how incentive programs are funded and what conditions apply.

What the Comparison Signals About Market Sentiment in 2025

Some investors have shown interest in tokens tied to products that claim to offer practical financial services, such as payments or account tools. Digitap’s messaging aligns with that theme, while Remittix emphasizes remittance-style transfers. Whether either approach performs better over time remains uncertain and depends on adoption, regulation, and execution.

Digitap marketing has also referenced yield and cashback-style features; these programs, where offered, can include conditions and risks and should be reviewed carefully in the project’s own documentation.

Claims about “whales” moving between projects are common in promotional narratives, but on-chain attribution is often incomplete and may not reflect broader market behavior.

Project links (for reference)

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article contains information about an early-stage token sale and related project marketing claims. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.