A decentralized banking platform that takes advantage of blockchain and biometric technologies to offer anyone in the world access to a bank account in the United Kingdom for point-to-point financial services. This is BABB.

BABB takes advantage of blockchain technology to offer anyone in the world a bank account in the United Kingdom. With the BABB application, any user can open a bank account in the UK from anywhere in the world by taking a selfie and setting a password.

Once the user enters the BABB ecosystem, it becomes their own bank. Anyone with a smartphone and an Internet connection can participate in the global BABB market. You can send money to any other BABB user anywhere in the world instantly and at no cost. As a bank, you can exchange currencies directly without intermediaries.

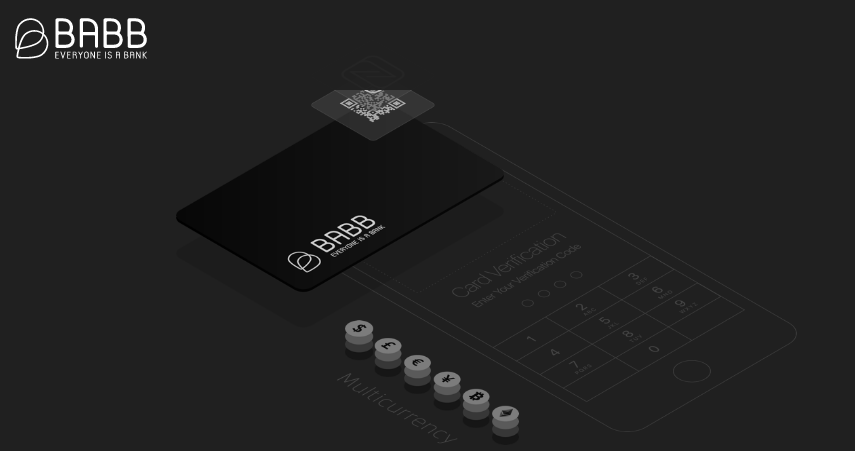

The Black Card

The user can spend any fiduciary or encrypted currency online and in any country using Black Card, a revolutionary decentralized payment card linked directly to his BABB bank account.

It is a secure payment card that is directly linked to your BABB bank account through a secure QR code or NFC tag. It allows functionality similar to that of a debit and can also be issued as a prepaid card for your friends and family.

Retailers can accept payment with the BABB card by simply downloading the BABB application and scanning the QR code or using NFC. Payment is made instantly in the retailer’s bank account and the funds can be used immediately.

Social growth

The innovative “Social KYC” process allows anyone who is fully KYC certified, with validated documentation, to respond for other users and on board the platform. In this way BABB will expand its services to millions of people without the need for them to present identification documents.

The KYC social mechanism will promote the exponential growth of its user base. This is particularly useful for incorporating the unbanked in emerging markets, since one of the main barriers they face is the lack of documentation.

As the value of BABB is proportional to the number of users in the network, there is a strong incentive for early adopters to encourage their peers to participate.

Social KYC is a key part of the strategy to create fully-banked communities and promote financial, economic and social integration.

https://youtu.be/7roMDZaRBLY

BAX, the native token of BABB, will allow central banks to issue their own digital currencies to stimulate local microeconomics.

Local digital currencies offer citizens access to international remittances and payment gateways.

With CBDC, central banks can replicate the many useful and innovative aspects of cryptocurrencies such as Bitcoin and Ethereum, while eliminating many of the destabilizing elements.

The value of the digital currencies of the central banks will not fluctuate, since they will be linked to their national fiduciary currency, and they will control and encourage their use as a means of exchange, ensuring economic stability.

This collaboration between central banks and BABB will not only allow users to carry out local transactions in the central bank’s local system; it will also allow them to carry out international transactions in the global BABB platform.

The BAX token will be placed on public sale soon and those interested can buy and maintain this currency and benefit from the enormous value of the platform. To keep up, you can visit the project’s web site.