TL;DR

- Avalanche is testing critical support after breaking down from a multi-month ascending wedge.

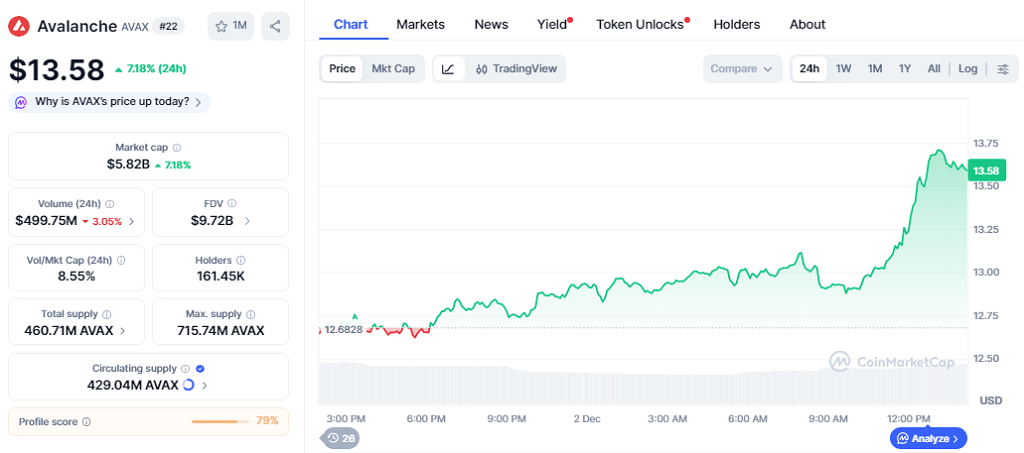

- The token trades at $13.58 with a 7.18% gain in the last 24 hours, reflecting short-term rebounds amid persistent bearish pressure.

- AVAX’s market cap stands at $5.82 billion with a 24-hour volume of $499.75 million, highlighting active trading even as downside momentum remains significant.

Avalanche faces pressure after a decisive breakdown from an ascending broadening wedge that shaped its trend through 2025. Despite a 7.18% gain in the past 24 hours, AVAX trades at $13.58, signaling that short-term rebounds have not yet reversed broader bearish momentum. Technical analysis suggests that the next support levels will be closely watched by traders and investors alike.

A right-angled ascending broadening wedge breakout puts Avalanche $AVAX on track for $9. pic.twitter.com/dZyct96Tky

— Ali (@ali_charts) December 2, 2025

Pattern Breakdown Signals Weakness

The AVAX chart shows a clear wedge failure. After multiple rejections at the upper boundary, the price fell below the lower trendline, confirming a breakdown. This structure, widening over time, reflects growing volatility and indicates that the loss of support could lead to extended declines. Analysts point to potential targets at $12, $11, and $10 if the current momentum persists. Each retest of the broken support has acted as resistance, reinforcing the bearish bias.

Market Metrics Reinforce Downside Pressure

Trading data indicates that the late-November rally could not sustain momentum. AVAX’s market cap of $5.82 billion and 24-hour volume of $499.75 million show active participation, yet the token struggles to reclaim previous highs. Technical indicators highlight this imbalance: a 14-day RSI of 31.23 approaches oversold territory, while the 50-day SMA at $17.31 and 200-day SMA at $22.29 remain well above the current price, confirming the broader downtrend. Volatility stands at 10.39%, suggesting rapid price swings could continue.

Avalanche Support Zones to Watch

Analysts are monitoring key levels to gauge AVAX’s trajectory. The $13–$12.50 range acts as immediate support, while $11.5–$10.4 represents the next significant liquidity area if selling resumes. A breakdown toward $9 aligns with the wedge’s technical implications. Reclaiming $15 would be critical to shift momentum back toward the upside, but short-term pressure keeps the token vulnerable.

Avalanche sits at a crucial juncture as the confirmed wedge breakdown, weakening momentum, and high volatility leave AVAX exposed to further declines. Traders and investors will likely watch whether buyers can stabilize price near current support levels or if the token moves toward lower targets in the coming weeks.