Avalanche prices are far from the glorious days of 2021. AVAX is down over 90% from peaks at spot levels.

Although there are recovery efforts when writing, the failure of prices to break higher and clear above immediate resistance levels should be a concern.

Fundamental aspects play a role in supporting prices. Still, as things stand, it hasn’t been enough to spark demand and lift AVAX above the liquidation line at $18.

If AVAX is to recover and bottom-up from the current consolidation, the leg up must also be with conviction.

That means there should be buyers in the mix that would inject momentum, lifting the coin above $18 towards $22 in a buy trend continuation.

Cortina Upgrade Launches

The sideways movement of AVAX prices is amid the activation of the Cortina Upgrade on the Avalanche Testnet.

The upgrade supported prices, but those gains weren’t substantial to spark massive shifts in demand. Cortina upgrade on Avalanche’s X-Chain makes support for exchanges smoother. The X-Chain is a part of Avalanche that supports the sending and reception of coins.

Besides, it means AvalancheGo migrates the X-Chain to support the Snowman++ consensus. This means the X-Chain will be compatible with Avalanche Warp Messaging. On supporting faster development, Avalanche explained:

“The X-Chain migrating to Snowman++ means the entire network has moved to a single consensus engine. This reduces the size of the trusted computing base and increases the leverage of existing R&D efforts, enabling faster development and more broadly-applicable innovation.”

The X-Chain migrating to Snowman++ means the entire network has moved to a single consensus engine. This reduces the size of the trusted computing base and increases the leverage of existing R&D efforts, which will enable faster development and more broadly-applicable innovation.

— Avalanche 🔺 (@avalancheavax) March 23, 2023

Avalanche Price Analysis

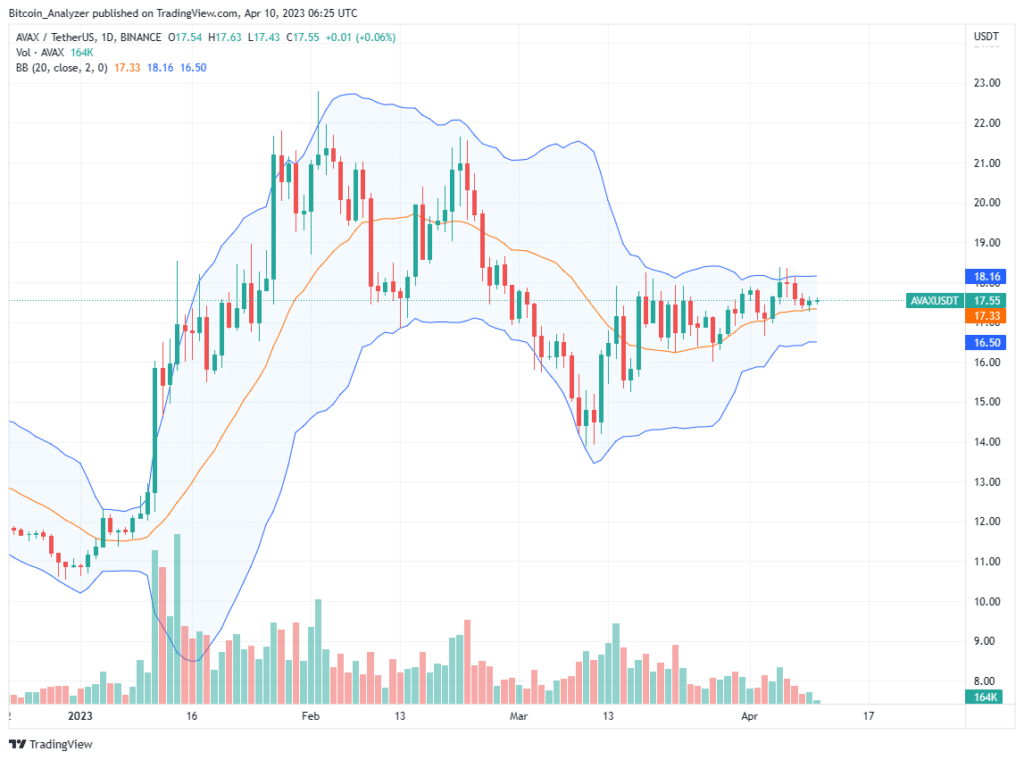

From the daily chart, AVAX is relatively stable.

Prices are moving horizontally, as evident in the daily chart. In the short term, primary support is at $16.50, while resistance is at $18. The dynamic 20-day moving average is also in a level to watch out for, and closely.

Overall, the uptrend remains since prices are broadly moving within a slightly rising wedge with shrinking volumes.

Therefore, since prices are anchored by the bull bars from March 10 to March 17, which had high volumes, traders can watch for a solid close above $18 for a trend continuation. This will favor buyers from a volume perspective, setting the base for a leg up to February highs at $22.

Any high-volume, wide-ranging bar breaking below $16 will invalidate the bullish preview. If gains are March 17 are sharply reversed, AVAX may pull back to March 2023 lows at $14.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Avalanche news.