TL;DR

- ASTER rebounded after a sharp intraday fall triggered by misleading claims linking Changpeng Zhao (CZ) to a large token selloff.

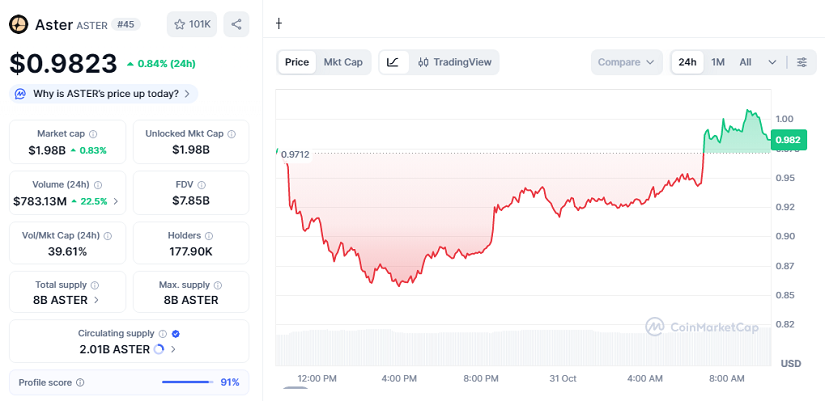

- The token, now trading at $0.9823 with a 24-hour gain of 0.84% and a market cap of $1.98B, avoided further decline as on-chain data fully disproved the rumor.

- Despite turbulence, ASTER continues to show strong trading activity and confidence improved after enhanced transparency on its on-chain buyback program.

Aster’s token experienced high volatility this week after unfounded speculation linked a multimillion-dollar transfer to former Binance chief executive Changpeng Zhao. The rumor suggested a wallet allegedly tied to him unloaded close to $30M in ASTER. The claim was quickly dismissed by Zhao through his X account, where he urged followers to stop engaging with accounts spreading false information. Independent blockchain monitoring also confirmed the wallet did not belong to him and the transfer was entirely unrelated to CZ.

The clarification helped calm the immediate sell pressure, although the rumor had already fueled a steep swing that briefly pushed ASTER nearly 9% lower and below the $1.00 psychological region. Friday data showed improvement, with ASTER changing hands at $0.9823 and modestly up 0.84% in the last 24 hours. Trading volume in the same period moved around $783M, marking a rise above 23% compared to the previous day.

Market Stabilization And Technical Picture

Market analysts noted that the fast bounce reduced concerns of extended downside. Earlier in the week, ASTER had struggled to maintain traction above $1.20, and slipping under $1.00 had sparked warnings of a possible bearish continuation. The latest stabilization suggests traders are reassessing the token’s short term direction rather than accelerating exits.

Ecosystem Performance And Buyback Progress

Away from price action, the ecosystem surrounding the decentralized perpetual and spot exchange remains robust. Data from DeFiLlama placed the platform’s TVL above $1.5B and noted more than $71B in perpetual trading volume during the past week. Spot exchange activity surpassed $600M over the same period. Monthly fee generation exceeded $130M, reinforcing long-term sustainability for protocol incentives.

The ongoing token buyback program continued to be executed fully on-chain, with the team reiterating that the initiative aims to repurchase between 70% and 80% of Series 3 trading fees. Regular on-chain progress updates have reassured market participants who value transparency and verifiable execution. Investors now look to the next weekly close to gauge if ASTER can reclaim the $1.00 level and set the tone for a more constructive November.