TL;DR

- Aster was delisted from DefiLlama due to concerns over potential volume inflation, sparking a debate on data reliability in DeFi.

- The exchange had briefly overtaken major competitors in trading volume, highlighting the competitive pressures in decentralized derivatives.

- This controversy underscores ongoing challenges in distinguishing genuine activity from wash trading and artificial metrics in the fast-growing crypto ecosystem.

The fight for dominance among decentralized derivatives exchanges has taken a new turn after DefiLlama removed Aster from its listings, citing concerns over the integrity of the data provided. Aster, a derivatives DEX supported by YZi Labs, saw a meteoric rise in trading volume that briefly surpassed Hyperliquid, a previously celebrated star in the DeFi market. This sudden spike drew attention from traders and analysts alike, prompting discussions about how transparency and accountability are increasingly critical for sustained growth in decentralized platforms.

Aster Activity Amplifies Allegations Against Data Providers

The delisting announcement from DefiLlama triggered accusations of centralization from Aster supporters while critics questioned whether the exchange’s rapid ascent reflected genuine market interest or artificially boosted volumes. CoinMarketCap reported Aster leading all DEXs on Monday with $41.78 billion in 24-hour trading volume, compared to Hyperliquid’s $9 billion. Analysts warn that wash trading and inflated use volumes remain a persistent issue across many exchanges, making it difficult for investors to trust emerging platforms fully.

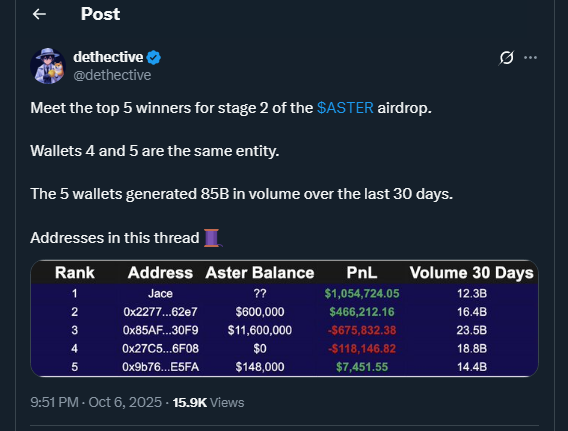

Greg Magadini of Amberdata explained that volume inflation often involves either traders seeking rewards through artificial trades or exchanges exaggerating activity to attract users. Investigations on X identified wallets that may have generated $85 billion in 30 days, suggesting a mix of authentic and manipulated trading behavior. In contrast, open interest figures show Hyperliquid leading with $14.68 billion, followed by Aster at $4.86 billion, indicating that some trading activity may have real financial commitment behind it. These dynamics emphasize the growing need for sophisticated analytics and independent verification in DeFi.

Dune Dashboards Draw Ironic Attention From Aster Fans

DefiLlama’s removal of Aster left a vacuum for users seeking reliable DeFi metrics. Many pointed to Dune Analytics as an alternative, though ironically, some of the dashboards relied on DefiLlama’s data itself. DefiLlama’s founder denied allegations of unfair targeting, noting that other exchanges have been delisted previously due to wash trading. The Aster situation highlights the broader struggle to measure truth and maintain trust in decentralized markets. As perpetual trading captures a growing share of the crypto economy, disputes over reported metrics reflect the high stakes and competitive pressures facing DeFi platforms today, and the necessity of independent verification remains clear.