TL;DR

- Aster reimbursed traders in USDT after a sudden anomaly in the XPL perpetual pair led to forced liquidations.

- The glitch was linked to a brief misalignment between testing safeguards and live market pricing, causing XPL to surge abnormally.

- The quick response, along with extra coverage of fees, reinforced Aster’s growing reputation as one of the most resilient and trader-focused decentralized perpetual exchanges in the sector.

Aster, a decentralized perpetuals exchange rapidly gaining ground in the sector, confirmed it has fully reimbursed users who suffered forced liquidations following an unexpected spike in the XPL perpetual contract. The incident happened late Thursday, with XPL briefly trading above four dollars on Aster, while remaining around one dollar thirty on other platforms. The discrepancy lasted only minutes but triggered several automatic liquidations before the system stabilized again.

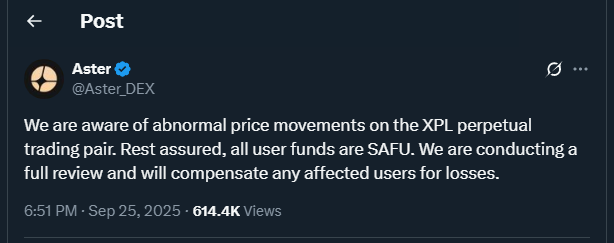

Aster reacted swiftly, announcing on X that all affected accounts would be reviewed and reimbursed. Within three hours, users received timely compensation in USDT directly in their wallets. Additional reimbursements were also provided to cover trading and liquidation fees, an action many traders welcomed as a strong sign of professionalism and transparency.

Background On The Anomaly

The sudden price movement is believed to have originated from technical adjustments made during the transition of the XPL market from test phase to full launch. During internal testing, price controls were applied to prevent volatility, reportedly locking the index at one dollar. Once those controls were lifted without a full sync to live market feeds, the contract briefly jumped, triggering liquidations before quickly reverting to its previous levels.

Although Aster has not officially confirmed this version of events, the team acknowledged ongoing internal reviews and pledged to share more findings with the public soon. Traders estimate the reimbursements may have reached millions of dollars, though the exact figure has not yet been disclosed.

Aster’s Expansion And Plasma’s Breakthrough

The glitch coincided with the mainnet launch of Plasma, the Layer 1 chain behind XPL, which opened with over two billion dollars in stablecoin liquidity locked at launch. This positioned Plasma among the largest blockchains for stablecoin support on day one. XPL itself rapidly achieved a double-digit billion-dollar valuation, reflecting strong and persistent market interest.

For Aster, the episode highlighted both the risks and resilience of decentralized exchanges. Despite the temporary disruption, Aster continues to outpace rivals such as Hyperliquid in daily perpetuals trading volume. With innovative features like hidden orders that allow stealth limit placement, the exchange remains positioned as one of the most competitive and trader-friendly DEXs in the space.