TL;DR

- Arthur Hayes predicts crypto market crash after Fed rate cut.

- Appreciation of the Japanese yen could cause the fall.

- Ethereum could benefit from the initial crisis thanks to its staking performance.

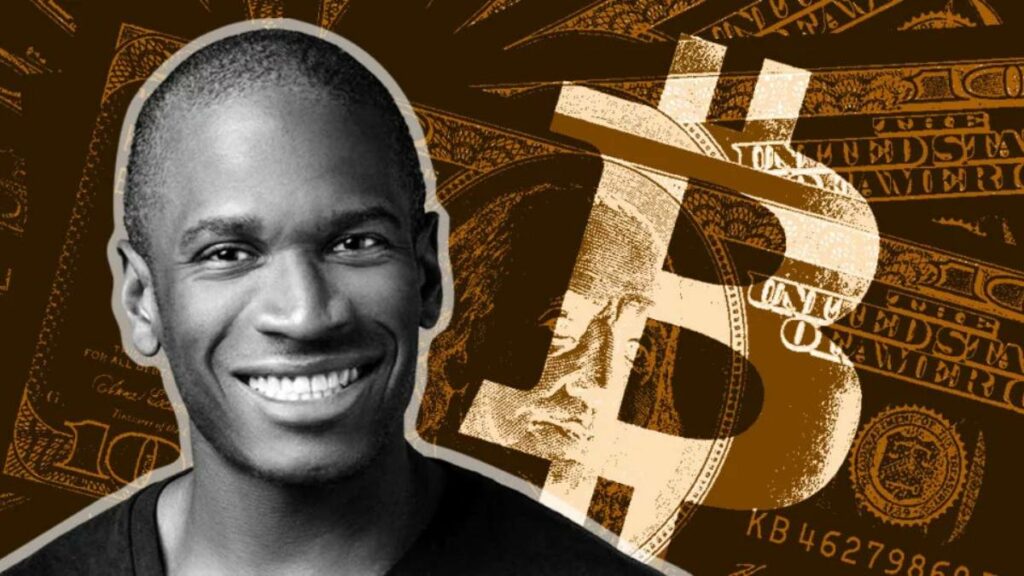

Arthur Hayes, co-founder of BitMEX and chief investment officer of Maelstrom, has issued a warning about the impending impact that the US Federal Reserve‘s rate cut will have on markets, particularly the cryptocurrency sector.

Speaking at the TOKEN2049 conference in Singapore, Hayes highlighted that the rate cut move, expected by many as an economic relief, could actually trigger a crash in risk assets like Bitcoin and other cryptocurrencies.

The main reason for this prediction lies in the interest rate differential between the US and Japan.

Hayes explained that the rate cuts in the US will narrow this gap, which will strengthen the Japanese yen.

This appreciation of the yen could lead to a massive unwinding of leveraged yen trades, commonly known as “yen carry trades“, which would destabilize global markets and affect cryptocurrencies.

In fact, already in August of this year, when the Bank of Japan slightly adjusted its rates, Bitcoin experienced a significant drop.

In addition to his analysis of the yen, Hayes also expressed concern about the U.S. economic backdrop, where government spending and inflation remain critical factors.

According to him, a rate cut will only increase these problems and aggravate the situation, causing the markets to react negatively in the days following the measure.

Opportunities for Ethereum according to Hayes

Despite warnings about an impending crash, Hayes also noted that this lower interest rate environment could eventually benefit certain assets, particularly Ethereum (ETH).

Ethereum staking, which offers a 4% annualized return, would become more attractive to investors if US Treasury yields fall to near-zero levels.

In this context, investors would look for higher-yield opportunities in alternative markets such as crypto.

In addition to Ethereum, Hayes mentioned other assets such as Ethena (USDe) and Pendle, both with mechanisms that allow generating yields, as options that could benefit from this scenario.

However, he was clear in ruling out ONDO, indicating that he has no investments in that asset.

Finally, Hayes concluded his intervention by stressing that although the market could face a strong initial pullback, this would pave the way for a new bullish cycle.

The Fed’s rate cut, while initially painful for cryptocurrency investors, could be the catalyst for a resurgence in the sector, with Ethereum leading the way in investment opportunities in this new economic environment.