As the crypto market gradually moves out of a prolonged consolidation phase, many participants are reassessing which altcoins may remain relevant into 2026. Rather than short-term momentum, attention is increasingly directed toward projects with defined use cases, operational platforms, and measurable adoption.

Sectors such as blockchain-based banking, payments infrastructure, decentralized finance, and scalable networks continue to attract interest. Among these, Digitap ($TAP) has recently drawn attention following the announcement that Solana deposits are now available within its platform.

With this context, the following are seven crypto projects that market participants continue to monitor as the next cycle develops.

Seven Altcoins to Watch

-

Digitap ($TAP) – An omnibanking application designed to manage crypto and fiat assets in a single interface

-

Solana (SOL) – A high-performance blockchain supporting a broad ecosystem of applications

-

Remittix (RTX) – A platform focused on simplifying cross-border crypto-to-fiat payments

-

BlockDAG (BDAG) – A scalable network architecture designed for high-throughput applications

-

Binance Coin (BNB) – The native token of the Binance ecosystem

-

Hyperliquid (HYPE) – A Layer-1 network designed for derivatives-focused decentralized finance

-

Chainlink (LINK) – Infrastructure connecting blockchains with real-world data and systems

Digitap ($TAP): A Unified Crypto and Fiat Banking Platform

Digitap differentiates itself by offering a live omnibanking application that integrates both crypto and fiat services. The platform supports multi-rail infrastructure, allowing users to manage balances, convert assets, and move funds across traditional and blockchain-based rails within a single interface.

Digitap also provides Visa debit cards that enable spending at millions of merchants globally. This aligns with broader trends toward mobile-first and borderless financial services.

A recent update introduced Solana-based deposits, allowing users to fund accounts with SOL, USDT, and USDC via the Solana network. This integration reduces transaction costs and settlement times while keeping users within the same application environment.

According to project disclosures, the presale has raised over $4.5 million, with participation from more than 120,000 wallets. These metrics have contributed to Digitap’s visibility among banking-focused crypto projects being evaluated for 2026.

Solana (SOL): Infrastructure Supporting a Broad Ecosystem

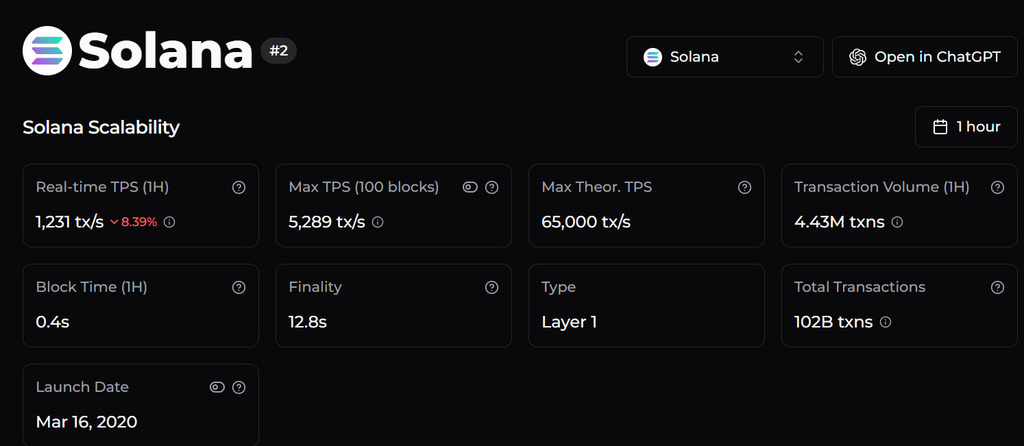

Solana remains a widely used blockchain due to its high throughput and low transaction fees. While its ecosystem experienced volatility during recent memecoin corrections, development activity across decentralized exchanges, NFT platforms, and gaming applications continues.

As the market shifts focus back to infrastructure utility, SOL is often monitored as a large-cap altcoin representing long-term exposure to scalable blockchain networks.

BlockDAG: High-Throughput Network Architecture

BlockDAG combines Directed Acyclic Graph (DAG) concepts with blockchain processing to reduce congestion and improve throughput. The project aims to support applications requiring fast confirmation times and low latency.

BlockDAG has reported significant presale participation and positions itself as an infrastructure layer rather than an application-specific token. Its relevance depends on broader adoption of its architecture by developers and enterprises.

Remittix: Simplifying Crypto-to-Fiat Transfers

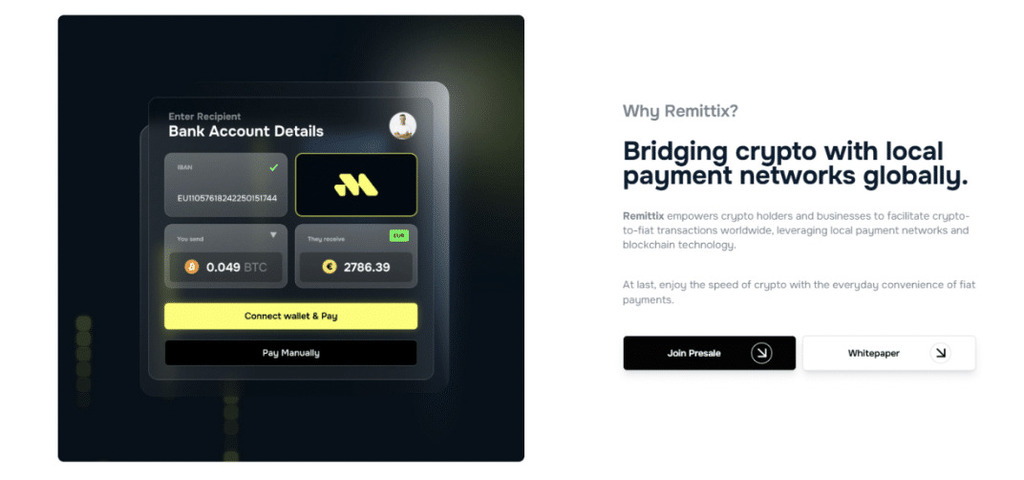

Remittix focuses on enabling users to send cryptocurrency directly to fiat bank accounts. By abstracting the conversion process and minimizing foreign exchange complexity, the platform aims to reduce friction in international transfers.

Recent exchange listings and security audits have supported visibility for the project, although it is now in later presale stages, which may influence how participants assess risk and upside.

Binance Coin (BNB): Exposure to a Large Exchange Ecosystem

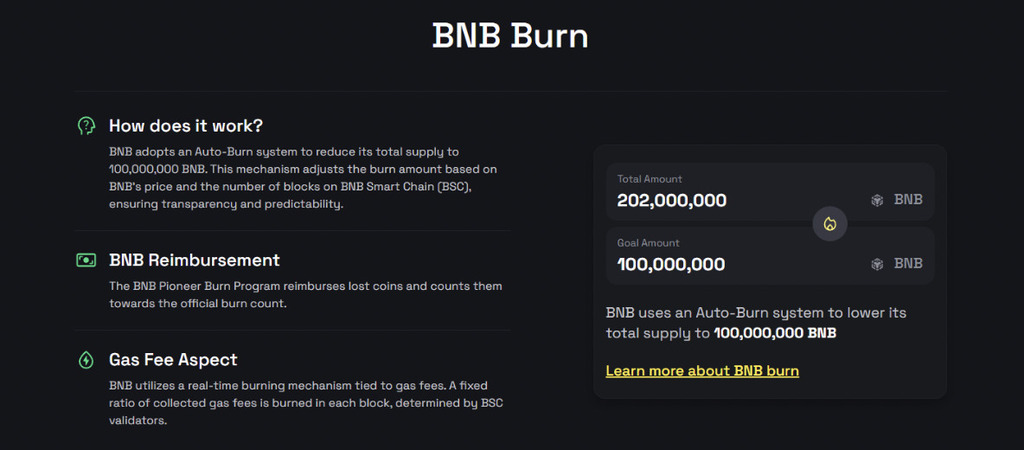

BNB plays a central role within the Binance ecosystem, supporting fee reductions, staking, governance, and other services. Its value remains closely linked to overall exchange activity and broader crypto adoption.

For participants seeking exposure to infrastructure supporting global trading volume, BNB continues to be monitored as part of diversified portfolios.

Hyperliquid (HYPE): Performance-Focused DeFi Infrastructure

Hyperliquid operates a custom Layer-1 network built specifically for derivatives trading. Its design emphasizes fast order execution, reduced slippage, and transparent price discovery through an on-chain order book.

The project addresses structural inefficiencies in decentralized derivatives markets and remains relevant for those tracking specialized DeFi infrastructure.

Chainlink (LINK): Connecting Blockchains to Real-World Systems

Chainlink provides decentralized oracle services that connect blockchains with external data, APIs, and traditional financial systems. Its technology supports tokenized assets, cross-chain settlement, and regulated access frameworks.

As interoperability becomes increasingly important, LINK continues to be referenced in discussions around foundational blockchain infrastructure.

Why Digitap Continues to Stand Out

While each project on this list addresses a different segment of the crypto ecosystem, Digitap stands out due to its dual focus on crypto and traditional banking users. By targeting both markets, its potential addressable user base is broader than application-specific tokens.

The project has also outlined mechanisms such as buybacks, staking, governance participation, and in-app utility for $TAP. These features are designed to align token usage with platform activity rather than short-term speculation.

$TAP Market Context

$TAP is currently priced around $0.045, reflecting gains since its earliest presale stages. Future pricing and listings remain subject to market conditions and execution milestones.

Digitap’s recent Solana integration and ongoing platform development continue to shape how the project is evaluated among banking-focused crypto initiatives heading into 2026.

Learn More About Digitap

- Presale: https://presale.digitap.app

- Website: https://digitap.app

- Social: https://linktr.ee/digitap.app

- Campaign: https://gleam.io/bfpzx/digitap-250000-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.