One night can change a narrative, but only if a project has the structure to handle increased attention.

That’s what made Misfits Dubai feel notable for some crypto observers.

Misfits Boxing held an event in Dubai with Andrew Tate vs Chase DeMoor as the headline attraction at the Dubai Duty Free Tennis Stadium.

During the broadcast, IPO Genie ($IPO) was presented as an official sponsor of the bout. The sponsorship gave the project real-world visibility beyond crypto-native channels.

DeMoor won by majority decision. As with many influencer-boxing cards, discussion after the fight extended beyond the result to broader commentary about the event and its sponsors.

Misfits Dubai Highlights: A Moment That Increased Scrutiny on Event Sponsors

Misfits events compress attention into a narrow window, which can increase scrutiny on the brands and projects that choose to sponsor the card.

This one came with extra fuel.

- A high-profile main event (Tate vs DeMoor)

- A global streaming narrative around the card

- A Dubai venue that adds “major event” weight

IPO Genie’s sponsorship placed the project in front of viewers who weren’t already focused on crypto.

For early-stage token projects, attention alone is not a measure of quality; it can simply lead more people to look for details such as documentation, token mechanics, and disclosures.

Visibility can drive interest; however, any evaluation still depends on verifiable information and risk considerations.

After the Final Bell: What Sponsorship Attention Means in Crypto

Every big fight creates follow-on discussion. Not just who wins, but what brands gain public attention once the clips circulate.

The result is clear: Chase DeMoor beat Andrew Tate by majority decision in Dubai. Separately, some viewers and traders also tracked which sponsors and projects were being searched online after the event.

When a spotlight hits, does interest translate into deeper research, or fade into the next cycle?

- The winner gets the headline (DeMoor did).

- Sponsors and brands may see a short-term attention increase (searches, mentions, and clicks).

- Any longer-term outcome depends on what information is available and how the project is structured.

In that context, IPO Genie was one of the names some readers encountered while looking up sponsors. That does not indicate performance or outcomes; it only indicates visibility.

What IPO Genie Says It Is Building (Project Description, Late 2025)

The early-stage token market includes a wide range of projects and risk profiles. In IPO Genie’s case, project materials describe an access-led model that includes:

- Tokenized private-market and pre-IPO deal access as a core narrative

- Staking-based tiers intended to differentiate participation levels

- Governance pathways (described as community input mechanisms)

- An “institutional-grade access” framing, as described by the project

Readers should treat these points as descriptions from the project, not independently verified claims about feasibility, regulation, or future results.

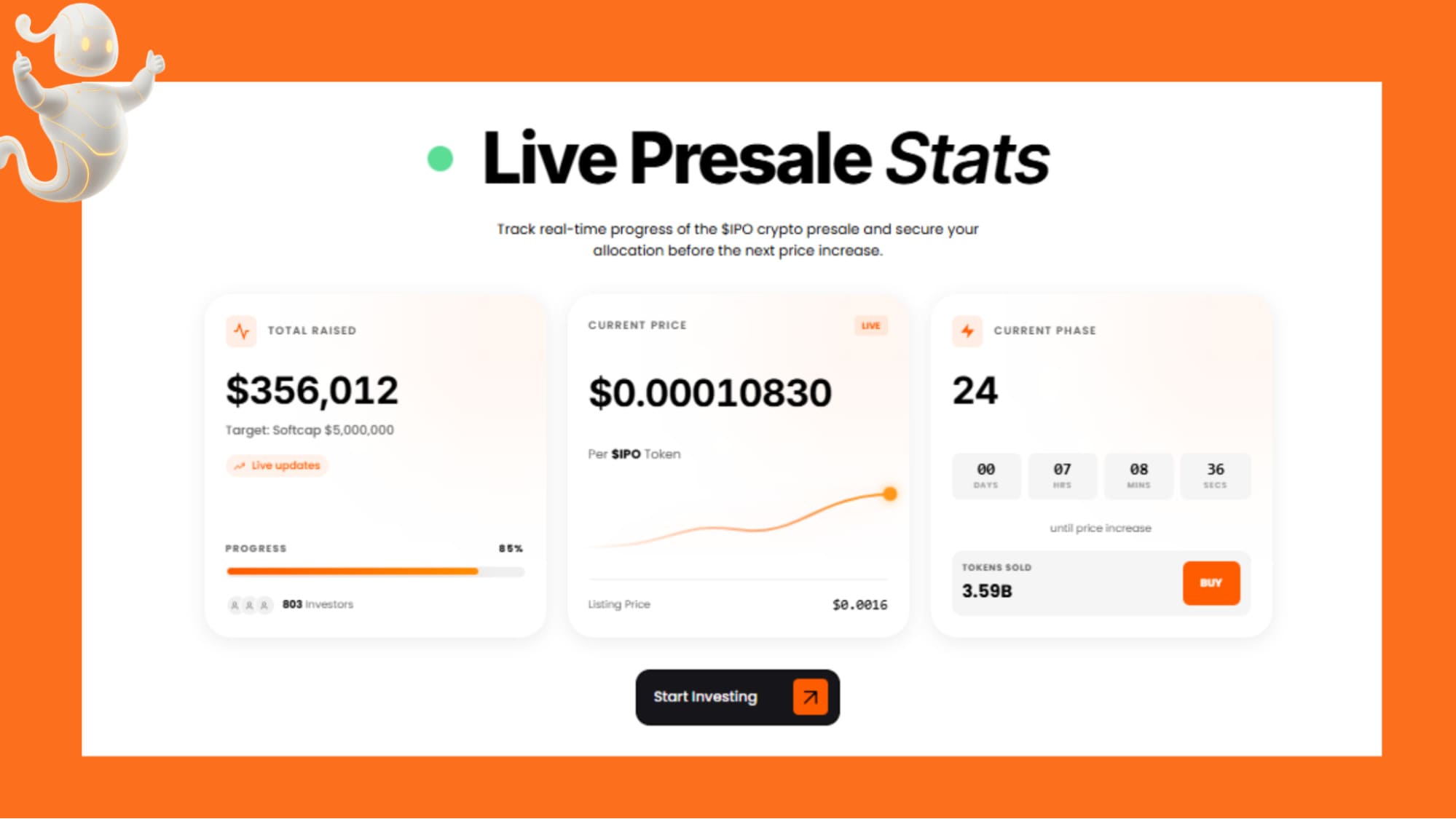

What the Live Token-Sale Panel Shows (Point-in-Time)

The IPO Genie dashboard screenshot is a point-in-time snapshot presented by the project. It may change as phases and on-page figures update, and it should not be read as a forecast.

Live Snapshot (as displayed):

- Total raised: $356,012

- Current price: $0.00010830

- Phase: 24

- Tokens sold: 3.59B

- Investors: 803

- Progress shown: 88%

- Softcap displayed: $5,000,000

- Listing price displayed: $0.0016

| Note: These numbers vary with the passage of time as the phase changes. Project page link (for reference) |

Phase-based token sales can make it easier to track changes over time, but the presence of a phase system does not remove market, execution, or smart-contract risks.

Example Evaluation Template (Not a Ranking)

| Criteria (2025) | IPO Genie ($IPO) | BlockDAG (BDAG) | Bitcoin Hyper (HYPER) | Nexchain (NEX) | Notes |

| Transparency & trackability | Not independently assessed | Not independently assessed | Not independently assessed | Not independently assessed | Use primary sources (docs, audits if available, contract addresses, disclosures) and verify independently. |

| Token utility clarity (pre-launch) | Project-described | Not independently assessed | Not independently assessed | Not independently assessed | Separate marketing narratives from implementable features and realistic user demand. |

| Post-event resilience | Not known | Not known | Not known | Not known | Sponsorship attention can be temporary; review updates, delivery milestones, and transparency over time. |

| Trust posture (security/compliance framing) | Not independently assessed | Not independently assessed | Not independently assessed | Not independently assessed | Look for clear disclosures, security practices, and jurisdictional considerations; treat claims cautiously. |

| Community activity | Not independently assessed | Not independently assessed | Not independently assessed | Not independently assessed | Activity levels are not the same as product-market fit or sustainability. |

| Mainstream discovery | Event sponsorship noted | Not assessed | Not assessed | Not assessed | Discovery does not imply endorsement or expected price movement. |

| Overall score (out of 30) | Not scored | Not scored | Not scored | Not scored | This table is a framework template, not a rating or recommendation. |

If you are reviewing early-stage token sales, consider using a checklist that prioritizes verifiable information and risk management over event-driven attention.

How to Approach Early-Stage Token Sales More Cautiously

“Early” can also mean higher uncertainty. Consider a basic checklist such as:

- Verify official domains before connecting a wallet

- Double-check contract details (if provided publicly)

- Be cautious with countdown timers and other marketing elements that can encourage rushed decisions

- Review phase pricing and rules (claim, vesting, staking mechanics) and look for disclosures about risks

If you choose to participate in any token sale, ensure you understand the mechanics and the risks, and consider professional advice where appropriate.

Where Participation Information Is Typically Presented

Projects that run token sales generally publish participation mechanics on their official sites (for example, accepted payment methods, wallet requirements, and any staking or tier rules). Readers should rely on verified sources and avoid sharing private keys or seed phrases.

Misfits Dubai and IPO Genie: What Can (and Can’t) Be Inferred

The Tate vs DeMoor main event ended with DeMoor’s hand raised. IPO Genie’s separate takeaway was increased exposure as an event sponsor, which may have contributed to more searches and discussion. That, by itself, does not provide evidence about the project’s fundamentals, token value, or future performance.

For readers comparing multiple early-stage projects, the most useful next step is typically to review primary documentation, assess risks, and avoid treating sponsorship-driven visibility as a signal of expected returns.

For context on similar coverage, see: top crypto presale Dec 2025.

Any on-page pricing and phase information should be treated as project-provided and subject to change.

Project links (for reference)

FAQs

How do people compare early-stage token sales in 2025?

Comparisons often focus on whether a project provides verifiable documentation, clear disclosures, and understandable token mechanics. Event sponsorships and marketing visibility can increase awareness, but they are not a substitute for independent due diligence.

What does IPO Genie ($IPO) say it does?

IPO Genie describes $IPO as a token connected to an access-led model, including tiered participation, staking mechanics, and an ecosystem narrative linked to private-market and pre-IPO opportunities.

How can I think about potential outcomes without relying on hype?

Consider (1) whether the project’s claims can be verified, (2) whether the token has a clear use case and realistic demand assumptions, and (3) the risks involved (including smart-contract, liquidity, regulatory, and execution risk). No framework can remove uncertainty, and outcomes are inherently unpredictable.

This article contains information about an early-stage token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved.