TL;DR

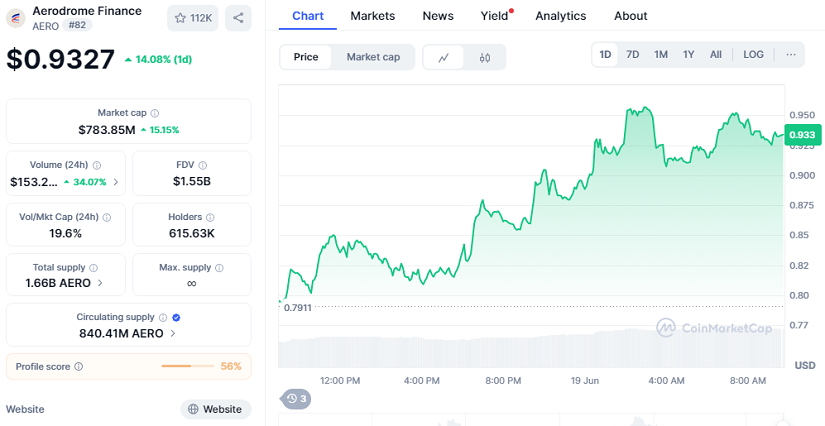

- Aerodrome’s native token, AERO, has soared over 70% in just seven days, outpacing the broader crypto market.

- Its price is now approaching $1, with current trading at $0.9327 and a 24-hour gain of 14%.

- The DEX has surpassed $1 billion in TVL, while JP Morgan’s move to Base is driving institutional interest toward AERO and other DeFi tokens on Ethereum’s layer-2 networks.

After a week of steady gains, AERO, the governance token of Aerodrome Finance, is once again in the spotlight. The token has jumped more than 14% in the past 24 hours and 71.12% on the weekly chart, trading at $0.9327 with a market capitalization of $783.85 million. This surge comes as the platform’s total value locked (TVL) crosses the $1 billion threshold, positioning Aerodrome among the top DeFi players on Base, Ethereum’s rapidly growing layer-2 scaling solution.

Aerodrome Strengthens Its Dominance As Base Grows

While Bitcoin and Ethereum have seen slight pullbacks, AERO is defying the downtrend. Bullish technicals, including a breakout from a falling wedge pattern, are driving momentum. The token is now testing its February highs near $1, a level that could signal a longer-term uptrend if broken. On-chain indicators show rising open interest and a negative funding rate, both signs that short positions are being liquidated — further fueling the rally.

The Aerodrome protocol has also seen a surge in trading volume, generating over $600,000 in fees in the last 24 hours and more than $15 million in the past month. Its integration with Coinbase on-chain services has expanded retail access, but institutional interest may prove to be the more powerful catalyst.

JP Morgan Move Validates DeFi and Layer-2 Ecosystems

Institutional adoption took a major leap this week when JP Morgan confirmed it had launched a USD deposit token (JPMD) on Base through its blockchain arm, Kinexys. In a post on X, Base highlighted the speed and efficiency of sub-second, sub-cent transactions, which are ideal for real-time liquidity and near-instant settlement. This development not only validates Base but also boosts confidence in protocols like Aerodrome that operate within its ecosystem.

Market watchers are now closely eyeing the GENIUS Act, which could create a safer, regulated environment for DeFi and stablecoins. If approved, this legislation may pave the way for a new wave of capital into platforms like Aerodrome, both from institutions and retail investors seeking reliable alternatives within the crypto economy.

As of now, AERO bulls are targeting the $1 mark and potential new highs for Q3 2025.