TL;DR

- A DeFi hacker exploited a vulnerability in Abracadabra’s smart contracts to steal over $13 million, primarily in ETH.

- The attacker involved a sophisticated flash loan strategy, targeting the protocol’s “cauldrons” connected to GMX’s liquidity pools.

- While GMX confirmed its core contracts remain secure, the incident underscores the persistent risks in decentralized finance, where even integrated protocols can suffer major breaches.

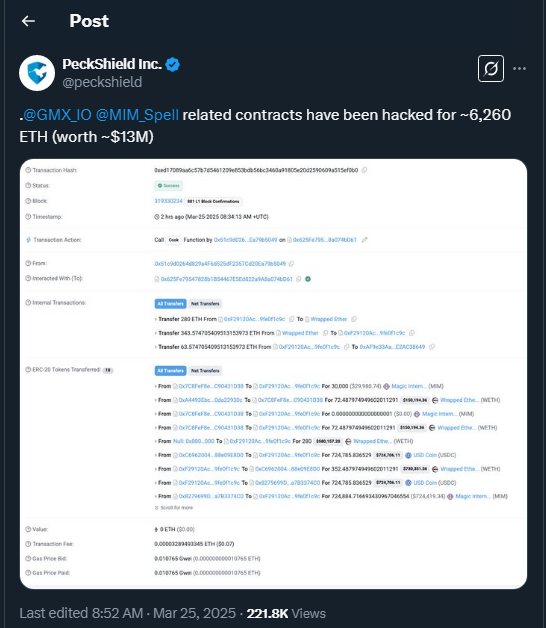

In a striking blow to the decentralized finance (DeFi) ecosystem, a hacker has successfully exploited a vulnerability within the Abracadabra protocol, siphoning off approximately 6,262 ETH, equivalent to over $13 million. The attacker cleverly manipulated the liquidation mechanisms within Abracadabra’s lending system, using a flash loan, a method in which funds are borrowed and repaid within the same transaction block, to carry out the heist.

The breach targeted Abracadabra’s “cauldrons”, smart contracts designed to manage loans and collateral through liquidity provided by GMX V2’s GM pools. Security firm Peckshield reported that the vulnerability allowed the attacker to borrow without collateral, immediately triggering self-liquidation and profiting from the rewards designed for those covering undercollateralized positions. This loophole, when executed with high-frequency and precision, enabled the attacker to drain funds without violating traditional lending constraints. The stolen ETH was swiftly bridged from Arbitrum to Ethereum, a move that deepened concerns and complicated tracking efforts across blockchain networks.

Flash Loan Attacks Still a Threat to DeFi Protocols

Flash loans have long been a double-edged sword in DeFi, enabling both advanced trading strategies and high-risk attacks. In this case, the hacker created a flashloan “state” in which the system wrongly assumed liquidation was due, allowing them to exploit Abracadabra’s liquidation incentives. The precision of the seven-step exploit process shows the attacker had deep knowledge of both Spell’s cauldrons and GMX’s structure. Analysts warn that similar integration-based risks may lie dormant in other protocols.

GMX Confirms Its Core Contracts Remain Untouched

Despite GMX’s involvement in the exploit, its developers quickly clarified that “GMX contracts are not affected.” Jonas_ALA, a developer from GMX, emphasized that the vulnerability came solely from the integration layer within Spell’s implementation, not GMX’s core infrastructure. Nevertheless, the incident has sparked concern about the interconnectedness of DeFi platforms, where one protocol’s weakness can expose others indirectly.

As crypto continues to push technological boundaries, this attack serves as a reminder: innovation must walk hand in hand with security. Despite this setback, pro-crypto voices argue that such incidents drive the ecosystem to evolve, becoming more resilient with each hard lesson learned.