“I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful,” says Warren Buffet.

Anyone who knows Warren Buffet will attest that he knows a thing or two about investing. He has always highlighted the importance of herd behavior in investing. Investors flock to an asset class until the price peaks; and then comes the fall.

Millennials have learned to dodge this phenomenon to a great extent, though not entirely. Millennials are far more prudent with their investments than the previous generation and don’t shy away from taking calculated risks.

For millennials out there seeking some enlightenment before testing the waters in their investment journey, or just looking to gain insight into a new asset class—this guide will talk about some of the best baskets that millennials can put their money in.

4 Asset classes millennials should consider investing in

Investment advisors call on the phone, knock at the door, speak on the TV, and yell on the radio—invest in mutual funds, invest in real estate, park the money in deposits…

They’re everywhere!

It’s only natural to feel overwhelmed with the gazillion investment options these advisers put in front of us.

We went ahead and put together some asset classes that have been in the spotlight and are currently hot and heavy among millennials. Let’s dive right in.

1. Cryptocurrency

Cryptocurrency is the talk of the town. With prominent tycoons like Elon Musk buying bitcoin worth billions, the prices keep touching a new high each week. Yes, there have been a lucky few who cashed in on this bitcoin wave and made ample wealth. The risks with bitcoin, though, are not everyone’s cup of tea.

The risks are particularly a problem for millennials who recently joined the workforce because they simply don’t have enough money in the bank to stomach the parabolic fluctuations in prices.

Whether millennials have been in employment for a while, or are just starting their career, there are several options in the crypto-verse where they can put their money.

If you’re planning on buying crypto, buy USDT to preserve your value within the crypto space and grow your wealth. Don’t take our word for it, let’s look at why USDT is a good bet.

The first reason any investor will feel reluctant to put money in crypto—risk! So, let’s look at how we can address risk when investing in crypto.

In one word: Stablecoins.

Stablecoins are cryptocurrencies pegged to the value of another asset or group of assets, like fiat currency, commodities, etc. They are designed to eliminate volatility and preserve value.

Let’s understand stablecoins using Tether (USDT) as an example. Tether is pegged to the USD, a fiat. If the USDT issuing entity issues $10 million worth of Tether, it will have an equivalent amount of money in its bank account. This money, in essence, serves as collateral for Tether.

Tether (USDT) has been a champion stablecoin for a while now. Just this week, USDT’s market capitalization on the Tron blockchain breached $24 billion, surpassing Ethereum’s $23.4 billion.

Among the stablecoins moving the markets right now, Tether tops the charts and looks the most promising. This makes Tether a great investment option for millennials who seek low volatility in the crypto-verse.

USDT is on its way up, hop on board!

2. Index Funds

Does the name ring a bell?

Index funds are the less expensive cousins of Mutual funds. Let’s look at how Index funds differ from Mutual funds in terms of cost structure and management style—the two factors that set them apart.

Mutual funds are managed by a fund manager who attempts to generate alpha returns by constructing a well-diversified portfolio of securities based on research. The fund manager, naturally, receives loads of cash as compensation—which comes out of the returns generated by the fund.

On the contrary, index funds are passively managed. They track a benchmark index like the FTSE 100. Essentially, the fund invests in all the securities of an index in the proportion of their market capitalization. Since this process requires no analysis, investors end up paying less in management fees.

So, what are the risks?

Well, since Mutual fund portfolios are actively managed, they are diversified to achieve a desired level of risk. Index funds are not diversified, so investors will be exposed to the risk of the overall market.

Investors with a low appetite for risk will find Index funds riskier, and vice versa. Index funds will bleed when the bears rule the market and give you healthy returns when market sentiment is bullish.

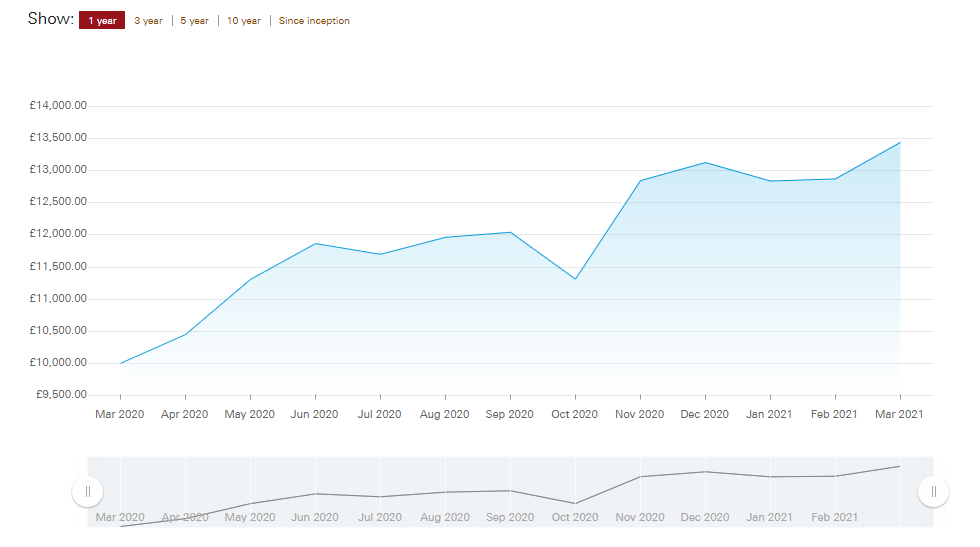

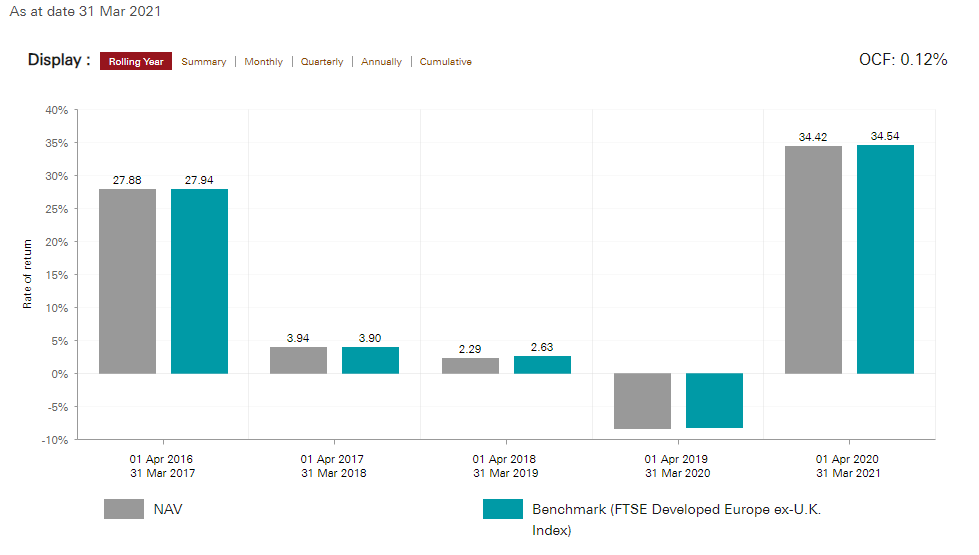

Let’s look at the FTSE Developed Europe ex-U.K. Equity Index Fund – Accumulation, by Vanguard.

For those who are new to investing and don’t know what this chart says: it tells us that investing £10,000 in this Vanguard fund in March 2020 would have accumulated to almost £13,500 as of March 2021. That’s over 34% return per annum!

Nevertheless, the 34% return comes with patience. Let’s look at how the fund performed over the past few years.

Notice how investors with a one-year time horizon would have lost money had they redeemed their investment in FY 2019-20. If you consider yourself a patient investor and have some money you won’t need for the foreseeable future, learn how to buy index funds and start building wealth.

3. Lifetime ISA

A Lifetime Independent Savings Account (LISA) is a key asset all millennials will want in their portfolio. There are several reasons for this.

First, free money!

Each year, investors may put up to £4,000 in their LISA. When investors add £4,000, the state will contribute 25% of the amount (£1,000) as a bonus. The state will add this bonus for all contributions by the investor until the investor turns 50.

Second, investors earn interest on the full amount (£5,000), not just the £4,000.

Third, this interest is tax-free.

To be eligible for opening a LISA, you must be aged 18 to 39. Also, you can only use the money in your LISA for:

- buying your first home, or

- converting it into a deposit, or

- retirement after you turn 60.

It’s important to note that the maximum bonus an investor will earn through the life of the LISA is £33,000. This figure results from the minimum age requirement for LISA (18 years), maximum age condition for bonus contribution by state (50 years), and cap on the yearly contribution (£4,000).

A LISA is a fixed income asset, which means it will reduce an investor’s portfolio’s overall standard deviation (or risk) as well. A LISA is a valuable asset all millennials must add to their investment bucket.

4. REITs

Real Estate Investment Trusts are a relatively younger class of assets. The underlying idea is the same as that of Mutual funds. A REIT pools money from investors but invests the money in real estate rather than equity or debt.

Traditional wisdom says real estate is one of the best asset classes. At today’s prices, though, it’s rather daunting to amass enough capital to purchase a property.

Enter REITs.

They eliminate the core issues real estate investors face: lack of capital and lack of liquidity. REITs enable investors to access the real estate market at a fraction of the capital required for purchasing a property. Investors can also quickly liquidate their REITs investments since they’re actively traded on an exchange.

Besides, there are several ancillary benefits as well. Their low correlation with equities and debt market makes them a great diversification tool, while still offering the potential for market-beating returns.

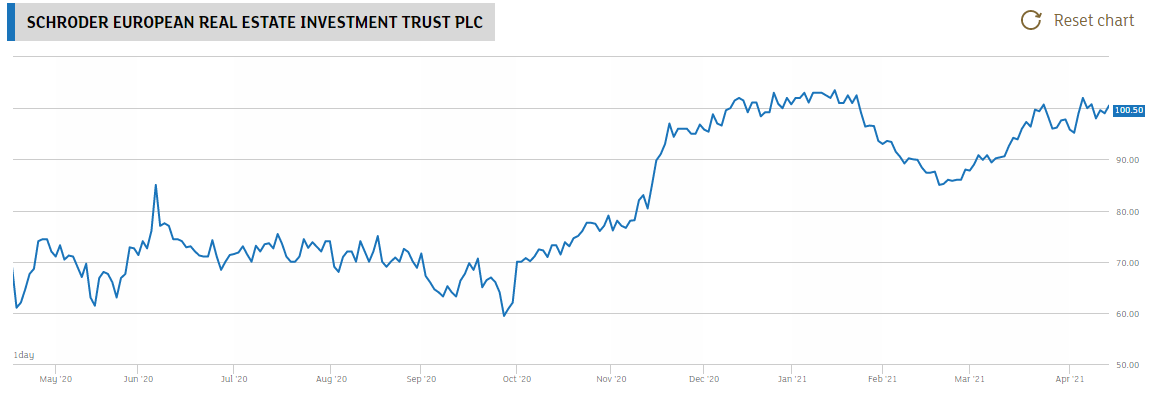

Let’s look at how much the Schroder European REIT delivered over the past one vs. five years.

Vast difference, right?

Investors directly look at the price line and think that’s some poor performance over the five-year term, one-year term performance looks much better.

However, REITs earn a large share of their earnings via rent. 90 percent of the rent so received, must necessarily be transferred to the investors each quarter as dividend after deduction of expenses like insurance, taxes, and maintenance, among other things.

So, while capital appreciation over the five-year term may be evidently poor, it doesn’t leave investors out to dry with minimal returns. Investors receive a healthy quarterly dividend payout, too.

Investors could invest in equities, debt, and other securities to appreciate capital at a million miles an hour—but as history suggests, they could go bust in the blink of an eye.

Real estate is here to stay.

Conclusion

Millennials are a step ahead of Baby Boomers when it comes to investing—not because of skill, but because of options they have, both in terms of asset classes and accessibility.

Baby Boomers focused on equities, and rightly so. Equities were the undefeated multi-baggers back in the day. Millennials, though, tend to be more open to venturing into new asset classes that offer higher potential returns.

While debt, equities, and mutual funds appear on most portfolios, we have enlisted four asset classes that could be absent. Remember, though, that it has been assumed that investors already have adequate insurance coverage and an emergency fund set up before making these investments.

Press releases published by Crypto Economy have sent by companies or their representatives. Crypto Economy is not part of any of these agencies, projects or platforms. At Crypto Economy we do not give investment advice and encourage our readers to do their own research.