The Bitcoin price is more like a “stablecoin,” so say some analysts. Despite general market optimism, BTC/USD prices have been swinging around the $45k level for the better part of this week.

Provided BTC prices are above $45k, optimistic traders contend that bulls will come on top in a buy trend continuation pattern that could even thrust the coin above $50k.

That would be an ideal situation. Building on this are various fundamental factors supportive of Bitcoin buyers in the medium term. For instance, users continue to extract their coins from CEXes.

Coinciding with this is the explosion in the number of LN active nodes and the number of BTC being tokenized in Ethereum for DeFi.

On-chain Readings and Fundamentals Support Bitcoin Bulls

As on-chain analysts observe, 111,033 BTC were withdrawn from exchanges in the last 30 days—one of the largest contractions of inventory in the coin’s history.

This can be interpreted to mean confidence, a move that overly supports determined bulls keen on maintaining prices above $42k.

Exchanges down 111,033 BTC in the last 30 days. One of the sharpest drops of exchange inventories in Bitcoin's history. pic.twitter.com/SjHVzOV7z2

— Will Clemente (@WClementeIII) August 18, 2021

Meanwhile, HOLDers appear to be accumulating, indicating that BTC/USD prices stand to tear even higher in the days ahead. This is a sign that the BTC bull market could extend into 2022 and in most crucially, in the process of breaking free from the 4-year halving cycle.

From a fundamental perspective, the simultaneous filings by Wells Fargo and JPMorgan for a Bitcoin private fund suggest demand from institutions. Their participation, guiding from the 2020-2021 rally, are signals of interest that translate to strength.

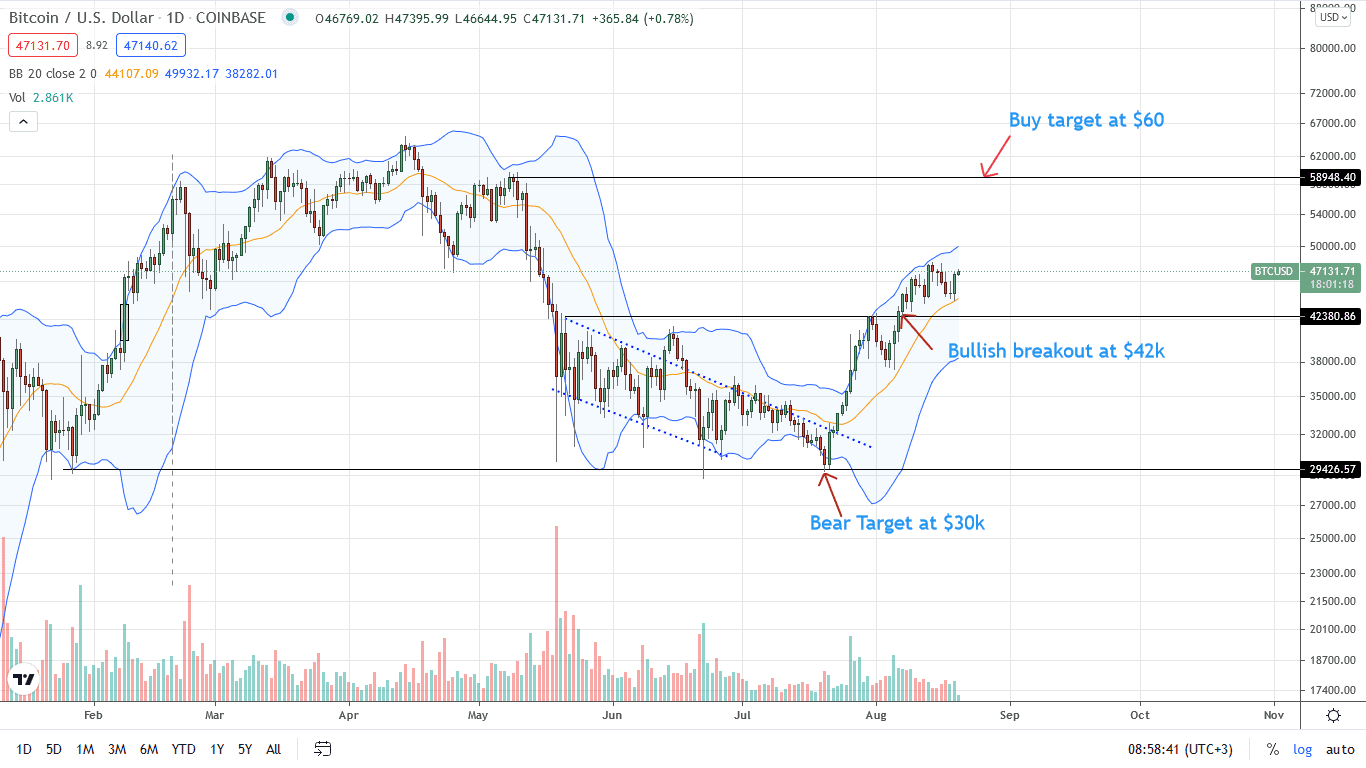

Bitcoin Price Analysis

The BTC price is stable on the last trading day, adding five percent week-to-date.

Overly, Bitcoin bulls are still in charge despite the recent contraction. Besides, BTC/USD prices are still within a bullish breakout pattern above the psychological round number at $40k and $42k—the January 2021 highs.

Therefore, as long as prices trend above these levels, every low is technically a loading opportunity for aggressive buyers targeting $50k in the short term. Note that the contraction of the past few days is with lighter volumes, translating to a low momentum hence the retracement from the upper BB.

If BTC/USD prices recover over the weekend, blasting above $47k and this week’s highs, the odds of the coin floating above $50k to over $52k would be high.

On the flip side, a dump towards and below $42k would likely deflate buyers. In this case, BTC/USD may contract back to $36k.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news