The Bitcoin price is both hot and cold, reading from price charts. Traders are cautious, convinced the uptrend and recent recovery is fleeting.

Accordingly, it is understandable if they keep their trading cards close to their chests. This, in return, is subsequential, reading from events in the daily chart.

BTC/USD Prices Are Heavily Fluctuating

The re-evaluation of BTC/USD price was sharp on the last two days. After sinking to as low as $28k, prices bounced back, driving prices to $34k. BTC is down eight percent week-to-date at the time of writing, stabilizing on the last trading day.

All the same, Bitcoin fundamentals are solid. There must be confirmation of recent gains for the uptrend to be valid, driving prices above June 21 highs and unwinding losses.

Citibank Points of Exciting Development in the Crypto Asset Sphere

The odds of such happening in a flash might be low, but Citibank is already following Goldman Sachs’ moves.

Recent news shows that the global bank has established a digital asset unit within its wealth management division.

According to the Wall Street giant, the unit, called the Digital Assets Group, will seek to exploit exciting developments in the crypto asset space.

The provision by Goldman Sachs now allows wealthy individuals to have exposure to Bitcoin following their partnership with Galaxy Digital.

Nonetheless, positive as it may. Citibank and Goldman Sachs won’t find direct exposure in Bitcoin. Instead, it would prefer derivatives and other investments offering indirect exposure available in a liquid market.

Bitcoin Technical Analysis

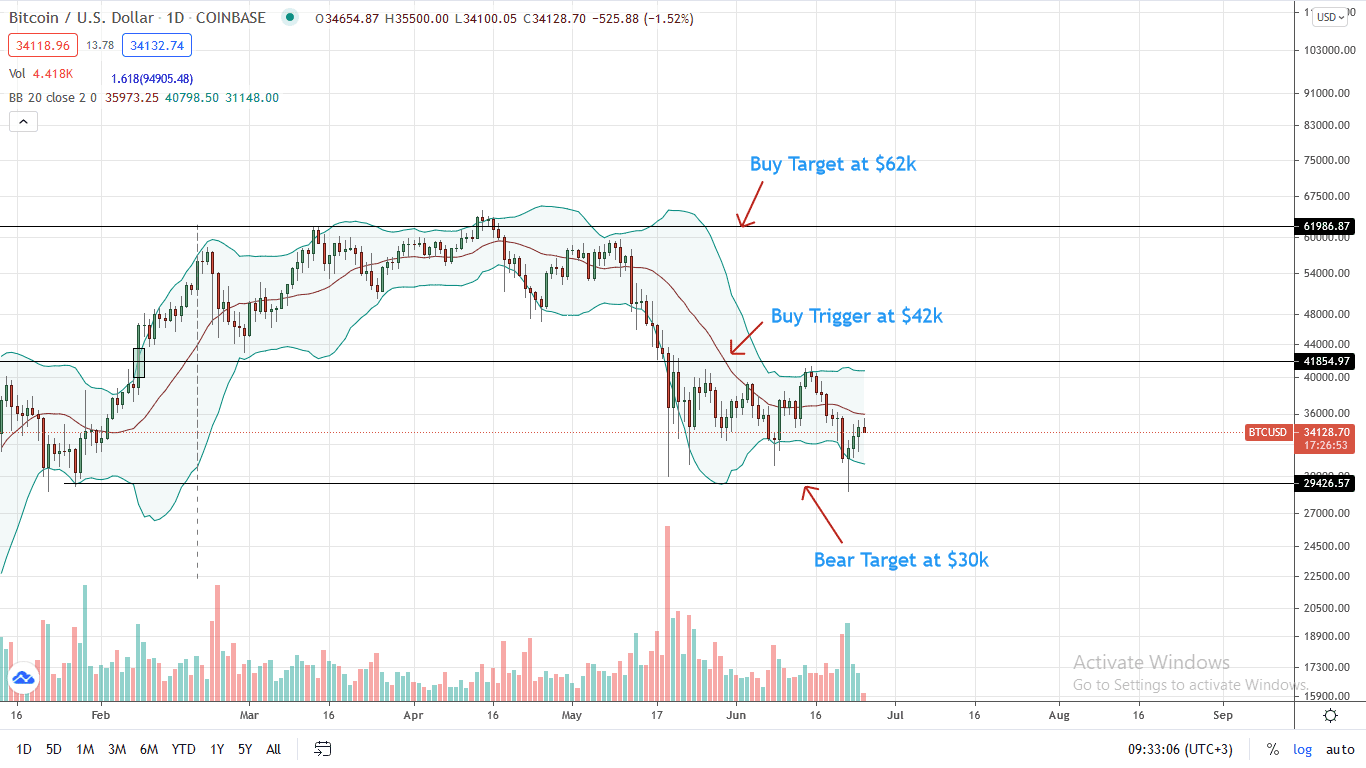

The BTC price is stable on the last trading day, adding four percent. Even so, it is down eight percent week-to-date, reading from price action in the daily chart.

At present, prices are also trading inside June 21 bearish bar, bouncing sharply from around May 2021 lows. Although bulls are confident, the trend is bearish, skewed for bulls.

Ideally, a close above the middle BB and June 21 highs at $36k may trigger more buying pressure with immediate targets at $42k—January 2021 highs.

On the flip side, the bear trend will resume if BTC/USD disintegrates at spot rates, sinking below $30k.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Bitcoin news