Decentralized finance [defi] protocol Injective has garnered significant popularity especially after its association with the world’s largest cryptocurrency exchange Binance.

In the latest development, the defi project and the creator of a new gentlecoin, Reflexer is all set to be integrating the RAI stablecoin with Injective. With this development, Injective Protocol will become the first derivatives exchange in the decentralized realm to support RAI.

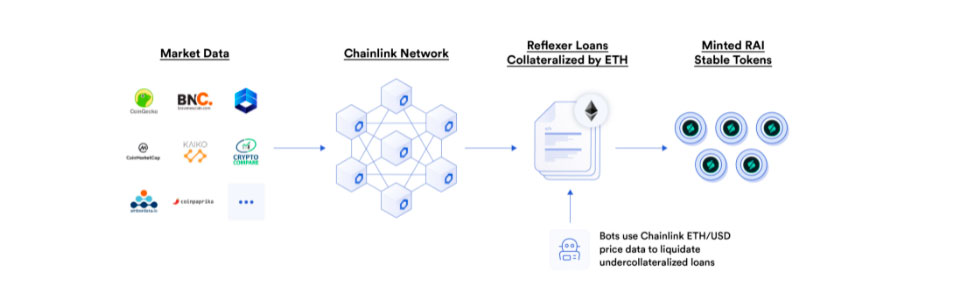

The official blog post explained that RAI is the first stablecoin on Reflexer and is similar to DAI in terms of operation. However, in contrast to DAI, Reflexer is wholly managed by algorithms instead of manual forms of governance in the former.

More importantly, RAI is a non-pegged, stable asset that is exclusively collateralized by Ethereum [ETH] in the sense that it is designed in a way to to reduce the price movement of the altcoin. In this way, RAI offers a more “stable” alternative to it as decentralized finance collateral.

The RAI Integration With DeFi Protocol

The stablecoin’s collaboration with Injective Protocol is set to take place in two separate phase.

Firstly, RAI will be made available on the defi platform via Chainlink’s price feeds. It is important to note that both Injective as well as Reflexer work with the decentralized oracle network. Therefore, the RAI price feed can be leveraged to faciliate futures trading through former.

Secondly, there will be a direct integration with RAI, through which the stablecoin can be bridged over to the Injective Chain using the Peggy bridge. RAI is an ERC20 token which makes it even easier to be bridged over onto Injective on its mainnet.

Stefan Ionescu, who happens to be the Co-founder of Reflexer noted that the move and collaboration Injective would mark the first ever instance of a stablecoin with a funding rate being integrated with a derivative platform.

CEO of Injective Protocol Erin Chen also commented,

“The team at Reflexer and Injective share a common goal of creating entirely community governed decentralized finance markets. We are excited to take this next step forward in launching new derivative products that utilize RAI.”

The latest news comes almost three weeks after Injective Protocol secured $10 million in a “party” funding round. Billionaire NBA team owner and Shark Tank judge Mark Cuban, including high-profile venture firms such as Pantera Capital, BlockTower, Hashed, Cadenza Ventures [backed by 100x Group], CMS and QCP Capital were the participants for the funding round.

The cross-chain derivatives exchange launched the testnet for its DeFi protocols in December last year.

If you found this article interesting, here you can find more DeFi News