The Bitcoin price is under immense pressure, down 10 percent on the last week and on the cusps of retesting a critical support level.

Still, traders are optimistic, expecting another higher high in light of the recent development.

Technically, the path of least resistance is northwards, and there are many supporting factors to support bullish outlooks.

Pay for a Brand-New Tesla using Bitcoin

For instance, this week, Tesla—the world’s most valuable automaker said it now accepts BTC as a payment method for their new cards. Interestingly–and this took the attention of fans across the world, is their decision not to liquidate the coin.

Instead, for every purchase Tesla makes, it is cutting out the middlemen (Payment processors) and HODLing the coin themselves. It makes sense, some analysts explain, because outside of this announcement, the car manufacturer already runs Bitcoin nodes.

The offer could exclude coin holders outside the continental United States. However, in the course of the year, Tesla plans to support purchases in BTC.

Tesla’s $1.5 Billion Investment

In February, the multi-billion car manufacturer invested a whopping $1.5 billion from their cash reserves. In an accompanying explainer, Tesla said their purchase was for diversification purposes and to maximize their yields.

A few days after this purchase, the BTC/USD price rose above $42k to post $62k in March.

Presently, Tesla has gained over $900 million in paper profits from their purchase, more than they earned from selling cars.

Although prices are lower, analysts point to supportive on-chain stats to back their positive outlook. For instance, Samson Mow is confident the BTC price will reach $100k this year, joining a long list of permabulls.

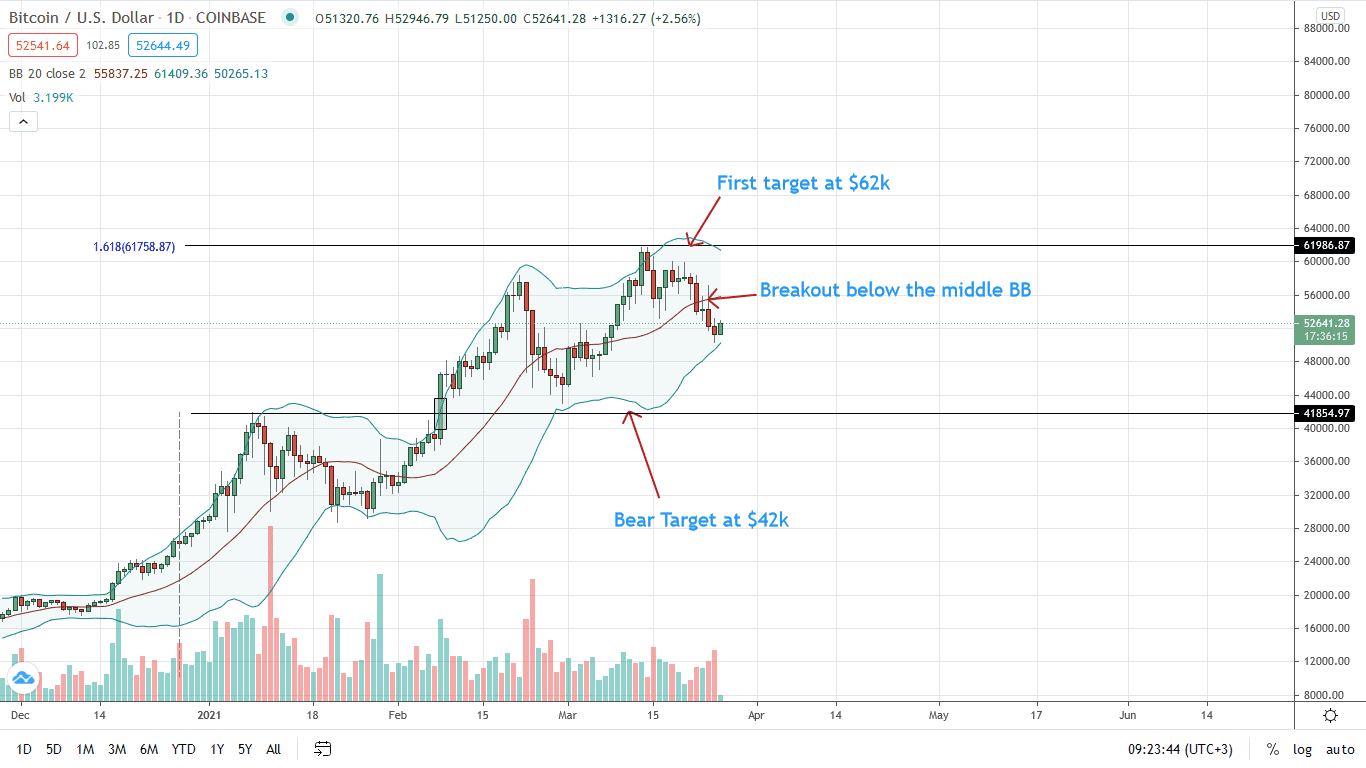

Bitcoin Price Analysis

The BTC/USD price is wavy, under pressure, losing 10 percent on the last week of trading.

From the daily chart, every low is potentially a selling opportunity following the close below the 20-day moving average on Mar 22. Note that BTC/USD price is in range mode inside the late Feb 2020 trade range.

Besides, accompanying trading volumes on the leg up in the first half of Mar 2021 was with low trading volumes.

Therefore, from a volume analysis, sellers are in control unless there is a sharp reversal above $62k with high trading volumes exceeding those of Feb 22 and 23.

With bears pressing lower, sellers can aim at $42k in the medium term—or Jan 2021 highs, in a retest.

Nonetheless, this is applicable only as long as prices are trending below the middle BB—the flexible resistance level and $57k—Mar 24 highs.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Bitcoin news