This Tuesday, the world’s largest asset manager, BlackRock, filed an amended S-1 registration statement with the SEC. In this document, the firm revealed that one of its affiliates has already provided the initial seed capital of $100,000 for the iShares Staked Ethereum Trust (ETHB), marking the formal start of this fund designed not only to track the price of Ether but also to generate passive yields.

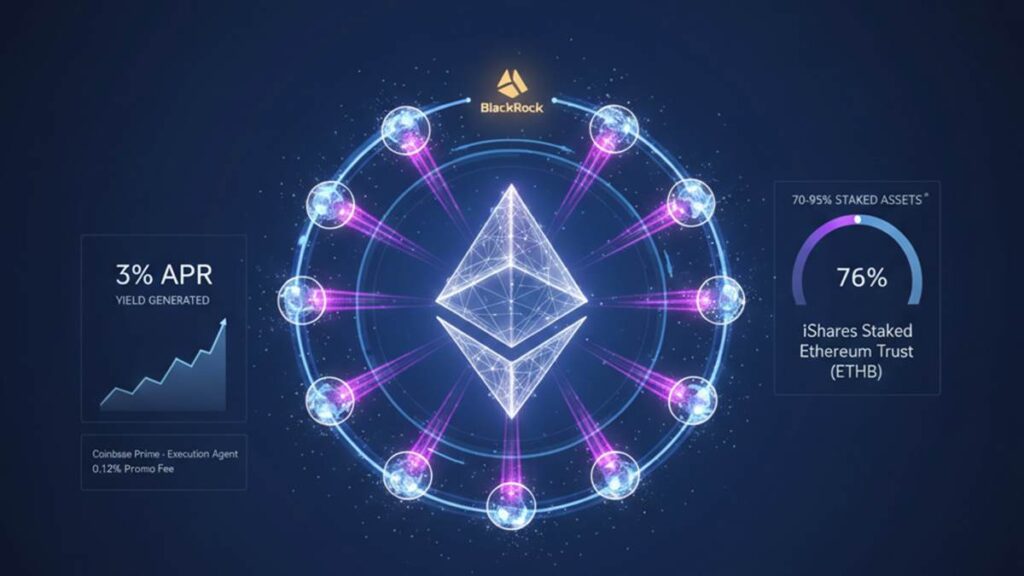

Unlike the conventional spot ETF (ETHA), this new vehicle plans to stake between 70% and 95% of its assets under normal conditions, with an estimated average annual yield of approximately 3%. The cost structure includes a 0.25% management fee, which will be temporarily reduced to 0.12% for the first $2.5 billion in assets. Additionally, BlackRock and its execution agent, Coinbase Prime, will retain 18% of the gross staking rewards generated by the network.

The SEC’s final response will be under close scrutiny in the coming weeks, as a definitive decision could be reached before April 2026, though analysts anticipate an accelerated resolution this quarter. The key to ETHB’s success will lie in its ability to attract institutional capital seeking “real yield” from Ethereum’s infrastructure, further consolidating this cryptocurrency as an investment-grade financial asset with native dividends.

Source:https://www.sec.gov/Archives/edgar/data/2099103/000143774926004276/iset20260214_s1a.htm

Disclaimer: Crypto Economy’s Flash News is prepared from official and public sources verified by our editorial team. Its purpose is to report quickly on relevant facts from the crypto and blockchain ecosystem. This information does not constitute financial advice or investment recommendations. We recommend always verifying the official channels of each project before taking related decisions.