TL;DR

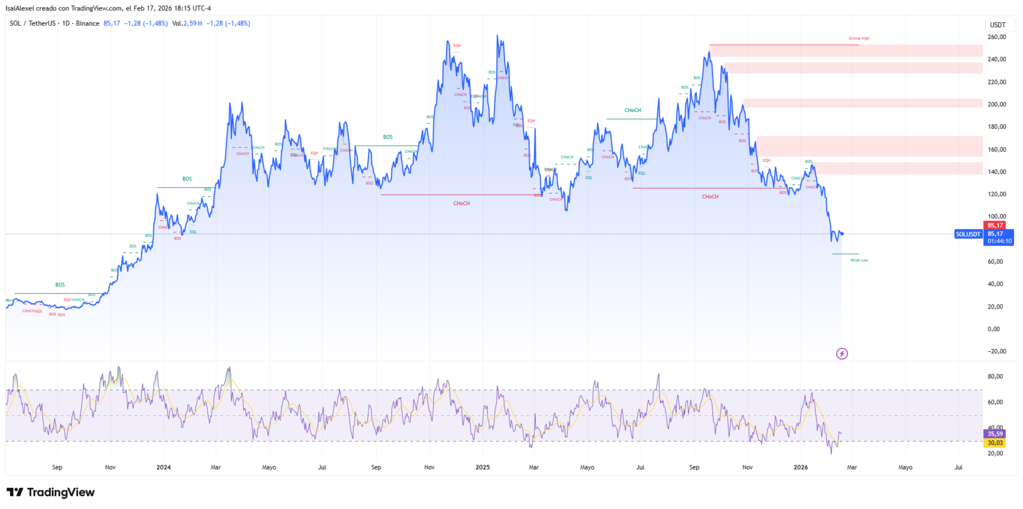

- The $60 to $70 zone acts as the first relevant support for a potential bottom.

- The $25 to $35 area is the strongest macro support, origin of the last major rally.

- A firm weekly close above $120 is required to invalidate the bearish bias.

Solana trades at $85 and maintains a bearish structure while price remains below $120, a level that now acts as key weekly resistance. Analyst Scient outlines a broader corrective phase and rejects any trend reversal scenario unless the asset reclaims that threshold.

SOL lost the former weekly support at $120 and failed to recover it during recent rebound attempts. Therefore, every rally below that barrier represents a corrective bounce rather than a sustained reversal. In addition, the chart prints a sequence of lower highs since the peak near $200–$220, a pattern that confirms structural weakness.

The macro view connects the current cycle with prior expansions and contractions. Solana advanced from under $10 to above $250 during the 2021 bull cycle. It later consolidated between $20 and $35 throughout 2022 and 2023. That base fueled the 2024–2025 advance toward the $200 region. Now, price action reflects distribution transitioning into correction.

Scient identifies $60–$70 as the first relevant support range

That area aligns with the 0.75 Fibonacci retracement of the latest bull cycle. Historically, that retracement absorbs deep sell pressure and produces consolidation before rebound attempts. However, a clear breakdown below that range would expose lower levels.

The second area sits between $25 and $35, a weekly demand zone that launched the previous major rally. Consequently, that region holds the strongest structural support on the macro chart.

Between $70 and $120, the analyst sees limited technical edge. Price could trade sideways within that band while the market establishes direction.

To invalidate the bearish bias, SOL requires a firm weekly close above $120. Only sustained acceptance above that level would shift structure. At present, Solana trades at $85.15 with daily volume above $3.29 billion.